2008 Credit Crisis

Name

Institution

2008 Credit Crisis

Credit Crisis代写 2008 Credit Crisis:The credit crisis signaled in 2006 when mortgage value began to decline.recession and financial market failure.

The credit crisis signaled in 2006 when mortgage value began to decline.

Though the realters hoped for the market to return to a sustainable level, the depression perpetuated to the 2008 credit crisis. Hedge funds, banks, and insurance companies caused the credit crisis (Ciner, Gurdgiev, & Lucey, 2013). Mortgage-backed securities were created by hedge funds and banks while insurance companies insured them against credit default. The high demand for mortgage led banks and hedge funds to sell too many mortgages to satisfy the demand. Banks allowed credit for even more than 100 percent the value of the new homes.

As a result, there was too many creditors with questionable creditworthy. Hence, after the market depression in 2006, creditors defaulted their mortgages which affected mutual funds, pension funds, and corporations that owned the investments. The resultant banking crisis in 2007 led to the 2008 financial crisis which produced the second worse recession after the great depression which seriously impacted the bond market.Credit Crisis代写**范文

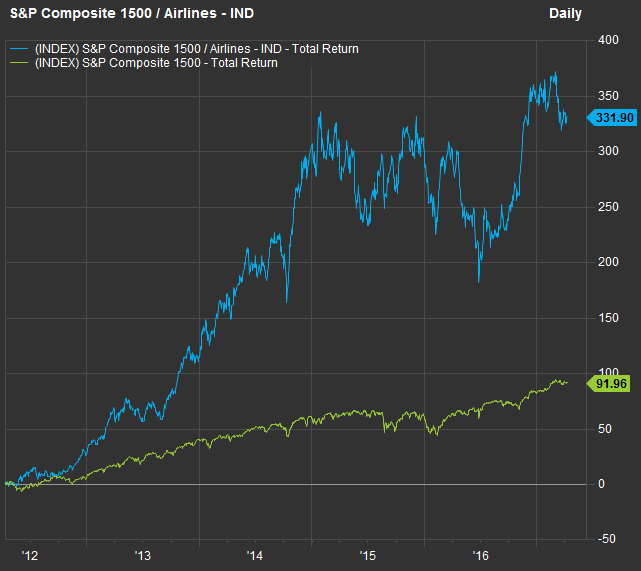

The credit crunch shacked the financial market with share values falling. Credit Crisis代写

Firms were making fewer profits and hence paid lower dividends. It led share unattractive investment option. However, after the 2008 recession, shares began recovery and share market bounced back due to higher economic growth.

On the contrary, while the share market was declining, the bond market was increasing.Credit Crisis代写**范文

Unlike shares that are risky and full of uncertainty, government bonds are a safe haven for investors (Ciner, Gurdgiev, & Lucey, 2013; Streeck, 2014). In the period of uncertainty in investment, investors prefer safer investments like government bonds. Consequently, the market bond was influenced by the policy of quantitative easing which led to the release of more money for the public to access government bonds. Therefore, the government increased its holding of bonds. Thus, at the advent of the 2006-2008 financial market crisis, the demand for bonds increased exponentially.

The recession and financial market failure led the government to borrow more. Credit Crisis代写

There was high demand for bonds and the government was selling. In this case, when the debt is high, the value of bond decline and interest rates increase. Due to high demand and supply of market bonds, their yield fell from more than 5 percent to less than 1 percent (Antonakakis, & Vergos, 2013). Short-term bonds were worse affected to the point of negative yield. The scenarios created a circumstance where investors were not confident with the financial system to the extent of paying the Treasury to hold their money instead of making investments that would earn substantial returns.Credit Crisis代写**范文

The government has a role to make sure the bond market is safe from the effects of the credit crisis in the future although its crush can be predicted and mitigated. Nevertheless, the government can come up with measures that will ensure the failure in the financial market does not affect the bond market. One of the strategies is to reduce short-term interest rates on bonds. Also, the interest rates on long-term bonds should be reduced and prices of such bonds increased. Besides, the government should not make available money to buy assets to limit investments. The measures will discourage investors to see government bonds as a safe haven for investment and opt for other options.

References Credit Crisis代写

Ciner, C., Gurdgiev, C., & Lucey, B. M. (2013). Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis, 29, 202-211.

Streeck, W. (2014). The politics of public debt: Neoliberalism, capitalist development and the restructuring of the state. German Economic Review, 15(1), 143-165.

Antonakakis, N., & Vergos, K. (2013). Sovereign bond yield spillovers in the Eurozone during the financial and debt crisis. Journal of International Financial Markets, Institutions, and Money, 26, 258-272.

更多其他: Case study代写 网课代修 代写CS 数据分析代写 润色修改 代写案例 Assignment代写 助学金申请 论文代写 prensentation代写 Case study代写 Academic代写 Review代写 Resume代写

您必须登录才能发表评论。