Module Code and Title: BUS340 Financial Markets and Institutions

金融市场代考 Date of exam: [as per exam timetable] Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading

Date of exam: [as per exam timetable]

Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading

Important: You must read the instructions on “Guidance on Take Home Examinations” before attempting this paper.

Students with Examination Access Arrangements (e.g. disabilities, specific learning differences such as dyslexia, mental health diagnoses) must attach a completed SpLD coversheet.

This paper contains three questions. Please answer ALL parts of the three questions.

All answers must be handwritten and uploaded as a PDF document.

Declaration of academic integrity for Open Book Timed Examinations: In submitting your exam paper you are formally confirming that during the allocated examination period you have had no unauthorised conversation about this exam with any persons. Further, you certify that the attached work represents your own thinking, and is entirely your own. Any information, concepts, or words that originate from other sources are cited in accordance with the citation conventions accepted by the School of Business and Management. You are aware of the serious consequences that result from improper discussions with others or from the improper citation of work that is not your own.

All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

If you encounter errors in the exam paper or are unable to upload the exam to the QMPlus page for this module, please email the following asking for advice during UK office hours 09.00 to 17.00: sbm-uglevel6@qmul.ac.uk

Question 1 金融市场代考

- a) Calculate the fair present values of the following bonds, both of which pay interest semiannually, have a face value of $1,000, have 12 years remaining to maturity, and have a required rate of return of 10%:

- i) The bond has a 6% coupon rate.

[4 marks]

- ii) The bond has a 10% coupon rate.

[4 marks]

iii) What do your answers to parts (i) and (ii) suggest about the relation between coupon rates and present values?

[2 marks]

b) East Bank has purchased a 5 million one-year Swiss franc (Sf) loan that pays 6 percent interest annually. The spot rate of US dollars for Swiss francs is 0.9691. It has funded this loan by accepting a Canadian dollar (C$) – denominated deposit for the equivalent amount and maturity at an annual rate of 4 percent. The current spot rate of US dollars for Canadian dollars is 0.9622.

i) What is the net interest income earned in dollars on this one-year transaction if the spot rate of US dollars for Sfs and US dollars for C$s at the end of the year are 0.9825 and 0.9588, respectively? 金融市场代考

[5 marks]

ii) What should be the spot rate of US dollars for C$s be in order for the bank to earn a net interest income of $125,000 (disregarding any change in principal values)?

[5 marks]

c)Suppose the Federal Reserve instructs the trading desk to sell $650 million of securities. Show the result of this transaction on the balance sheets of the Federal Reserve System and commercial banks.

[8 marks]

d)i) An investment bank agrees to pay $26.75 for 5 million shares of a company in a firm commitment stock offering. It then can sell those shares to the public for $25.50 per share. What is the profit to the investment bank? [4 marks]

ii) An investment bank agrees to underwrite a $100 million, 15-year, 10 percent semiannual bond issue for a company on a firm commitment basis. The investment bank pays the company on Monday and plans to begin a public sale on Tuesday. If interest rates rise 0.5 percent, or fifty basis points, overnight, what will be the impact on the profits of the investment bank?

[8 marks]

[Total: 40 marks]

Question 2

a)Oceanside Bank converts a dollar of equity into 10 cents of net income and has $9.50 in assets per dollar of equity capital. Oceanside also has a profit margin of 15 percent. What is Oceanside’s AU ratio?

[10 marks]

b)A stock you are evaluating is expected to experience super normal growth in dividends of 8 percent over the next six years. Following this period, dividends are expected to grow at a constant rate of 3 percent. The stock paid a dividend of $5.50 last year, and the required rate of return on the stock is 10 percent. Calculate the stock’s fair present value?

[10 marks]

c) What are the primary responsibilities of the Federal Open Market Committee?

[10 marks]

[Total: 30 marks]

Question 3 金融市场代考

a) i) A municipal bond you are considering as an investment currently pays a 6.75 percent annual rate of return. Calculate the tax equivalent rate of return if your marginal tax rate is 28 percent.

[4 marks]

ii) A particular security’s equilibrium rate of return is 8%. For all securities, the inflation risk premium is 1.75% and the real risk-free rate is 3.5%. The security’s liquidity risk premium is 0.25% and maturity risk premium is 0.85%. The security has no special covenants. Calculate the security’s default risk premium.

[4 marks]

b) What are the different firms in the securities industry and how do they differ from each other? Please discuss three subgroups of national full-service firms and at least two types of smaller specialised firms.

[10 marks]

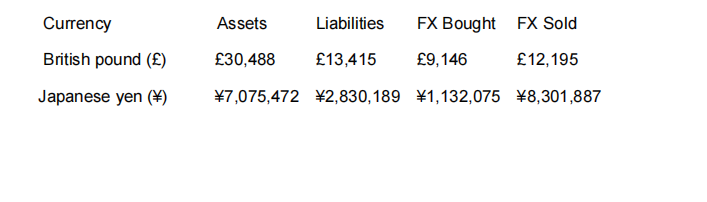

c) The following are the foreign currency positions of an US FI, expressed in the foreign currency.

The exchange rate of dollars per British pounds is 1.6400, and of dollars per yen is 0.010600.

i) What is the FI’s net exposure in British pounds stated in pounds and in dollars?

[2 marks]

ii) What is the FI’s net exposure in Japanese yen stated in yen and in dollars?

[2 marks]

iii) What is the expected loss or gain if the £ exchange rate appreciates by 2 percent? State you answer in pounds and dollars.

[4 marks]

iv) What is the expected loss or gain if the ¥ exchange rate appreciates by 3 percent? State you answer in yen and dollars.

[4 marks]

Total [30 marks]