Problem set1 Eco371

Prof. Michael Connolly

留学生Econ代考 Indicate whether the following are true or false and defend your answer in the space provided. (7 points each, 42 total)

1. Indicate whether the following are true or false and defend your answer in the space provided. (7 points each, 42 total) 留学生Econ代考

1.1 The“Convertibility Law” of April 1991 restricted the Argentine central bank to only buying. And selling foreign exchange at a fixed exchange rate as its sole monetary True ☐ False ☐ Defend your answer

1.2Acurrency board is, however, allowed to act as the lender of last resort to commercial banks in case of a financial crisis and runs on the True ☐ False ☐ Defend your answer 留学生Econ代考

1.3 In the 1980’s there was a “dirty war” in Argentina where the government suspended the “writof habeus corpus”, damaging human rights True ☐ False ☐ Defend your answer

1.4 When a county has a currency board or is fully dollarized, it must run a balance of payments surplus to increase its domestic money True ☐ False ☐ Defend your answer: 留学生Econ代考

1.5 In 1982, the military government successfully recovered the Islas Malvinas/Falkland Islandsfrom the UK by a brief and swift occupation of the True ☐ False ☐ Defend your answer:

1.6 If sovereign debt rises faster than income forever, the country will eventually default, True☐ False☐ Defend your answer:

Please feel free to elaborate on your answer on the back of this page 留学生Econ代考

-

In 1994, the Central Bank of Argentina suffered the “Tequila” effect – contagion from theMexican peso crisis. The Tequila effect occurred due to a sudden devaluation in the Mexican peso, which caused other currencies in the region to come under selling pressure.

Argentina had a “currency board” at the time, so its central bank sold billions of USD to capital flight at one peso per dollar from its reserves since investors and the public feared a devaluation of the peso. Answer the following, defending your answer.

2.1 Would a devaluation of the peso have been legal at that time?

2.2 Why did the central bank sell US dollars to the foreign exchange market at a fixed price of0001 pesos per US dollar?

2.3 Whatwas the effect of the sale of USD on the Argentine money supply? 留学生Econ代考

2.4 Couldthe central bank of Argentina have bought government bonds to neutralize any monetary effects of its intervention?

2.5 Could the central bank of Argentina have run out of USD reserves to sell to the exchangemarket?

2.6 The Argentine Treasury sold BONEX, Argentine securities denominated in USD to theCentral Bank and counted these as foreign reserves to satisfy its 100% backing requirement. What rules of the currency board did it violate in doing so?

Feel free to use the back of the page to elaborate upon your answers. 2 留学生Econ代考

3.1. What are the key rules of an orthodox currency board?

3.2 Which of these rules did Argentina break in its currency board experiment 1991 to 2002, leading to its collapse and debt default in 2002?

Feel free to elaborate upon your answer on the back of this page. 3

-

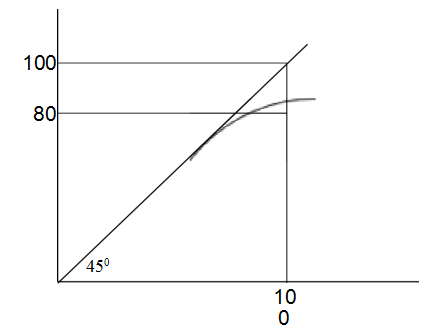

Consider the Figure below indicating market value of a security on the verticalaxis. And its present value discounted at the risk free rate of interest on the horizontal axis. The security currently has a market price of $80, but a present value of $100 discounted at the risk free rate. Answer the following questions, supporting your answers:

Market value of debt (secondary market)

Present value of debt discounted at the risk-free Treasury rate

4.1 Does this security have any risk of default, as reflected in its market price of $80 along the vertical axis, while its present value at the Treasury risk free interest rate is $100 along the horizontal axis

4.2 What is the default risk premium on this security? Defend your