Executive Summary:

经济学essay代写 In this paper we will discuss about the possible impact of Brexit on the Australian economy. As UK is a ···

In this paper we will discuss about the possible impact of Brexit on the Australian economy. As UK is a major trading partner of Australia . Brexit will slow down the growth prospect of UK and European economies as well. Hence we can expect that will reduce demand for Australian export . And flow of UK FDI to Australian economy as well. 经济学essay代写

This will be going to reduce Australian growth rate. Hence as the central bank of Australia.The Reserve Bank of Australia should follow expansionary monetary policy . And would reduce cash rate or interest rate to boost investment in the domestic economy. In this manner there will be higher aggregate demand and higher growth rate in the Australian economy.

Impact of Brexit on Australian economy 经济学essay代写

Introduction:

We know that Bretain has left European Union and the most impactful event is known as ‘Brexit’. As London, the capital of Bretain is the financial capital of the world economy . We can expect that Brexit would have large amount of short run and long run influence on many economies. However in this paper we will consider the impact of Brexit on the Australian economy.

Here we will see that Brexit will impact the immigration of Australian skilled workers to Bretain. We will also analyse how Brexit will affect aggregate expenditure or aggregate demand of the Australian economy . Because that will actually lead to economic growth or economic recession in the Australian economy (Hutchens, 2016).

Depending upon the overall growth and economic scenario of the Australian economy . We can advise on the correct approach of central bank of Australia towards its monetary policy and cash rate movement.

Aggregate Demand condition of the Australian economy: 经济学essay代写

Aggregate expenditure function of an economy equalises to the aggregate demand function of the economy. Aggregate demand is considered as the sum of Consumption expenditure (C), private investment expenditure (I), Government expenditure (G) and net exports (NX, which is the difference between exports and imports). The growth in aggregate demand can be considered as economic growth of an economy (“Domestic Economic Conditions – Statement on Monetary Policy – August 2016”, 2016).

To analysis the impact of Brexit on the Australian economy we will first analyse the domestic economic condition of Australian economy. In the economy we can see lower level of interest rate by Reserve Bank of Australia. Since the first quarter of 2016, we can see stable growth in the household demand . And growth in consumption expenditure has been due to the employment growth, growth in household income coupled with stable growth in household wealth level.

However mining investment has been low recent years. 经济学essay代写

We can see that unemployment rate has been steady at the rate of 5% which reassures the improved labor market condition. Due to lower interest rate and higher prices . In the housing sector we can see construction of high-density houses . And retail sales have also been increased in recent years (“Domestic Economic Conditions – Statement on Monetary Policy – August 2016”, 2016).

In case of private business investment we can see downward trend recent years . And the fall is attributed to lower growth in investment in engineering and construction sector. However mining investment has been reduced by 45% since 2012 (peak time of growth in investment).

The Non-mining sectors like education, agriculture, health care and software development had also been reduced . During the recent phase and this trend is specially can be seen in resource rich states like Queensland and Western Australia. However continuous phase of lower interest rate and depreciation of Australian dollar is expected to revive the investment scenario (“Domestic Economic Conditions – Statement on Monetary Policy – August 2016”, 2016).

In the external sector we can see that there has been modest growth in resource and service export. 经济学essay代写

Due to the increased production of Liquidified natural Gas (LNG), higher amount of export of LNG is expected in the future. Higher export growth of iron ore (due to lower production cost of iron producers and the resultant competitive advantage in the world market) . And coal will increase export overtime.

In case of import we can see lower demand and this is expected to increase net export in coming years. The depreciation of Australian dollar has also provided a boost to Australian export (“Domestic Economic Conditions – Statement on Monetary Policy – August 2016”, 2016).

The Australian government has assured to maintain budget deficit in recent year . And in 2016-17 it will be around 3% of GDP (Gross Domestic Product). Considering all these aspects we can say that the Australian economy is in the expansionary phase where modest rate of economic growth can be witnessed.

Impact of Brexit on Australian Trade and Investment: 经济学essay代写

Due to the incident of Brexit, The UK and European economy as a whole will be going to suffer. The UK economy will be likely to experience slower economic growth during next couple of years. As UK is the main source of financial capital, the growth process of the entire European economy will suffer. The lower amount of growth in the UK and European economy will adversely impact the consumption, investment, employment aspects of those economies. (“BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT”, 2016).

We know that UK, European economies and Australia have been trading partners for decades. Demand for Australian exports by UK and European economies will be going to reduce in the short run. Hence net export in the Australian economy will be going to reduce. Apart from that due to lower growth in the world economy on account of Brexit . Will reduce growth prospect of Australian economy as Australian dollar will be going to lose competitive advantage in the international market.

We know that London is the important financial capital 经济学essay代写

And Brexit will adversely impact on its financial stability. This will cause lower amount of investment (Foreign Direct Investment, FDI) in the Australian economy. As FDI will reduce, the production and employment growth prospect . In the Australian economy will be reduced as well and that will reduce Australian aggregate demand and growth rate in the future (“BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT”, 2016).

In the above paragraph, we have discussed the short run impact of Brexit on the Australian economy. However the longer term consequences would be greater. Before Brexit, UK is provided with free trade facilities with European economies and due to Brexit . UK is now subjected to import tariff and quotas. Before Brexit UK got the facility of trading into the single European market and also got a significant share of FDI from Europe. It could access European Economic Area.

After Brexit we can anticipate that all kinds of administrative trading cost of UK is going to increase further. As UK is the seven largest trading partner of Australia and eight largest export market . In the long run Australia’s bilateral trading agreement with UK will be going to adversely affected. During the phase of 2000 to 2015 we can see that share of total export volume of Australian economy to UK economy was in the range of 12

% to 7%.

In 2015 经济学essay代写

Australian export to UK for the financial service was around 22% of total export . Followed by personal travel and education, business travel and telecommunication and information technology (“BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT”, 2016).

During the phase of 2001 to 2015 . We can see that UK FDI to Australia was around 21% to 10% which was around Australian dollar 70 billion to Australian dollar 35 billion. Hence UK FDI to Australian had reduced considerably while Australian FDI to UK economy was around the range of Australian dollar 60 billion to 50 billion (“BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT”, 2016).

Due to the lower expected growth in the UK economy (due to Brexit) . Flow of FDI from UK economy to Australian economy will be significantly reduced and lower demand of export of Australian economy will be going to reduce as well. Hence we can expect that Brexit would reduce the growth prospect of Australian economy in recent years in terms of lower investment growth and growth in net export (“BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT”, 2016).

执行摘要:

在本文中,我们将讨论英国退欧对澳大利亚经济的可能影响。由于英国是澳大利亚的主要贸易伙伴,英国退欧也将减缓英国和欧洲经济体的增长前景。因此,我们可以预期这将减少对澳大利亚出口的需求以及英国对澳大利亚经济的外国直接投资流量。这将降低澳大利亚的增长率。因此,作为澳大利亚中央银行,澳大利亚储备银行应遵循扩张性货币政策,并将降低现金利率或利率以增加对国内经济的投资。通过这种方式,澳大利亚经济将有更高的总需求和更高的增长率。

英国脱欧对澳大利亚经济的影响

介绍:

我们知道不列颠已经离开了欧盟,而影响最大的事件就是“脱欧”。由于不列颠的首都伦敦是世界经济的金融首都,我们可以预期,英国脱欧对许多经济体的短期和长期影响很大。但是,在本文中,我们将考虑英国退欧对澳大利亚经济的影响。在这里,我们将看到英国退欧将影响澳大利亚熟练工人向不列颠的移民。我们还将分析英国退欧将如何影响澳大利亚经济的总支出或总需求,因为这实际上将导致澳大利亚经济的经济增长或经济衰退(Hutchens,2016年)。

根据澳大利亚经济的整体增长和经济状况,我们可以为澳大利亚中央银行采取正确的货币政策和现金利率变动方法提供建议。

澳大利亚经济的总需求状况:

一个经济体的总支出函数等于该经济体的总需求函数。总需求被认为是消费支出(C),私人投资支出(I),政府支出(G)和净出口(NX,即进出口之间的差额)之和。总需求的增长可以被视为一个经济体的经济增长(“国内经济状况-货币政策声明– 2016年8月”,2016年)。

为了分析英国退欧对澳大利亚经济的影响,我们将首先分析澳大利亚经济的国内经济状况。在经济中,澳大利亚储备银行的利率水平较低。自2016年第一季度以来,我们可以看到家庭需求稳定增长,消费支出的增长归因于就业的增长,家庭收入的增长以及家庭财富水平的稳定增长。但是,近年来采矿投资一直很低。我们可以看到失业率一直稳定在5%,这确保了劳动力市场状况的改善。由于较低的利率和较高的住房价格,我们可以看到近年来高密度房屋的建设和零售额也有所增加(“国内经济状况-货币政策声明– 2016年8月”,2016年)。

如果是私人企业投资,我们可以看到近年来的下降趋势,而下降的原因是工程和建筑领域投资的增长下降。但是,自2012年以来(投资增长的高峰时间),矿业投资已减少了45%。在最近阶段,教育,农业,医疗保健和软件开发等非采矿业也有所减少,这一趋势在昆士兰州和西澳大利亚州等资源丰富的州尤为明显。然而,较低的利率和澳元贬值的连续阶段预计将恢复投资情况(“国内经济状况-货币政策声明– 2016年8月”,2016年)。

在外部部门,我们可以看到资源和服务出口一直在适度增长。由于液化天然气(LNG)的产量增加,预计未来LNG的出口量将增加。铁矿石的出口增长较高(由于铁矿石生产商的生产成本降低以及由此产生的世界市场竞争优势)和煤炭将增加出口超时时间。如果是进口,我们可以看到需求下降,预计这将在未来几年增加净出口。澳元贬值也促进了澳大利亚的出口(“国内经济状况-货币政策声明– 2016年8月”,2016年)。

澳大利亚政府已保证在最近一年保持预算赤字,在2016-17财年,赤字将占GDP的3%左右。考虑到所有这些方面,我们可以说,澳大利亚经济处于扩张阶段,可以看到适度的经济增长率。

英国退欧对澳大利亚贸易和投资的影响:

由于英国退欧事件,整个英国和欧洲经济将遭受重创。英国经济可能会恶化未来几年,经济增长放缓。由于英国是金融资本的主要来源,整个欧洲经济的增长过程将受到影响。英国和欧洲经济增速较低,将对这些经济体的消费,投资和就业方面产生不利影响(“英国脱欧之后:对澳大利亚贸易和投资的潜在影响”,2016年)。

我们知道,英国,欧洲经济体和澳大利亚已经成为贸易伙伴数十年了。短期内,英国和欧洲经济体对澳大利亚出口的需求将减少。因此,澳大利亚经济的净出口将减少。除此之外,由于英国脱欧导致世界经济增长放缓,澳元将在国际市场上失去竞争优势,这将降低澳大利亚经济的增长前景。我们知道伦敦是重要的金融首都,英国退欧将对其金融稳定产生不利影响。这将导致澳大利亚经济中的投资额减少(外国直接投资,FDI)。随着外国直接投资的减少,澳大利亚经济的生产和就业增长前景也将降低,这将降低澳大利亚未来的总需求和增长率(“超越英国脱欧:对澳大利亚贸易和投资的潜在影响”,2016年)。

在以上段落中,我们讨论了英国脱欧对澳大利亚经济的短期影响。但是,长期的后果会更大。在英国脱欧之前,英国已获得与欧洲经济体的自由贸易便利,由于英国脱欧,英国现在要接受进口关税和配额。在英国脱欧之前,英国已经拥有进入单一欧洲市场的交易设施,并且还从欧洲获得了大量外国直接投资。它可以进入欧洲经济区。英国退欧后,我们可以预期英国的各种行政交易成本将进一步增加。由于英国是澳大利亚的第七大贸易伙伴和八个最大的出口市场,从长远来看,澳大利亚与英国的双边贸易协议将受到不利影响。在2000年至2015年期间,我们可以看到澳大利亚经济对英国经济的出口总额所占份额为12

%至7%。 2015年,澳大利亚对英国的金融服务出口约占总出口额的22%,其次是个人旅行和教育,商务旅行以及电信和信息技术(“超越英国脱欧:对澳大利亚贸易和投资的潜在影响”,2016年)。

在2001年至2015年期间,我们可以看到英国对澳大利亚的外国直接投资约为21%至10%,约为700亿澳元至350亿澳元。因此,英国对澳大利亚的外国直接投资大幅减少,而澳大利亚对英国经济的外国直接投资则在600亿至500亿澳元左右(“超越英国脱欧:对澳大利亚贸易和投资的潜在影响”,2016年)。

由于英国经济的预期增长率较低(由于英国退欧),从英国经济到澳大利亚经济的外国直接投资流量将大大减少,对澳大利亚经济的出口需求也将减少。因此,我们可以预期,就投资增长下降和净出口增长而言,英国脱欧将降低近年来澳大利亚经济的增长前景(“超越英国脱欧:对澳大利亚贸易和投资的潜在影响”,2016年)。

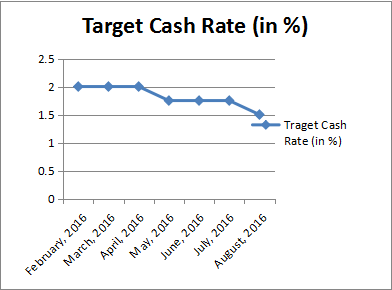

Forecasting of Cash rate depending upon the previous movement of cash rate: 经济学essay代写

(source: (“http://www.rba.gov.au”, 2016)

Considering above aspects we can say that ··· 经济学essay代写

Brexit will reduce growth trajectories of the Australian economy . And for this reason aggregate demand and aggregate expenditure of the Australian economy will be reduced. Lower amount of FDI investment and net export will reduce domestic consumption expenditure of the Australian economy . And that will increase unemployment rate and lower income growth. Hence there will be a possibility that the Australian economy will be in the phase of recession.

In the above diagram we can see that cash rate have been on downward trend since the beginning of 2016. Due to the possibility of Brexit, the Reserve Bank of Australia had continued reduction in cash rate . And depending upon the possible recessionary phase of the Australian economy (due to long run adverse impact of Brexit) we can expect that till the end of 2016 cash rate will be reduced.

英国脱欧将减少澳大利亚经济的增长轨迹。 因此,澳大利亚经济的总需求和总支出将减少。 FDI投资和净出口的减少将减少澳大利亚经济的国内消费支出。 这将增加失业率并降低收入增长。 因此,澳大利亚经济有可能进入衰退期。

在上图中,我们可以看到自2016年初以来现金利率一直呈下降趋势。由于英国退欧的可能性,澳大利亚储备银行一直在继续降低现金利率。 并且,根据澳大利亚经济可能陷入衰退的阶段(由于英国脱欧的长期不利影响),我们可以预期到2016年底现金利率将降低。

Forecasted cash rate till the end of 2016:

| Time period | Target cash rate (in %) |

| August, 2016 | 1.5 |

| September, 2016 | 1.5 |

| October, 2016 | 1.5 |

| November, 2016 | 1.25 |

| December, 2016 | 1.25 |

As the central bank of the Australian economy it is advisable for the Reserve Bank of Australia to reduce its interest rate (cash rate) further. If the interest rate will be low, cost of borrowing in the Australian economy will be reduced and that will enhance the investment prospect of the economy.

Higher investment growth will enhance production and employment prospect . And for this reason there will be higher aggregate demand and moderate level of inflation. Lower rate of interest will also cause further depreciation of Australian dollar . And that will help Australian export to regain competitive advantage in the international market (“Monetary Policy”, 2016).

Conclusion: 经济学essay代写

Considering the above aspects we can say that Brexit will adversely impact the growth trajectory of Australian economy . May be it will be in terms of lower immigration or may be in terms of lower FDI. Hence there will be possibility that the Australian economy will suffer from the recessionary phase. In this context the best way for the Reserve bank of Australia is to follow expansionary monetary policy (reduce cash rate) to boost aggregate demand as that will expand the possibility of economic growth further.

作为澳大利亚经济的中央银行,建议澳大利亚储备银行进一步降低其利率(现金利率)。如果利率低,澳大利亚经济中的借贷成本将降低,这将提高经济的投资前景。

更高的投资增长将改善生产和就业前景。因此,总需求将增加而通货膨胀率将处于中等水平。较低的利率也将导致澳元进一步贬值。这将有助于澳大利亚出口在国际市场上重新获得竞争优势(“货币政策”,2016年)。

考虑到上述方面,我们可以说英国退欧将对澳大利亚经济的增长轨迹产生不利影响。可能是因为移民减少或外国直接投资减少。因此,澳大利亚经济将有可能陷入衰退期。在这种情况下,澳大利亚储备银行的最佳方法是遵循扩张性货币政策(降低现金利率)来刺激总需求,因为这将进一步扩大经济增长的可能性。

References 经济学essay代写

Hutchens, G. (2016). Brexit and Australia: what would be the consequences if Britain left the EU?. the Guardian. Retrieved 27 August 2016, from https://www.theguardian.com/australia-news/2016/jun/23/brexit-and-australia-what-would-be-the-consequences-if-britain-left-the-

Domestic Economic Conditions – Statement on Monetary Policy – August 2016. (2016). Reserve Bank Of Australia.

BEYOND BREXIT: POTENTIAL IMPLICATIONS FOR AUSTRALIAN TRADE AND INVESTMENT. (2016). Australian Trade Commission.

Monetary Policy. (2016). Reserve Bank Of Australia.

http://www.rba.gov.au. (2016). Retrieved 28 August 2016, from http://www.rba.gov.au/statistics/cash-rate/