Distressed Private Equity

陷入困境的私募股权

私募股权代写 First forward, the outbreak of COVID-19 has significant negative implications for all sectors in the economy and has put…

Hello everyone

It is my pleasure to present to you about “Distressed Private Equity.”

译文:大家好

我很高兴向您介绍“陷入困境的私募股权”。

Slide 2 私募股权代写

First forward, the outbreak of COVID-19 has significant negative implications for all sectors in the economy and has put American out of work. Many businesses have closed down, and others are likely to never open in the future. However, the corners of Wall Street may find an opportunity amid this new crisis that has caused distress in the private market. According to Sanjay Nayar, the Chief Executive Officer of KKR India, the increase in acceptance and importance of private equity comes from the global environment that is favoring P.E. companies over the other investment alternatives (Choudhary & Dhanjal, 2017). There is a likelihood that private equity will be the most attractive option for businesses in a post-coronavirus pandemic.

译文:首先,COVID-19 的爆发对经济的所有部门都产生了重大的负面影响,并使美国人失业。许多企业已经倒闭,其他企业未来可能永远不会开业。然而,在这场给私人市场造成困境的新危机中,华尔街的角落可能会找到机会。据 KKR India 首席执行官 Sanjay Nayar 称,私募股权的接受度和重要性的增加来自有利于 P.E.公司优于其他投资选择(Choudhary 和 Dhanjal,2017 年)。在冠状病毒大流行后,私募股权有可能成为企业最具吸引力的选择。 私募股权代写

Slide 3

The investors in distressed private equity are neither short-term debt traders nor buyers of stable, class generated companies. The aim is to loan the companies then earn a stake in control of the company. Investors target to purchase the debts of a troubled company then use the debt as controlling equity stake to structure the business model of the company. The investor has the discretion to sell the position after the debt-to-equity exchange, or they can hold it for long enough for the equity to appreciate. Nonetheless, the investor in distressed private equity is required to have skills to analyze capital structure, financial statements, and bankruptcy process of the distressed company.

An investor ought to be conversant with business planning, oversight skills, and the ability to steer the restructuring process of the company during distress. As such, the process of salvaging distressed private equity requires specialist skills and the ability to dedicate significant time, energy, and resources in the restructuring process.

陷入困境的私募股权的投资者既不是短期债务交易员,也不是稳定的、阶级产生的公司的买家。目的是向公司贷款,然后获得公司控制权的股份。投资者的目标是购买陷入困境的公司的债务,然后将债务作为控股权来构建公司的商业模式。投资者可以在债转股后自行决定出售该头寸,或者他们可以持有足够长的时间以使股权升值。尽管如此,陷入困境的私募股权投资者需要具备分析陷入困境公司的资本结构、财务报表和破产程序的技能。

投资者应该熟悉业务规划、监督技能以及在困境中引导公司重组过程的能力。因此,挽救陷入困境的私募股权的过程需要专业技能以及在重组过程中投入大量时间、精力和资源的能力。

Slide 4 私募股权代写

In the United States, there are record 2,296 private equity funds in the market by the end of early 2018. The number is an increase of 26 percent from the previous 921 private equity firms in 2017. There was a record of $453 billion in capital commitment in 2017 and represented the highest ever recorded in the previous years. The trend in capital commitment over $5 billion continues to trend in the last four years and hence giving a new watermark for capital raised despite a dip of 26 percent in the funds raised in 2017 compared to 2016. Research conducted revealed that 98 percent of the institutional investors were hopeful of maintaining or increasing capital investment on private equity in the following 12 months (Preqin, 2018). The increasing trend in need for capita injections may have been caused partly by continued record distribution above the capital call in early 2017.

译文:在美国,截至 2018 年初,市场上有创纪录的 2,296 只私募股权基金。这一数字比 2017 年之前的 921 家私募股权公司增加了 26%。资本承诺达到创纪录的 4,530 亿美元2017 年,是前几年的最高记录。资本承诺超过 50 亿美元的趋势在过去四年中继续呈趋势,因此尽管 2017 年筹集的资金比 2016 年下降了 26%,但为筹集的资金提供了新的水印。进行的研究表明,98% 的机构投资者希望在未来 12 个月内维持或增加对私募股权的资本投资(Preqin,2018)。资本注入需求增加的趋势可能部分是由于 2017 年初资本需求持续创纪录的分配。

Slide 5

The momentum was expected to slow due to the economic downturn caused by the COVID-19 outbreak. However, the head of mergers at a Wall Street firm told CNBC that, private equity investors have the largest of all time more than $1.5 trillion cash ready to invest in distressed companies and that they have been waiting for market dislocation as currently experienced by the global economy (Son, Sherman, & Hirsh, 2020). The optimistic speculation by private investors is an indication of a continued increasing trend in a private equity fund in the future.

译文:由于 COVID-19 爆发导致经济下滑,预计这一势头将放缓。然而,一家华尔街公司的并购负责人告诉 CNBC,私募股权投资者有史以来最大的超过 1.5 万亿美元现金准备投资于陷入困境的公司,他们一直在等待全球当前所经历的市场错位。经济(Son、Sherman 和 Hirsh,2020 年)。私人投资者的乐观投机预示着私募基金未来将继续呈上升趋势。 私募股权代写

Slide 6 私募股权代写

Although the future private equity funding in the United States seem brighter, it is dominated by a few firms. The top 300 firms raise an aggregate amount of $1.7 billion in the last five years (Shukla, 2019). Out of this amount, the top 10 firms contribute more than $403 billion. The following are the leading five firms. The leading private equity firm is The Blackstone Group and has raised more than $82.9 billion from 2014 to 2019 toward private equity funding. The group has more than $545 billion of assets under management. The Carlyle Group is the second and has raised $63.8 billion in the last five years. It has over $222 billion of assets under management.

The third is Kohlberg Kravis Roberts (KKR) and has contributed more than $47.9 billion in the last five years. The fourth is CVC Capital Partners, which has contributed around $47.4 billion for the last five years. The company has more than $75 billion in assets under management. Lastly, the fifth position is Warburg Pincus, which has contributed more than $36.5 billion in the last five years. The majority of these private equity firms are in the U.S. These company among the top pacesetters in the private equity funding, especially at the time of market dislocation.

译文:尽管美国未来的私募股权融资看起来更加光明,但它由少数几家公司主导。前 300 家公司在过去五年中总共筹集了 17 亿美元(Shukla,2019 年)。其中,前 10 家公司贡献了超过 4030 亿美元。以下是领先的五家公司。领先的私募股权公司是黑石集团,从 2014 年到 2019 年已筹集超过 829 亿美元用于私募股权融资。该集团管理着超过 5450 亿美元的资产。凯雷集团位居第二,在过去五年中筹集了 638 亿美元。它管理着超过 2220 亿美元的资产。 私募股权代写

第三位是 Kohlberg Kravis Roberts (KKR),在过去五年中贡献了超过 479 亿美元。第四个是 CVC Capital Partners,它在过去五年里贡献了大约 474 亿美元。该公司管理的资产超过 750 亿美元。最后,排名第五的是 Warburg Pincus,它在过去五年中贡献了超过 365 亿美元。这些私募股权公司中的大多数都在美国,这些公司在私募股权融资方面处于领先地位,尤其是在市场错位的时候。

Slide 7 私募股权代写

It is expected that most companies may fall in cash flow crunch or slowed operations. The most affected sector since the financial crisis in 2007/2008 is the real estate sector. Today, the main affected sectors are air transport, entertainment, and restaurants. The global airlines are grounded due to the spreading of COVID-19 (ICAO, 2020). Also, restaurants and entertainment companies are not operating due to restrictions on social distancing. These sectors are likely to have cash flow and operational problems in the future. As a result, they are more likely to go for private equity fundraising.

译文:预计大多数公司可能会陷入现金流紧缩或经营放缓。自 2007/2008 年金融危机以来,受影响最大的行业是房地产行业。今天,受影响的主要部门是航空运输、娱乐和餐饮。由于 COVID-19 的传播,全球航空公司停飞(国际民航组织,2020 年)。此外,由于社交距离的限制,餐馆和娱乐公司也停止营业。这些行业未来很可能会出现现金流和运营问题。因此,他们更有可能进行私募股权融资。

Slide 8, 9 & 10

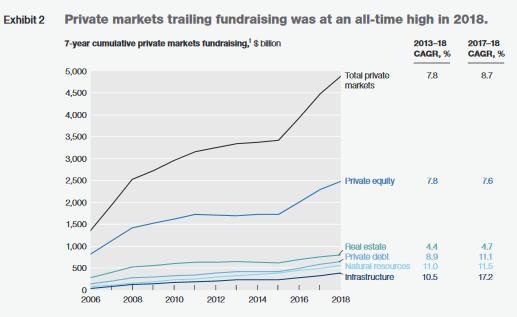

According to research by McKinsey, fundraising has remained 10-year high since 2006, as shown in figure 1 below, as assets undergo management and fund size increases. The fundraising slowed to $778 billion in 2018 compared to 2017 by 11 percent. In late 2018, the leading firms had set more than $300 billion in speculation of investment in early 2019. Nonetheless, 2018 remained the third-strongest year of fundraising behind 2017 and 2016. The trend indicates that the private market has grown by 8 percent since 2013.

译文:根据麦肯锡的研究,随着资产进行管理和基金规模的增加,筹资自 2006 年以来一直保持 10 年高位,如下图 1 所示。与 2017 年相比,2018 年的筹款放缓至 7780 亿美元,下降了 11%。 2018 年底,领先的公司在 2019 年初的投机投资额已超过 3000 亿美元。 尽管如此,2018 年仍然是继 2017 年和 2016 年之后筹款第三强的年份。趋势表明,私募市场自此增长了 8% 2013 年。 私募股权代写

Slide 11

Source: McKinsey (2019)

Slide 12

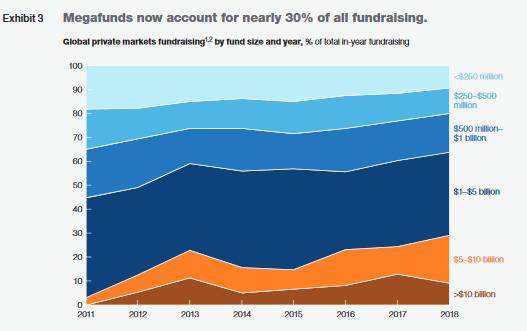

The mega-funds have been the most attractive to investors in fundraising. Between 2007 and 2018, thirty-two funds of $5 to $10 billion were raised. Nineteen funds of these sizes were raised in 2018 alone. In 2018, the mega-funds were 29 percent of the total private market fundraising, which was an increase of 15 percent compared to three years back (See figure 2). The trend can be used to predict an optimistic future for the private equity industry. Also, it can be noted that the private market has not had risks, and there are high returns.

译文:大型基金在筹资方面对投资者最具吸引力。 2007 年至 2018 年期间,共筹集了 32 支 5 至 100 亿美元的基金。 仅在 2018 年就筹集了 19 只这种规模的基金。 2018 年,大型基金占私募市场融资总额的 29%,与三年前相比增长了 15%(见图 2)。 该趋势可用于预测私募股权行业的乐观未来。 另外,可以看出,私募市场没有风险,收益高。 私募股权代写

Slide 13

Source: McKinsey (2019)

Slide 14, 15, & 16 私募股权代写

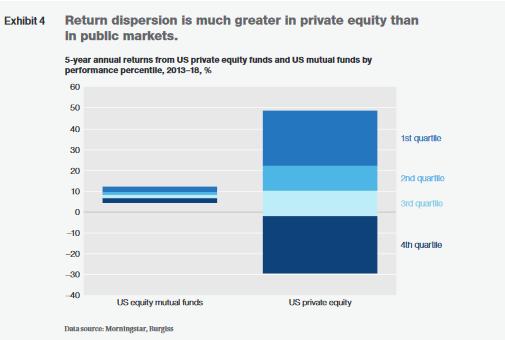

Therefore, PE has remained the largest of all private markets in the U.S (see figure 3). The sector has had unprecedented success in the past five years. However, the growth came at the cost of risks. Some of the inherent risks in private equity include funding risk, liquidity risk, market risk, and capital risk. Compared to public equity risks, the above risks are unpredictable because most companies are traded and hence do not have market value. These risks can be mitigated and controlled by getting the right P.E. manager.

译文:因此,PE 仍然是美国所有私募市场中最大的市场(见图 3)。 该行业在过去五年中取得了前所未有的成功。 然而,增长是以风险为代价的。 私募股权的一些固有风险包括资金风险、流动性风险、市场风险和资本风险。 与公共股权风险相比,上述风险是不可预测的,因为大多数公司都在交易,因此没有市场价值。 这些风险可以通过获得正确的 PE 来减轻和控制。 经理。

Source: McKinsey (2019)

Thank you for this opportunity and your time

译文:感谢您提供这个机会和您的时间 私募股权代写

References

Choudhary, A. & Dhanjal, S., S. (2017). Distressed assets remain an attractive space for private capital: KKR’s Sanjay Nayar. Live Mint. Retrieved from https://www.livemint.com/Companies/R5oIKxgfncidAlWz4iJ9XN/Distressed-assets-remain-an-attractive-space-for-private-cap.html

ICAO. (2020). Economic Impacts of COVID-19 on Civil Aviation. ICAO. Retrieved from https://www.icao.int/sustainability/Pages/Economic-Impacts-of-COVID-19.aspx

McKinsey. (2019). Private markets come to age. McKinsey Global Private Markets Review 2019. Retrieved from https://www.mckinsey.com/~/media/McKinsey/Industries/Private%20Equity%20and%20Principal%20Investors/Our%20Insights/Private%20markets%20come%20of%20age/Private-markets-come-of-age-McKinsey-Global-Private-Markets-Review-2019-vF.ashx

Preqin. (2018). 2018 Preqin global private equity & venture capital report. Preqin. Retrieved from https://docs.preqin.com/reports/2018-Preqin-Global-Private-Equity-Report-Sample-Pages.pdf

Son, H. Sherman, A. & Hirsh, L. (2020). Private equity eyes industries crippled by coronavirus: ‘They have been waiting for this.’ CNBC. Retrieved from https://www.cnbc.com/2020/03/25/private-equity-eyes-coronavirus-hit-industries-theyve-been-waiting.html

Shukla, V. (2019). Top 10 Largest Private Equity Firms: Eight Of Them Are U.S. Firms. Value Walk. Retrieved from https://www.valuewalk.com/2019/07/top-10-largest-private-equity-firms/