BUS224 International Corporate Reporting

国际公司报告代考 All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

Answer THREE questions. All questions are compulsory.

All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

If you encounter errors in the exam paper or are unable to upload the exam to the QMPlus page for this module, please email the following asking for advice: sbm-uglevel5@qmul.ac.uk .

Question 1 国际公司报告代考

Critically evaluate whether the ‘substance over form’ concept, inherent in international financial reporting standards, results in financial statements that are fairly stated.

(30 Marks)

Question 2

During the year ended 31 December 20X1, Serena Plc, a manufacturing company, introduced the following changes:

a) The company had a policy of calculating depreciation on equipment using the straight line method. In light of significant losses recognised on recent disposals, the management has decided to depreciate equipment by using the reducing balance method at a rate of 20%. This is expected to more accurately reflect the wear and tear of equipment.

(12 marks)

b) The company had a policy of valuing its inventories by using theweighted average cost (AVCO) method in accordance with IAS 2 Inventories. In the current period, the management has reviewed their policy and decided to adopt the first in first out (FIFO) method. 国际公司报告代考

(12 marks)

c) In the current period, the company discovered that a bad debt of £4500 was not included in last year’s financial statements. Adjustments for the omission of this amount were made in the current period.

(11 marks)

Required:

Explain how Serena Plc should account for these changes (omissions) in its financial statements for the year ended 31 December 20X1 in accordance with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors (including the disclosures required).

(Total: 35 Marks)

Question 3 国际公司报告代考

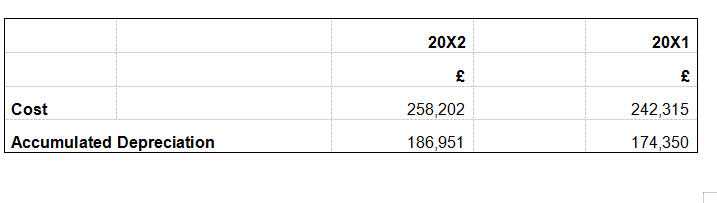

a) If the company did not sell any fixtures and fittings during the year ended 30 September 20X2:

(i) Calculate the depreciation expense for the year (6 marks).

(ii) Calculate the cost of fixtures and fittings the company acquired during the year (6 marks).

b) During the year ended 30 September 20X2, the company sold some shelving for £13,500. This shelving had originally cost £40,500 and, at the time of sale, had accumulated depreciation of £28,700.

(i) Calculate the depreciation expense for the year (8 marks).

(ii) Calculate the cost of fixtures and fittings the company acquired during the year (8 marks).

(iii) Calculate the gain or loss on the sale of the shelving (7 marks).

(Total: 35 Marks)