FIN 958 FINANCE ASSESSMENT

财务代写 As of 4 April 2020, Australia had 6,400 confirmed cases of COVID-19, of which 3,598 people had recovered and 61 deaths. The…

Background 财务代写

As of 4 April 2020, Australia had 6,400 confirmed cases of COVID-19, of which 3,598 people had recovered and 61 deaths. The humanitarian impact of the disease has potentially equally disruptive economic fallout. The pandemic has affected the forecasts of Australia’s gross domestic products (GDP), the risk of sovereign bonds, banking sectors as well as companies that depend on suppliers in other impacted countries. Companies are retrenching, businesses are closing, credits have defaulted. And the overall economy is dwindling if not coming to a halt.

Qantas sent more than 20,000 workers on compulsory without pay (Butler, 2020). Banks, on the other hand, have called off funding injections totaling at least $2.5 billion because companies are not able to fresh money. For instance, NAB considered not to raise about $2 billion by selling investors’ notes (Ben, 2020). As COVID-19 continues to reverberate, significant stress has grown in the banking system. And hence banks have a role to play as systemic stabilizers.

Question A: Elevated risks encountered by banks in Australia 财务代写

Banks in Australia have been adversely affected by the social and economic impacts caused by a coronavirus. Moody has downgraded the Australian banking system to negative with the anticipation that the pandemic will recontinue to reduce profitability due to increased provisions for loan losses and record low-interest rates (Duran, 2020). Overall, banks in Australia are grappling with a variety of risks, including credit, market, reputational, and operational risks.

a.Credit risk 财务代写

Credit risk is a type of threat from likely non-payment of loans by debtors, including delayed payment (Lando, 2009, p. 787). For instance, when a borrower defaults payment of principal. And interest of a loan. Banks in Australia are facing defaults in mortgages, credit cards, and fixed income securities. Credit risk also occurs in such areas as derivatives and guarantees provided. Australian banks have A$2.9 trillion in gross loans and advances to domestic customers and businesses (Paulina, 2020). Banks cannot protect themselves from credit risk. But can put up measures to reduce the extent of exposure.

The impact of the COVID-19 on the mortgage and commercial customers cannot be underestimated. The commercial real estate in retail is the most hit segment. Although most retain businesses have moved online due to pandemic, the vast majority of retail businesses are still dependent on foot traffic. They include not only stores but also those that offer face-to-face services such as barbershops, restaurants. And bars where remove services are not possible.

When people are unable or afraid to patronize local businesses 财务代写

It means retailers have not customers. Also, retailers will have an uphill task to get workers because some are in mandatory or voluntary quarantine. At the same time, retailers have an additional cost of ensuring their customer they are sanitizing their facilities not to be scared. Therefore, as the situation continues to escalate, there is a significant slowdown in the economy. Hence retailers, who lack enough capital or lines of credit, are operating in a downturn. Some of these retailers are unable to pay their rents, and as the slowdown perpetuates to unbearable levels, leases will go to default.

Therefore, landlords on lease contracts with these retail tenants are likely to find themselves in a cash crunch being unable to service their mortgage loans. Also, properties used to take loans will devalue if the multiple of earnings is used because there has been a decline in rental income. Thus, it can become difficult to make additional financing as banks are tightening their loan-to-value ratios. Furthermore, although a landlord may manage to repay the mortgage. The decline in property value may lead to default due to a financial ratio clause in some mortgages.

Similarly, many homeowners with no paychecks either because they were furloughed or unable to get to work may default on their mortgage. Additionally, the home lending market is mostly collateralized. Banks are more likely to deal with borrowers who may have limited capacity to repay. If the pandemic continues and mortgage continues to default, home prices will begin to slide.

The Reserve Bank of Australia is providing a lower discount rate to banks. 财务代写

As a result, banks have options to lend at a lower interest rate. However, refinancing existing debts, although attractive, is risky to banks, which are currently stress-testing their portfolios. Credit card borrowers have low income or are on leave without pay. And hence future repayment is not predictable. On the other hand, residential borrowers have to put up with additional. And restrictive conditions for financing, such as proof of current income and net worth. Overall, refinancing is less available, and if possible, it is expensive because of penalties for defaults and tighter financial covenants.

Unfortunately, debt collection may be difficult for the banks in need to recover their money from loan defaulters. Banks are likely to suffer credit loss of over A$9 billion of private loans (Paulina, 2020). The economic environment is making property buyers and investors reluctant. Also, even though potential buyers are willing. And able, they have a fear of coming into contact that increases the chances of infection. Therefore, until the situation is ended, banks will continue to bear the burden of credit risk while using mitigating options available.

b.Market risk 财务代写

Market risk arises when banks are involved in the capital market. The risk is caused by the unpredictability nature of equity markets, commodity prices, interest rates, and credit spread. The emergence of the COVID-19 pandemic was unpredictable and hence has taken a toll in the capital market as the Australian economy slowdown.

Banks function as underwriters in the issuance of debt securities such as bonds. Most businesses, including large corporations, are undergoing a tough time ahead as the financial impact of the coronavirus outbreak spreads through the economy (Beveridge, 2020). Some of the most hit are the airlines, carmakers, and beer companies in Australia. Since the government introduced social distancing, the number of workers has significantly reduced. As the number of workers reduces, productivity also reduces and hence the overall profitability. Additionally, there is a reduction in demand for airline services, cars, and beer.

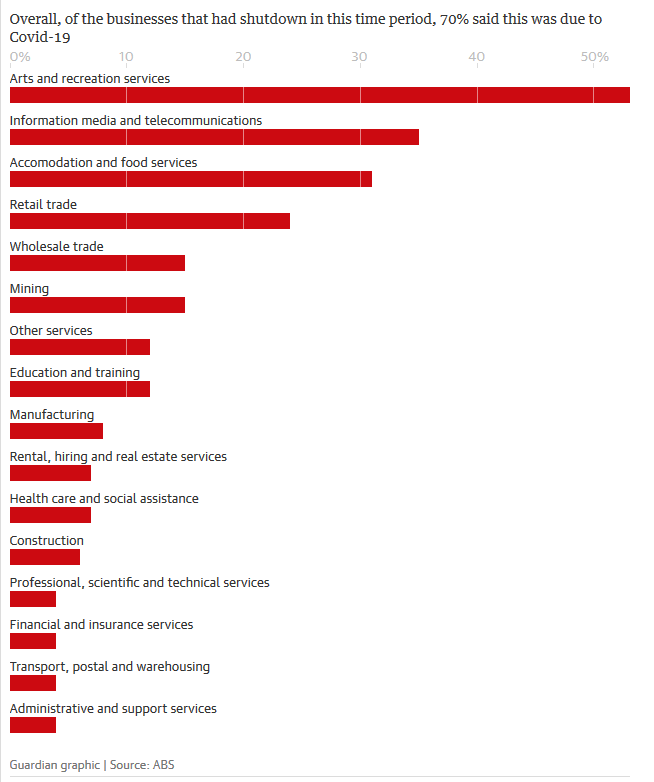

Since June 2019 and 30 March 2020, the number of closed businesses has increased by 70 percent due to COVID-19, as shown in figure 1 (Knaus, 2020). The reason being, people are avoiding excessive expenditure on cars because the situation is not predictable or because the disposable income has decreased. Most of the airports are closed for international travel, and restrictions are made for local traveling. Bars and other social joints are closed and hence reducing the demand for beer. It means that these large businesses may not be able to pay their debts to which banks are underwriters.

Therefore, when a bank acts as an underwriter to corporate bonds 财务代写

It assumes to bear the burden of risk at their maturity. Since the overall productivity and demand has declined in the airline, cars, and beer industries, the possibility of these companies failing to settle their bonds when due is high. As such, banks that underwrote these bonds will have to pay investors. The banks do not only risk losing interest rate due on these bonds but also suffer the loss of cash.

Similarly, equity risk presents potential damage due to an adverse change in stock price at the advent of the novel coronavirus (Ramelli, and Wagner, 2020). The risk will mainly affect banks that accept equity as collateral for loans and purchase ownership stakes in other companies as investments with their free or investible cash. When the stock price falls, it leads to a loss or diminution in investments’ value.

Investors are worried about the looming impact of COVID-19 on the economy.

Figure 1: Percentage of closed businesses

Source: Knaus (2020)

The stock price is a reflection of investor’s expectations about future payoffs (Amadeo, 2020). Investors use data on dividend futures to obtain growth expected in stock. Dividend futures are the contracts that pay dividends of the aggregate stock market in a specific year. If assuming there is no arbitrage, the sum of all dividend price claimed is the price of the overall market. In this context, investors do not expect much pay off to keep their investment tied for a short time but instead require more to keep it tied up for longer. However, when the stock yield curve inverts, investors will need more pay off in the short-term than in the long-term.

In this regard, as the coronavirus effect continues to intensify 财务代写

investors are demanding more on a one-month Treasury bill than the 10-year note. Their action is a market signal that the pandemic is likely to harm the economy. As a result, people who have invested their savings in the stock market witness value decline of their holdings. They start to panic and sell their stock to avoid losing more. For instance, the ASX200 lost 7.33 percent of shares value as about $ was wiped off from the market (Doherty and Murphy, 2020). The reason being the combination of a stock market crash and the inverted yield curve is a sign of economic recession.

Because most banks have invested in the stock market and hold stocks as collateral for loans. The decline or looming crash in the stock market signal risk of loss. If a debtor default on loan secured by stock, the banks may be compelled to sell the stock at the lower margin or may never recover the debt from the stock sale. It may also take many years for the stock to recover its collateralized value.

c.Reputational risk 财务代写

When the novel coronavirus hit Australia, banks became the utmost importance in maintaining economic activities such as enabling delivery and supply of basic needs. The government, on the other hand, has a role in developing considerable measures that overrule the currently applicable regulations that introduce special once that incentivize to avert the economic catastrophe. If any bank involves in a practice that its customers consider unfair regarding the current economic challenges, it risks damaging its image and loss of public confidence.

As such, COVID-19 has not only affected the economy, but also some businesses are directly affected, such as restaurants, tourism, and entertainment. Financial institutions have a framework that guide the contractual relationship with these businesses. And which underpins their rights and obligations. The government regulation input has a significant bearing on the course of action and policies that can offer them a reprieve. For instance, banks are generally expected to treat customers and conduct business fairly. The government redress rules are also guiding banks’ protocols. At this time, customer protectionism is the benchmark on which banks are operating.

In this regard, banks in Australia are expected to adopt affirmative government directives intended to protect the economy and the public as a whole. The RBA introduced interest rate cut to curb market reaction from the impact of COVID-19. It announced to reduce the cash rate by 25 basis points (bps) to 0.50 percent (Sinclair, 2020). The objective is to boost demand to assist in easing pressure for local businesses and homeowners. Banks are the implementors of the policy move by passing the savings to their consumers. Failure to do so will expose them as practicing unscrupulous business practices that will damage their reputations.

Additionally, bank customers have been affected by coronavirus pandemic. 财务代写

Some have lost their jobs, businesses have closed, and loans and rents have defaulted. The ripple effect on the population is a result of the health requirement of social distancing and government directive of self-quarantine. AS such, banks have a responsibility to conduct fair business in response to the overall economic and social impact of the pandemic.

Through the Australian Banking Association, banks are willing to support customers and assist them in times of need. Some of the measures that some banks have undertaken include deferring scheduled loan payments, waiving fees charges, interest-free periods or constant interest rates, and debt consolidation (Grant, 2020). Since the information is in the public domain, a bank that fails to be considerate regarding fair business practices risks damaging its reputation.

d.Operational risk 财务代写

Operational risk occurs due to errors, interruptions, or damages in the system, human resources, or processes. COVID-19 mainly affect operations in human resource. It has increased chances of errors, interruptions, and damages from workers. The disease is primarily spread through contact with the virus from an infected person or a surface. The main control of the disease from spreading is social distancing and cleanliness. As such, it is encouraged that companies adopt online working to limit a person to person contact at the place of work. Working from home for bank employees can result in certain risks owing to the critical nature of work involved.

The banking sector is highly affected by the risk of working from home as coronavirus pandemic, making it a common trend. Trust in employees is one of the biggest challenges, and a crucial element is the bank’s willingness to believe that employees would deliver results. Trust is needed between the human resource manager and employees. However, owing to the social, economic, and work ethic factors, trusting bank employees to work remotely is difficult. If any of the employees are allowed to work from home, the banks risk that the worker will uphold confidentiality and integrity. An employee can be tempted to tamper with the bank system because there is a lack of close monitoring. If this happens, the bank can lose money, reputation, or security breach.

Additionally, bank profitability is likely to reduce. Worker productivity may decline due to difficulty in monitoring workers online, decrease in morale, lack of development. At home, a worker may feel free, relax, or have much disturbance. Workers may also make errors that can compromise the bank system. The bank risks losing money and reputation if profitability decline and errors occur.

Question B: Mitigating measures 财务代写

The COVID-19 outbreak is urging banks and their risk functions to form crisis plans. The above risks can be mitigated through various measures. Although credit risk is inevitable, especially in the advent of coronavirus, a bank can take steps to strengthen its lending program. The banks should reinforce on checking new customer credit records and add stringent standards for them to qualify for credit (Carter, 2020). At this time of the pandemic, more individuals and businesses are applying for low-interest rate loans and mortgages. Due diligence and conditions need to be instituted to avoid failure of repayment.

Secondly, banks should avoid advancing loans to the new customers that they have not established the previous relationship. Management of customer’s credit risk requires building a long-term and trusted relationship. Many businesses and individuals will apply for low-interest loans as new customers, which present high risk to banks because there will be no adequate groundwork to establish adequate credit terms before extending the credit.

Thirdly, banks should establish a credit limit for both new and existing customers. There might be an influx of loan applicants because the interest rate is low. Owing to the looming credit default and extension of the repayment period due to the impact of coronavirus pandemic, banks should have strict credit limits. The limits can be established based on credit-agency reports, bank reports, and audited financial statements. Lastly, banks can use credit insurance for non-payment or defaults. In the current instance of many creditors defaulting, the bank will have recourse by claiming insurance recovery of unrecoverable loans.

The market risk can also be mitigated by the use of various measures. 财务代写

First, banks should seek to diversify stock investment instead of concentrating risks (India Infoline News Service, 2020). The current situation is a lesion to banks to never invest in one theme sector because if something goes wrong in that sector, the banks risk losing all its investment. Banks can not control company performance or the occurrence of a pandemic, but they can control which stock to buy or sell. Secondly, banks can tweak their portfolio to mitigate interest rate risk, which mainly affects bonds and equities. When the central bank reduces the interest rate, bond prices increase, making the NAV of the bond fund to improve.

It also happens to equities, where lower rates discount the future cash flows at a lower rate and boost valuation. The reverse is also true. When a bank has invested in bonds, it can transfer maturities. If the bank has invested in equities, it can tweak the exposure to rate-sensitive sectors such as banks, realty, and auto. Lastly, since it is difficult to escape volatility resulting from the impact of COVID-19, banks can go long-term to get through economic crisis time. Banks with short-term maturity bonds are hard hit by market volatility. In the long-term, volatility in equities even out over time.

Moreover, safeguarding bank reputation is critical 财务代写

Because it constitutes one of the most valuable and fragile assets that a bank has (Bassig, 2019). As coronavirus continues to ravage the economy, banks have a responsibility to protect their reputation. First, they need to demonstrate business integrity. Customers want to be associated with banks that identify with their interests. In the current situation, customer interests include an extension of loan repayment, low-interest credit, among other fair practices. The banks can also maintain a good reputation by adhering to the government policy directives that seek to protect the interest of the public and avert economic downturn.

Lastly, operational risk, particularly in human resource management, can be mitigated by enacting several measures. Banks should not allow high risk and essential workers to work from home. Doing so increases the risk of errors, low productivity, and breach of confidentiality. Alternatively, banks can plan work in shifts to maintain social distancing rule and. At the same, maintain productivity, trust, and reduce human errors.

References

Amadeo, K 2020, How Does the 2020 Stock Market Crash Compare with Others? The Balance, viewed on 15 April 2020, https://www.thebalance.com/fundamentals-of-the-2020-market-crash-4799950

Bassig, M 2019, What is Bank Reputation Risk Management? Review Trackers, viewed on 15 April 2020, https://www.reviewtrackers.com/blog/bank-reputation-risk-management/

Butler, B 2020, ‘Outrageous’: Qantas criticized for standing down 20,000 workers without pay, The Guardian, viewed on 14 April 2020, https://www.theguardian.com/business/2020/mar/19/coronavirus-qantas-and-jetstar-to-suspend-international-flights-and-stand-down-20000-workers

Beveridge, J 2020, Coronavirus is now hurting Australian companies directly, Small Caps, viewed on 15 April 2020, https://smallcaps.com.au/coronavirus-is-now-hurting-australian-companies-directly/

Ben, B 2020, ‘They would have been slaughtered’: Coronavirus crisis causes capital freeze for Australian business, The Guardian, viewed on 14 April 2020, https://www.theguardian.com/australia-news/2020/mar/14/they-would-have-been-slaughtered-coronavirus-crisis-causes-capital-freeze-for-australian-business

Carter, M 2020, 7 ways to manage credit risk and safeguard your global trade growth, Trade Ready, viewed on 15 April 2020, http://www.tradeready.ca/2014/trade-takeaways/7-ways-manage-credit-risks-safeguard-global-trade-growth/

Duran, P 2020, Australian regulators examine banks’ pandemic preparations, Reuters, viewed on 14 April 2020, https://www.reuters.com/article/us-china-health-australia-regulator/australian-regulators-examine-banks-pandemic-preparations-idUSKCN20M052

Doherty, B, and Murphy, K 2020, Australia heads for recession as the stock market falls 7.33% in worst day since GFC, The Guardian, viewed on 15 April 2020, https://www.theguardian.com/world/2020/mar/09/australian-stock-market-down-733-in-worst-day-since-gfc-as-coronavirus-sparks-recession-fears

Grant, R 2020, Banks are ready to face coronavirus challenge, Australian Banking Association, viewed on 15 April 2020, https://www.ausbanking.org.au/banks-are-ready-to-face-coronavirus-challenge/

India Infoline News Service 2020, 8 ways to mitigate market risks and make the best of your investments, viewed on 15 April 2020, https://www.indiainfoline.com/article/news-personal-finance/8-ways-to-mitigate-market-risks-and-make-the-best-of-your-investments-118101900122_1.html

Knaus, C 2020, Coronavirus crisis has had a staggering impact on Australian businesses, data reveals, The Guardian, viewed on 15 April 2020, https://www.theguardian.com/australia-news/2020/apr/07/coronavirus-crisis-has-had-staggering-impact-on-australian-businesses-data-reveals#maincontent

Lando, D., 2009. Credit risk modeling. In Handbook of Financial Time Series (pp. 787-798). Springer, Berlin, Heidelberg.

Paulina, D 2020, Loan losses to double at Australian banks from COVID-19 – rating agencies, Reuters, viewed on 14 April 2020, https://www.reuters.com/article/healthcare-coronavirus-australia-banks/loan-losses-to-double-at-australian-banks-from-covid-19-rating-agencies-idUSL4N29T19O

Ramelli, S. and Wagner, A.F., 2020, Feverish stock price reactions to covid-19.

Sinclair, S 2020, Coronavirus Rate Cuts: Australia’s Central Bank Did It First, Coin Desk, viewed on 15 April 2020, https://www.coindesk.com/coronavirus-rate-cuts-australias-central-bank-did-it-first