BUS224 International Corporate Reporting

国际企业报告代写 YOU ARE NOT PERMITTED TO READ THE CONTENTS OF THIS QUESTION PAPER UNTIL INSTRUCTED TO DO SO BY AN INVIGILATOR

YOU ARE NOT PERMITTED TO READ THE CONTENTS OF THIS QUESTION PAPER UNTIL INSTRUCTED TO DO SO BY AN INVIGILATOR

Answer THREE questions. All questions are compulsory.

If you answer more questions than specified, only the first answers (up to the specified number) will be marked. Cross out any answers that you do not wish to be marked Calculators are permitted in this examination. Please state on your answer book the name and type of machine used.

Complete all rough workings in the answer book and cross through any work that is not to be assessed. 国际企业报告代写

Possession of unauthorised material at any time when under examination conditions is an assessment offence and can lead to expulsion from QMUL. Check now to ensure you do not have any notes, mobile phones, smartwatches or unauthorised electronic devices on your person. If you do, raise your hand and give them to an invigilator immediately.

It is also an offence to have any writing of any kind on your person, including on your body. If you are found to have hidden unauthorised material elsewhere, including toilets and cloakrooms it will be treated as being found in your possession. Unauthorised material found on your mobile phone or other electronic device will be considered the same as being in possession of paper notes. A mobile phone that causes a disruption in the exam is also an assessment offence.

EXAM PAPERS MUST NOT BE REMOVED FROM THE EXAM ROOM

Question 1 国际企业报告代写

Summarise the changes (at least five of them) in the IASB’s revised Conceptual Framework (2018) and briefly explain how these changes relate to the decision-usefulness of financial information and issues of accountability.

(35 Marks)

Question 2

Critically discuss why publicly listed companies are required to report on corporate governance matters in their annual reports.

(30 Marks)

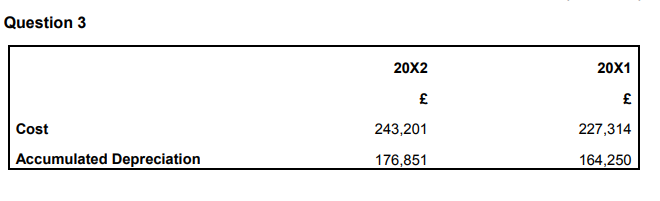

a) If the company did not sell any fixtures and fittings during the year ended 30 September 20X2:

(i) Calculate the depreciation expense for the year (6 marks).

(ii) Calculate the cost of fixtures and fittings the company acquired during the year

(6 marks).

b) During the year ended 30 September 20X2, the company sold some shelving for £7,500. This shelving had originally cost £34,500 and, at the time of sale, had accumulated depreciation of £22,700.

(i) Calculate the depreciation expense for the year (8 marks).

(ii) Calculate the cost of fixtures and fittings the company acquired during the year 国际企业报告代写

(8 marks).

(iii) Calculate the gain or loss on the sale of the shelving (7 marks).

(Total: 35 Marks)