Module Code and Title: BUS224 International Corporate Reporting

Corporate Reporting代写 Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading.

Duration and submission of exam: upload your completed exam paper to QMPlus within three hours of downloading.

Important: You must read the instructions on “Guidance on Timed Examinations” before attempting this paper.

Students with Examination Access Arrangements (e.g. disabilities, specific learning differences such as dyslexia, mental health diagnoses) must attach a completed SpLD coversheet.

This exam contains two sections: Section A and Section B.

Answer THREE questions in total:

Section A: Answer ONE compulsory question.

Section B: Answer TWO questions out of FOUR.

If you answer more questions than specified, only the first answers (up to the specified number) will be marked.

Declaration of academic integrity for Open Book Timed Examinations: In submitting your exam paper you are formally confirming that during the allocated examination period you have had no unauthorised conversation about this exam with any persons. Further, you certify that the attached work represents your own thinking, and is entirely your own. Any information, concepts, or words that originate from other sources are cited in accordance with the citation conventions accepted by the School of Business and Management. You are aware of the serious consequences that result from improper discussions with others or from the improper citation of work that is not your own.

All exam papers will be run through plagiarism software (Turnitin) and QMUL’s standard Assessment Offences policy applies.

SECTION A Corporate Reporting代写

The question presented in this section is compulsory.

Question 1

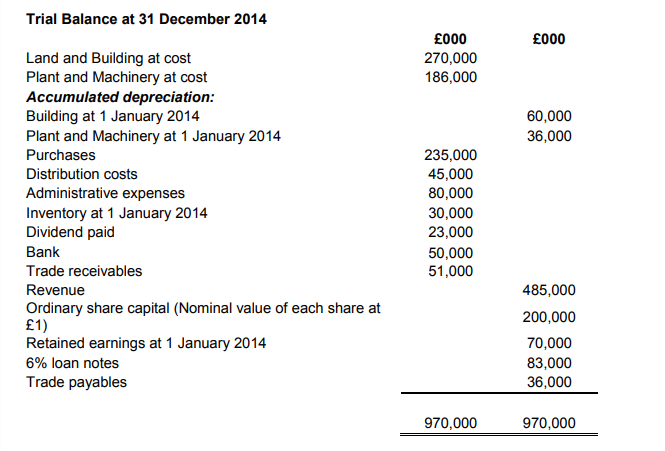

The trial balance of Remoli Plc at 31 December 2014 showed the following balances:

The following additional information is available:

a) The land and building were purchased on 1 January 1999. The cost of the land was £70 million. No land and buildings have been purchased since that date. On 1 January 2014, the company had its land professionally valued at £80m and the building was valued at £210 million. The estimated useful life of the building was originally 50 years with a nil residual value. The remaining useful life has not changed as a result of the valuation. Depreciation on building is charged to the cost of sales.

b) Plant and Machinery are depreciated at 20% per annum using the reducing balance method. Depreciation is charged to the cost of sales.

c) The long term loan (6% loan notes) was raised on 1 January 2014. It was interestfree for the first 12 months.

d) Tax expense for the year ended on 31 December 2014 has been estimated as £40 million.

e) Inventory at 31 December 2014 was valued at £52 million.

Question 1 – continued

Required:

Prepare the following financial statements for Remoli Plc for the year ended 31 December 2014 in accordance with IAS 1 Presentation of Financial Statements:

a) A Statement of Comprehensive Income.

(Workings for the calculation of cost of sales is worth 3 marks, non-current assets schedule is worth 9 marks and the statement of comprehensive income is worth 10 marks).

(22 marks)

b) A Statement of Changes in Equity.

(10 marks)

c) A Statement of Financial Position.

(18 marks)

Note: (i) Notes to the financial statements are not required and (ii) expenses should be analysed by function.

(Total: 50 Marks)

SECTION B Corporate Reporting代写

Answer TWO questions out of the FOUR presented in this section.

Question 2

Balfour Properties has three properties, details of which are listed below.

The company uses the cost model for property, plant and equipment and fair value model for investment properties. All assets measured on the cost basis are depreciated on the straight-line basis over the asset’s estimated useful life. Residual values of all three properties are assumed zero.

The financial year-end of the company is 31 December.

Property A

This property was acquired on 1 January 20X4 at a cost of £4,500,000, with the intention of using the property as the company’s administrative office. At acquisition, the cost of the land was estimated at £1,500,000 and the cost of the building was estimated at £3,000,000. The property has an estimated useful life of 20 years.

At 31 December, an identical property situated alongside Property A was sold for £4,600,000.

Property B Corporate Reporting代写

This property was acquired on 1 April 20X4 at a cost of £6,400,000, with the intention of letting it out on a long-term basis. The property has an estimated useful life of 40 years.

The property is specialised and the directors are of the opinion that it will not be possible to obtain reliable values on a continuing basis.

Property C

This property was acquired on 1 July 20X2 at a cost of £3,400,000, with the intention of letting it out on a long-term basis. The property has an estimated useful life of 35 years.

The fair value of the property at 31 December 20X3 was £4,100,000.

During the year ended 31 December 20X4, £3,100,000 was spent upgrading and refurbishing the property. This has led to increases in the rent for the property and, as a result, its estimated fair value at 31 December 20X4 is £8,400,000. Had the additional expenditure not been incurred it is estimated that the fair value of the property at 31 December 20X4 would have been £4,500,000.

Required:

Describe giving reasons, how Balfour Properties should account for these properties in its financial statements for the year ending on 31 December 20X4, in accordance with IAS 16 Property, Plant and Equipment and IAS 40 Investment Property.

(Property A – 7 Marks, Property B – 8 Marks, Property C – 10 Marks)

(Total: 25 Marks)

Question 3 Corporate Reporting代写

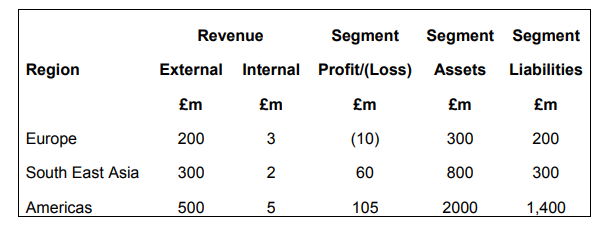

Papillion Plc is an international hotel group whose sole business is that of operating hotels. The group reports to management on the basis of regions, these being Europe, South East Asia, and the Americas. The hotels are located in capital cities in these regions and the company sets individual performance indicators for each hotel based on its city location. The results of these regional segments for the year ended 30 June 20X8 are as follows:

There were no significant intersegment balances in the asset and liability figures.

Required:

a) For an international company such as Papillion Plc, discuss the purpose behind the requirements of IFRS 8 Operating Segments (max. 200 words).

(8 marks)

b) Explain the principles in IFRS 8 Operating Segments for the determination of a company’s operating segments and whether they are reportable (max. 300 words).

(10 marks)

c) Explain whether each of Papillion Plc’s operating segments is a reportable segment

(please show your workings clearly).

(7 marks)

(Total: 25 Marks)

Question 4 Corporate Reporting代写

At 1 January 20X7 and 20X8, the issued share capital of Reina Plc comprised:

Equity Share Capital (25p shares) £3,000,000

5% irredeemable preference share capital (£1 shares) £600,000

On 1 September 20X8, Reina made a rights issue of three new equity shares at a price of 80p per share, for every two shares held. The offer was fully subscribed. The market price of Reina’s equity shares immediately prior to the offer was £1.55 each.

Reina’s profits after tax for the years ended 31 December were as follows:

20X7: £3,750,000

20X8: £2,600,000

Preference dividends were paid at the end of each quarter.

Required:

In accordance with the requirements of IAS 33 Earnings per Share, calculate Reina Plc’s basic earnings per share for disclosure in its financial statements for the year ended 31

December 20X8, including comparative figures.

(Total: 25 Marks)

Question 5 Corporate Reporting代写

i. The daughter of a director of Peruna Plc.

ii. A director of Peruna owns 60% of the share capital of another entity called Myra Ltd.

iii. Peony Ltd is an entity owned by the niece of the finance director of Peruna.

iv. Mrs. Whitehall owns 30% of the share capital of Peruna.

v. Giovanni Plc is one of Peruna Plc’s suppliers.

Required:

Discuss whether the relationships of Peruna Plc (outlined above) constitute a related party relationship as defined by IAS 24 Related Party Disclosures.

Each point is worth 5 marks.

(Total: 25 Marks)