Minimum Variance Hedge

代写time series A Future embeds marked-to-market cash-flows on variances in the price until contract termination. They can be used to hedge…

A Future embeds marked-to-market cash-flows on variances in the price until contract termination. They can be used to hedge exposure to the exchange rate where items are quoted in a foreign currency.

On combining a futures hedge with a HC/EUR spot transaction we may choose a derivative HC/FC that is closely correlated with the EUR and minimizes the remaining exposure’s variance or risk. 代写time series

![]()

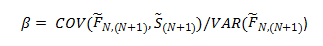

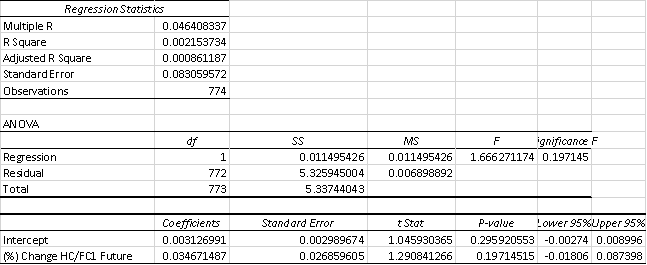

The (%) change in the spot and futures rate in time series data is calculated, and a regression coefficient is identified. Futures rates are calculated using the covered interest parity relation.

Beta is multiplied by the exposure and divided by the contract size to estimate the contracts in FC that would need to be bought to hedge the exposure. Multiple regression can be used on multiple FCs.

Direct Hedge 代写time series

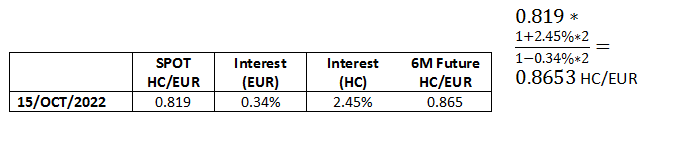

The covered interest parity equation is used to estimate the futures rate at 15/OCT/2022. We assume Beta = 1 contract, as the exposure is perfectly hedged – there’s no mismatch in the expiry date or the currency, and we assume the market prices securities correctly.

Delta Hedge 代写time series

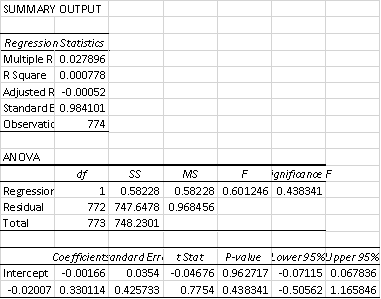

The Futures contract is on EUR but matures in 12M as opposed to 6M (Months). We use excel to regress the (%) change in the 12M (Month) Futures rate against the HC/EUR spot rate to find the minimum variance hedge (beta = 0.33 contracts).

The Futures contract is on EUR but matures in 12M as opposed to 6M (Months). We use excel to regress the (%) change in the 12M (Month) Futures rate against the HC/EUR spot rate to find the minimum variance hedge (beta = 0.33 contracts).

Formulas

- (New – Old)/Old = (%)

- Future = Spot * (1+R)/(1+R*)

Multi-Cross Hedge

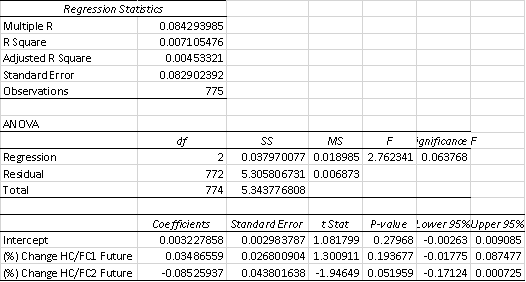

Here we used excel multiple regression with the (%) change in the HC/FC1 and HC/FC2 6M Future relative to the spot HC/EUR. The beta coefficient is shown; this equals N contracts that need to be bought future in both currencies on 15/OCT/2021 to hedge the 500,000 EUR exposure, when multiplied by this, and divided by the contract size.

Cross-Hedge 代写time series

Here we regressed the (%) change in the HC/FC1 6M Future against that with the spot HC/EUR. The beta coefficient is shown, which (when multiplied by 500,000 EUR / Contract Size) equals N contracts bought Future in HC/FC1 at 15/OCT/2022.