Dividend Policy in Equity Bank

Name

Institution

Dividend Policy in Equity Bank

Dividend Policy代写 Companies like Equity Bank Limited raise funds from different sources, including debentures, preference shares, and equity shares.

Companies like Equity Bank Limited raise funds from different sources, including debentures, preference shares, and equity shares. A company is committed to paying debenture and preference shareholders a fixed rate. However, there is no commitment to make payment to equity shareholders from the company returns. The management has the power to opt to retain the earnings or distribute them as dividends.

If a company makes losses, equity shareholders are not paid, but if it makes profits, then the company is obligated to decide whether to pay a dividend or retain the earnings and convert them to equivalent shares. Besides, the profits earned can be channelled to different other purposes including investments and expansions programs. If the dividends are to be paid to shareholders, then the management has to decide on the amount to pay.

Regardless of the decision taken, it has to be done with the interest of maximizing wealth for the shareholders. There are various types of divided policies available to the company to choose from including regular, stable, constant and irregular. The payment of any of these dividends is affected by several factors, both in the internal and external control of the bank, as well as regarding the models of capital and dividend payment policy.

About Equity Bank Dividend Policy代写

Equity Bank Limited is a commercial bank established in Kenya and provides banking products and services to individuals, businesses and other organizations. The bank offers a range of services and financial products, including transactional accounts, digital banking, agency services, investment trustee and group accounts, trade finance, asset finance, and microfinance loans. The company is a subsidiary of Equity Group Holdings Limited and has a head office in Nairobi, Kenya.

The company was formally referred to as Equity Building Society and began operations in 1984. In the 1990s, Equity Bank was changed to microfinance to serve the low-income population, especially in tea regions. The growth in its business and market penetration led to the company being converted to a commercial bank in 2004. It was then listed on the Nairobi Stock Exchange in 2006. Equity Bank Limited has since 2006 become the parent company of the subsidiaries in Uganda, Southern Sudan, Rwanda as well as Tanzania.

According to Bank Supervision Report 2017 published by the Central Bank of Kenya Dividend Policy代写

Equity Bank Limited is among the largest commercial banks in Kenya, and that has highest growth potentials (Central Bank of Kenya, 2017). The CIO East Africa (2018) reports that the Equity Bank is among the leading 1000 banks in the globe. Equity Bank is the first in Kenya and position 799 globally. The bank has improved by seven places compared to the previous year’s 806 position. Besides, it was ranked 11th on the return on assets and 44th based on the capital return. Also, Mwaniki (2019) reporting for Business Daily found that the bank made more than Ksh. 19.8 billion in the year 2018.

The increase in profits makes the company the second most profitable company in the country. Its shares have been exponentially high and were reported to hit a 38-month high in April 2018 (Munda, 2018). These are indications that the bank remains the most robust commercial bank in Kenya and African, regardless of the harsher operations environment. Consequently, the top performance trend shown by Equity Bank over the years is an indication that shareholders have been receiving or claiming substantial dividends as the share of the excellent performance.

Factors Affecting Dividend Policy Dividend Policy代写

A rational financial manager aims to maximize the owners’ wealth through profits, higher dividends rates, and higher share prices. Despite the decision made ranging from investment, financing, and dividend, they must align to the objective of value maximization for the owner and shareholders. There exists a positive relationship between the dividend policy and the value of the firm. It means that dividend payment increases the value of a firm.

On the other hand, dividend policy means the company’s set rules and regulations that guide the payment of dividends. Dividend Policy代写

It determines the ratio between the dividend payout and earnings retained. There are various types of dividends policy that a firm can adopt, and can be set to be 25 percent or 50 percent or 70 percent or any other proportion that a company avails to the shareholders. The dividend policy takes two critical dimensions. That is the dividend payout ratio and stability of the payment over time. Equity Bank gave 40 percent of the profits as a dividend to shareholders in 2019.

The dividend payment policy and retained earnings vary from one industry to the other as well as among the firms in the industry. Dividend Policy代写

The factors influencing a firm’s dividend policy lead to the emergence of variations in dividend types. However, it is the role of the management executive to approach dividend payment with an open mind to achieve a balanced decision that is based on the company’s needs and the interests of the shareholders. In this regard, financial executives are obligated to adopt an optimum dividend policy that balances current dividends and future growth in the bid to maximize the price of the firm’s shares. The overall decision on the dividend payout should be based on the shareholder’s wealth maximization and sufficiency of funds for growth objectives.

Stability of Earnings Dividend Policy代写

A company with stable earnings can predict the number of dividends to be paid in future. There is a likelihood of the company paying higher dividends with stable earnings than when it is concerned with fluctuating incomes. According to research conducted by Migwi (2015), there exists a relationship between dividend policy adopted by commercial banks and their profitability. The same finding was confirmed by Muendo, Githii, Mwangi, and Dominic (2018), who found that corporate earnings and liquidity have a significant relationship with dividend payout.

Since it was listed in 2006, Equity Bank Limited has tremendously shown extemporary performance. According to the Nairobi Securities Exchange, the company has grown from 1.1 billion profit in 2006 to 22.4 billion in 2018 (Nairobi Securities Exchange, 2018b). Therefore, the company has been giving a stable dividend of Kshs. 2 per share over the last three years.

Financing Policy of the Company Dividend Policy代写

The company’s financial policy affects and influences its dividend policy. Assuming that the company intends to service its expenses from its earnings, it will have to pay fewer dividends to shareholders. On the other hand, the decision to source external financing as the most convenient and cheaper method, then the company will pay higher dividends to its shareholders (Mudeizi, 2015). As such, the internal company policy influences its dividend policy to be adopted. A close analysis of Equity Bank’s 2018 financial statements (2018) reveals that the company had the plan of financing its internal activities through retained earnings. If the company did not keep some profits, it could have a low dividend payout.

Liquidity of Funds Dividend Policy代写

The liquidity of a company’s assets is a crucial determiner of dividend policy decisions. Although it is customary that dividends are paid from profits, the dividend payment is made out of the bank. The presentation of profit in the financial statement is an accounting phenomenon and a legal requirement. It needs to be supported by the cash and working capital position to make informed judgments on the dividend payout. According to Olang, Akenga, and Mwangi (2015), there exists a positive effect between liquidity and dividend payout.

Thus, increase in liquidity lead to an increase in dividend paid. Since dividend is “cash outflow, the better the cash position and liquidity of the company, the better for the company” (Olang, Akenga, & Mwangi, 2015). Equity Bank maintains sustainable liquidity and cash position of more than 7 billion every financial year and hence making it healthy to pay better and regular dividends.

Dividend Policy of the Competitive Concerns Dividend Policy代写

Equity Bank is the largest commercial bank in Kenya and the most profitable. Nonetheless, its size and profitability do not exclude it from market competition. Its main competitors include Kenya Commercial Bank, Barclays Bank, NIC Bank, among others. These banks do not only compete on the services but also on attracting investors. For instance, Kenya Commercial Bank paid Kshs. 2.5 per share and Barclay Banks paid Kshs. 0.2 per share. KCB being the second largest bank in Kenya, is ahead of Equity Bank in dividend payout.

Equity Bank is, therefore, working to pay higher dividends than KCB in the nest financial years while KCB will work to ensure it remains at the top in dividend payout. Thus, although the payout is affected by other factors, Equity Bank keeps a close watch on its competitors to make sure it does not pay little dividends that may scare away investors.

Past Dividend Rates Dividend Policy代写

Equity Bank is an already existing company, and therefore, its future dividend payout is based on previous rates. The comparison of prices between two periods is to ensure stability and predictability in dividend payment. Companies strive to be consistent in serving the interests of shareholders. As such, Equity Bank has adopted a stable and predictable dividend payout policy. For instance, the dividend for the financial year 2019 was announced to be 200 cents. The same rate was paid in the previous year 2018.

Debt Obligations

If a company has a high debt to equity ratio, then it will not be in a position to pay higher dividends to its shareholders. According to research by Mwangi (2014), the rate of dividend payout by the firms registered at the Nairobi Securities Exchange is inversely proportional to the financial leverage. Therefore, retained earning becomes a key aspect in reducing the company debts to substantial levels. If the company does not have high obligations, then it can afford to pay higher dividend rates. In this regard, Equity Bank has a low debt ratio and high retained earnings and hence can pay higher dividends to its customers.

Ability to Borrow Dividend Policy代写

Like any other company, Equity Bank requires finance for expansions investments and to meet immediate expenses. Thus, the company needs the ability to borrow from the market where established and large companies have better access to the credit facilities than the new and small firms. Manjunatha (2013) and Mworia (2016) found that the capital structure of a firm affects its access to debt financing and a subsequent impact on the rate of dividend payout. Equity Bank is a large company with its presence in the whole of East Africa, and hence I can enjoy the borrowing ability as well as internal financial, which it harnesses to create a balance for higher dividend payout.

Growth Needs of the Company

The growth needs of the company also determine the dividend rates to be paid. If a company is young and needs to expand, then it will pay fewer dividends to its shareholders compared to already developed and established companies like Equity Bank. When the company was growing to East African, including Rwanda and Southern Sudan, it had to reduce its retained earnings and increase its debt financing. The more money was needed for growth and development and hence reduced its dividend rate at that period.

Profit Rate Dividend Policy代写

Another important consideration for deciding the dividend is the profit rate of the firm. The company profitability can be used as the basis for comparison of the productivity of retained earnings any other incomes that can be earned elsewhere. In deciding the dividend payout, the alternative investment opportunity is a critical consideration. For instance, when Equity Bank was expanding to other countries, alternative investments in these countries was preferable than giving higher dividend rates.

Legal Requirements

There are legal restrictions that the board of managers has to consider when declaring dividend payouts. The Kenya Company Act of 2015 prescribes dividend declarations and payment and which companies have to follow after announcement strictly. The dividend payout should not exceed the retained earnings as per the company statement of financial position. Though the Equity Bank has never been in a situation to have negative retained earnings, such as the time when retained earnings are not enough for dividend payment, it is not obligated to pay.

Policy of Control Dividend Policy代写

According to Sáez and Gutiérrez (2015), the company’s policy of control is critical in determining the price of dividends to be paid. For instance, if Equity Bank feels that it does not need new shareholders to be added, it will start to pay lower dividends to its shareholders. The reason being that new shareholders are perceived to dilute the control of the company management. Therefore, if Equity Bank’s management feels that the bank wants to continue with the current power, then it should maintain the level of dividend payment or lower and continue meeting its financial obligations from retained earnings without shareholders’ contribution.

Corporate Taxation Policy

According to Zagonel, Terra, and Pasuch (2018), when taxation policy changes, the rate of dividend payout also changes. In this regard, Equity Bank adopts a balanced view of taxation, dividends, and capital gains. As a result, the company has continued to offer competitive dividend rates and retaining higher earnings for capital gain. Therefore, the taxation policy has not impacted much on the company’s dividend decisions.

Tax Position of Shareholders Dividend Policy代写

Shareholders have a tax differential view on the dividend policy. Considering other factors, shareholders prefer equity appreciation to dividends because capital gains are taxed at a lower rate compared to dividends (Khan, Jehan, & Shah, 2017). If a large number of shareholders have other income from other sources, they might not any prefer high dividend payouts because of high taxation but instead requests for capital gain.

Here, they prefer to not receive dividend in form of cash but in form of shares that will increase their shareholding in the company. There several benefits that accrue to this decision including the ability to sell extra shares in proportion to their shareholding. Though there is taxation for the capital gain, it will be less compared to the income-tax that they would have paid after receiving cash dividends.

Effects of Trade Cycle Dividend Policy代写

Just like any other business, Equity Bank is not immune to industry shocks. The banking sector undergoes boom and recession while the economic experiences prosperity and inflation, which all affect its operations. Zhu (2016) explained dividend changes using cash flow hypothesis theory that managers use to signal company performance. It means that managers are likely to pay more dividends when they have more cash flow than when they do not which signifies the various business cycles.

Conventionally, companies pay higher dividend rates when they make higher profits, and there are not cash outflows to reduce the payout. Cashflow hypothesis theory also applies to Equity Bank. It announced 200 cents per share, probably due to the high profits in 2019. Assuming that the bank profits reduced by 50 percent, then the dividend payout rate would have been reduced by even more than 50 percent or the management opt not to pay.

The attitude of the Interest Group Dividend Policy代写

A company may have a specific group of interested and dominant shareholders. They may have a confident attitude towards payment of dividends and have a definite say in policy formulation regarding dividend payments. If they are not interested in a higher rate of dividend, shareholders are not likely to get low price. On the other hand, if they are interested in higher rate of bonuses, they will manage to make company declare higher rate of dividend even in the face of many odds.

A study by Dewri and Islam (2015) in Bangladesh found that most investors do not have autonomy in making investment decisions. They cited that their investment decisions are based on other investor stock buying decisions. Most big companies were found to pay fewer dividends regardless of the number of profits made. The amount of dividend payout is a deliberate manipulation by the board of directors who act for the interests of the prominent and influential investors. Equity Bank is not an exemption from external influences on the amount of dividend rate to pay.

Changes in Government Policy Dividend Policy代写

Banks are victims of government interventions on interest rates caps, employment laws, taxations, and other policy changes. Sometimes the government can limit the rate of dividend declared by companies in a particular industry. For instance, the government of Kenya repealed the interest rates capping to give banks discretion to determine their interest rates on a competitive basis.

According to a report by the International Monetary Fund, Alper, Clements, Hobdari, and Porcel (2019) found that interest capping was the worse for the banking sector since because of the risks involved. The capping lends to banks taking risky lending and hence cost them higher insurance cover and write-off. Every year, Equity Bank has to write-off some loans as bad and unrecoverable which hurts its cashflow and overall dividend payout rate.

Theories of Dividend Policy

On the other hand, the above factors are generally explained using theories of dividend policy. The dividend theory is a formulation of an apparent relationship that seeks to explain the relationship between dividend patterns and causal factors impacting on the trend. These theories are used by the management to determine and predict the dividend payout policy to be used or followed. The mainly recognized theories include the Modigliani-Miller Hypothesis and Walter’s Model.

Modigliani-Miller Hypothesis Dividend Policy代写

The hypothesis provides the irrelevance concept of dividend comprehensively. According to Modigliani and Miller, there is no need for a company to have a dividend policy since it does not affect the price of shares of a firm. That is, it does not have an impact on shareholders’ interests of the firm (Cline, 2015). They argued that the value of a firm is determined by the profitability of a firm and returns on investment and assets. As such, dividend policy adopted by the company by sharing deducting dividends from retained earnings is not relevant in the value of a firm.

Therefore, for the theory by Modigliani-Miller to be applicable, there are several assumptions made. First, the authors assumed that there are not taxes, which means that the tax differences between dividends and capital gains do not exist. Secondly, the company is created by rational investors. Rational investors will seek to increase wealth and that they are indifferent between dividends and the appreciation in the value of shares. Third, they assumed that the investment policy of the company does not change. And lastly, risk and uncertainty do not exist. That means investors can look into the future and predict the prices of shares and dividends payout with certainty and that one discount rate is used for all types of securities at all times.

The Modigliani-Miller hypothesis can be proved as follows;

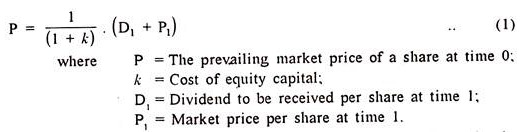

According to them, at the beginning of a certain period, the market price of a share is equal to the present value of dividend paid at the end of that period plus the market prices of the stock at the end of the period. It can be illustrated using the formula below;

Assuming that there exist new but external funds for Equity Bank, its value (V) will be the number of outstanding shares (v) multiplied by the prices of each stock (P) by multiplying both sides of equation (1) we get:

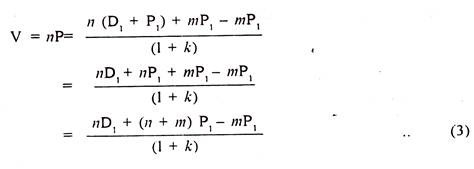

If we assume that Equity Bank sold (m) new shares at a time (1) at prices of P1, the company value (V) at the time (0) will be:

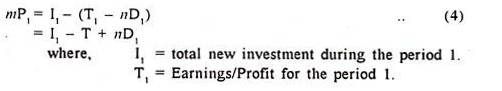

Regarding the capital structure of a firm, it is conventional that the company finance its programs using retained earnings, equity, or both. Thus, the amount of earning for a particular period will be given by;

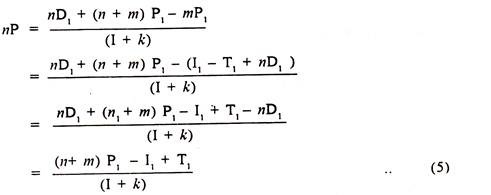

The total equity financing through the issue of shares can be calculated by investment of the first period and not by the dividend policy for that period, that is, nD1, which are eliminated as shown below:

Therefore, Modigliani-Miller’s valuation model in equation (5) can be traced back to other equations (2) and (3) stated above in terms of external financing. D1 can be eliminated from equation five which another presentation of firm’s value (V). The exclusion of dividends from the equation proves that dividend policy does not affect a firm’s value.

However, the M-M hypothesis has elicited criticisms on its applicability. Dividend Policy代写

Most of the objections come from their assumptions. The assumption that there are taxes is, in reality impossible. Shareholders must pay taxes on dividends and capital gains. Since taxation on capital gains is relatively low compared to that of bonuses paid, investors prefer the former over the latter to pay comparatively lower taxes when shares are floated in the market. Generally, Equity Bank management would prefer to raise funds through internal financing because it is cheaper compared to debt financing. Therefore, regarding tax payment, a dividend policy would be affected by investors’ preference for retained earning and capitalization of their dividends over the cash dividends.

Additionally, the assumption of the M-M that both equity and debt financing are equal is wrong. They argue that if cash dividends are paid, then the company will have to raise the funding from external sources. They added that no variations in shareholders’ wealth regardless of whether the company chooses capitalization through retained earnings or offer new shares in the market as long as there is floatation cost. However, in reality, there are floatation costs in new issues and are not incurred in retained earnings. Due to these, debt financing is costlier compared to equity financing.

Moreover Dividend Policy代写

The Modigliani-Miller assumption that shareholders’ wealth remains unchanged whether dividends are paid or not, is also erroneous. M-M did not consider the transaction that exists when a shareholder wants to sell his/her shares for current income. A shareholder incurs transaction costs such as brokerage commission, and hence a shareholder would prefer to have cash dividend to capital gains to escape bureaucracies and inconveniencies that come with sales of shares. Therefore, again, the choice of shareholders determines the dividend policy that Equity Bank will adopt.

Furthermore, Modigliani and Miller’s assumption that the discount rate should be the same regardless of whether the firm uses debt and equity financing is misleading. A firm may opt to diversify its portfolio through capitalization of dividend earnings and invest in other firms. In such cases, shareholders may take preference for the higher discount rate if equity financing is used and vice versa.

Walter’s Model Dividend Policy代写

Walter’s model state that the dividend and investment policy of a firm are interlinked and cannot be isolated (Panigrahi, & Zainuddin, 2015). Thus, the dividend policy choice has a significant effect on the value of the firm. The model argues the relationship that exists between the internal rate of return (r) and cost of capital (k). In the context of Equity Bank, the optimum policy can be determined by the relationship between r and k (Equity Group Holdings PLC, 2018). Equity Bank retains its profits if the return on investment is higher than the cost of capital. The dividends distributed to shareholders are deducted from the retained earnings if they exceed set threshold.

Therefore, Walter’s proposition can be summarized as follows:

- When the bank’s r is greater than k, then the return on its investments are adequate to earn investors more through dividends. The optimum dividend policy is determined D/P ratio of 0. In such a scenario, the bank can retain its profits and increase the market value of its share, which was averaging at 50 in 2019 (Financial Times, 2019).

- On the other hand, if the r is less than k, then the bank will not be making enough profit from its investments. In such a case, the company will not retain its earning because it will not be profitable. Therefore, the management will prefer to offer cash dividends to shareholders for them to invest them elsewhere for better returns. Fortunately, Equity Bank has been making tremendously higher profits in every investment made (Nairobi Securities Exchange, 2018b).

Nonetheless, for Walter’s Model to be applicable, there are several assumptions. Dividend Policy代写

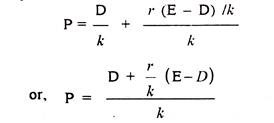

First, the bank makes financing using retained earnings only. The internal rates of returns and the cost of capital are constant. Walter also assumed that key variables do not change in the model and that the company retains all earnings or distribute as dividends. Lastly, the firm is a going concern and has great prospects. Therefore, dividends decision is made using the formula;

Where;

P = price per share;

D = Dividend;

E = Share earning;

r = Equity rate of return;

k = capitalization rate.

Notably, the D/P ratio is determined by variance in D only and only if the company’s share hit the highest value in the market.

However, the application of this model is criticized on several grounds. Dividend Policy代写

The assumption that the firm only finances its investment using internal funds is not realistic in the real business world and ignores the benefits that accrue to optimum capital structure. Another assumption that internal rate of return will remain constant is not correct in real-world since as the company increases, investment r will reach a point of decline. Also, Walter’s assumption that capital, k, will remain constant cannot work in real world. As the risk pattern of the company changes the cost of capital will also change. The model ignores the effect of risk on the value of the firm.

In summation, Equity Group Holdings PLC is a thriving commercial bank and has continued to serve the interests of the shareholders. Since its initial public offer in 2006, the company has grown to become the largest company in Kenya and Eastern Africa. The growth is highly attributed to the innovative investment decisions that saw it expand and grow to other countries and serve more than 12 million customers and its shareholders (Matara, 2019). The dividend payout for the company has been stable since its listing. The management uses both retained earnings and capitalization as the primary source of financing its growth and expansion. The dividend policy adopted by Equity Bank has positively impacted its growth.

References Dividend Policy代写

Alper, M. E., Clements, M. B. J., Hobdari, M. N. A., & Porcel, R. M. (2019). Do Interest Rate Controls Work? Evidence from Kenya. International Monetary Fund.

Cline, W. R. (2015). Testing the Modigliani-Miller theorem of capital structure irrelevance for banks. Peterson Institute for International Economics Working Paper, (15-8).

Central Bank of Kenya. (2017). Bank supervision annual report, 2017 [online]. CBK. Retrieved from https://www.centralbank.go.ke/uploads/banking_sector_annual_reports/873911276_2017%20Annual%20Report.pdf

CIO East Africa. (2018). Equity Bank Ranked 35th Most Solid Bank in the World. CIO. Retrieved from https://www.cio.co.ke/equity-bank-ranked-35th-most-solid-bank-in-the-world/

Dewri, L. V., & Islam, M. R. (2015). Behavioral Analysis of Investors’ Attitude towards the Dividend Declaration in Developing Country-A Case of Bangladesh. International Journal of Business and Management, 10(11), 185.

Equity Group Holdings PLC. (2018). 2018 Equity Group Holdings PLC Annual Report. Retrieved from https://www.equitybankgroup.com/uploads/default/files/2018/equitygroupholdingsplcannualreportandfinancialstatementsfortheyearended31december2018.pdf

Financial Times. (2019). Equity Group Holdings PLC. Retrieved from https://markets.ft.com/data/equities/tearsheet/summary?s=EQTY:NAI

Khan, N. U., Jehan, Q. U. A. S., & Shah, A. (2017). Impact of taxation on dividend policy: Evidence from Pakistan. Research in international business and Finance, 42, 365-375.

Mwaniki, C. (2019). Equity Bank’s profit hits Sh19.8bn. BusinessDailyAfrica. Retrieved from https://www.businessdailyafrica.com/corporate/companies/Equity-Bank-profit-hits-Sh19bn/4003102-5044096-usl9euz/index.html

Mwangi, A. R. (2014). The effect of debt financing on the dividend policy of firms listed at Nairobi Securities Exchange (Master’s thesis). Retrieved from https://pdfs.semanticscholar.org/f1a4/1677093a2874de670aeaccbfa6ee8966d874.pdf

Mworia, V. G. (2016). The Relationship Between Financial Leverage and Dividend Pay Out Ratio of Firms Listed at the Nairobi Securities Exchange. Unpublished MBA Project, University of Nairobi, Nairobi, Kenya). Retrieved from http://erepository. uonbi.ac. ke/bitstream/handle/11295/100232/Mworia_The Relationship Between Financial Leverage And Dividend Pay Out Ratio Of Firms Listed At The Nairobi Securities Exchange. Pdf.

And

Manjunatha, K. (2013). Impact of debt-equity and dividend payout ratio on the value of the firm. Glob J Commer Manag Perspect, 2(2), 18-27.

Munda, C. (2018). Equity Bank share hits a 38-month high. BusinessDailyAfrica. Retrieved from https://www.businessdailyafrica.com/markets/capital/Equity-Bank-share-hits-38-month-high/4259442-4381798-2oxiyhz/index.html

Matara, V. (2019). List of Equity Bank shareholders 2019. Retrieved from https://victormatara.com/list-of-equity-bank-shareholders-2018/

Muendo, M., Githii, W., Mwangi, M., and Dominic, M. (2018). Corporate Earnings and Dividend Payout Ratio of Commercial Banks in Kenya. Journal of Business and Management, 4(20), pp. 69-75.

Migwi, W., E. (2015). The effect of profitability on the dividend policy of commercial banks of Kenya (Master’s thesis). Retrieved from https://pdfs.semanticscholar.org/8bc7/21e01bcd8e315282eaf279bf24e13f540eea.pdf

Mudeizi, L. (2015). The impact of debt financing on the dividend policy of firms listed at Nairobi Securities Exchange (Master’s thesis). Retrieved from http://erepository.uonbi.ac.ke/bitstream/handle/11295/102593/Mudeizi_The%20Effect%20of%20Debt%20Financing%20on%20Dividend%20Policy%20of%20Firms%20Listed%20at%20Nairobi%20Securities%20Exchange.pdf?sequence=1&isAllowed=y

Nairobi Securities Exchange. (2018b). Equity bank’s growth and success since listing on the NSE (2006).

Olang, M. A., Akenga, G. M., & Mwangi, J. K. (2015). Effect of liquidity on the dividend pay-out by firms listed at the Nairobi securities exchange, Kenya. Science Journal of Business and Management, 3(5), 196-208.

Panigrahi, S., & Zainuddin, Y. (2015). Dividend Policy Decisions: Theoretical Views and Relevant Issues. Reports on Economics and Finance, 1(1), 43-58.

Sáez, M., & Gutiérrez, M. (2015). Dividend policy with controlling shareholders. Theoretical Inquiries in Law, 16(1), 107-130.

Zagonel, T., Terra, P. R. S., & Pasuch, D. F. (2018). Taxation, corporate governance and dividend policy in Brazil. RAUSP Management Journal, 53(3), 304-323.

Zhu, P. (2016). Dividend changes over the business cycle. The University of Pittsburgh. Retrieved from http://www.fmaconferences.org/Vegas/Papers/Payout_over_Business_Cycles_Draft_1.15.pdf

更多其他:Essay代写 Proposal代写 Admission Review代写 Report代写 Case study代写 艾莎代写 研究论文代写 文学论文代写 Academic代写