ECON7310: Elements of Econometrics

Research Project 1

Econometrics代写 This is not a group assignment, which means that you must answer all the questions in your own words and submit your report…

Marking Allocation

Instruction Econometrics代写

This is not a group assignment, which means that you must answer all the questions in your own words and submit your report separately. To facilitate the grading work, please clearly label all your answers. upload your research report via the “Turnitin” submission link (in the folder of “Assessment”) by 11:00 on the due date 12 April, 2021. The marking system will check the similarity, and UQ’s student integrity and misconduct policy on plagiarism apply. Answer all questions following a similar format of the answers to your tutorial questions. That is, your empirical analysis has to based on the correct STATA outputs, and you should highlight the outputs in your answers.

Data Description

The data set Assign I Data.csv contains data collected from the real estate pages of the Australian. These are homes selling in the greater Brisbane area. In particular, you have the following variables:

- id, house ID number;

- price, the selling price of the house in $1000;

- bdrms, the number of bedrooms;

- lotsize, the size of the lot in square feet;

- sqrft, the size of the house in square feet;

- colonial, a dummy variable which is equal to 1 if the home is colonial style.

Research Questions Econometrics代写

(a) (5 points) Obtain the summary statistics (i.e. mean, median, standard error, minimum and maximum, etc.) and histograms for the variables price and sqrft. Discuss the data characteristics. Use a scatter plot and a regression line to explore the relationship between price and sqrft.

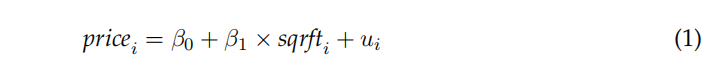

(b) (10 points) Estimate the linear regression model1

Report the OLS estimation results in the standard form introduced in the lecture or textbook2 . In addition, interpret the estimated intercept term, slope coeffificient, and R2.

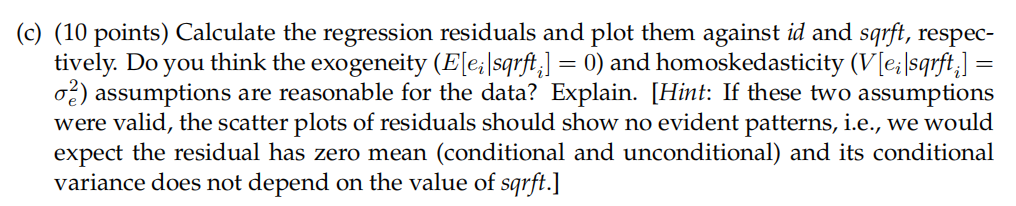

(d) (10 points) Estimate Model (1) using OLS but compute homoskedasticity-only standard errors (SE). Compare the regression results with what you obtained in (b). Comment your fifindings.

(e) (10 points) The lot size (lotsize) and house style (colonial) may also affect the house prices. Use a scatter plot to explore the relationship between price and ln(lotsize). Comment on your fifindings. How many houses in the sample are of colonial style? Are these houses on average more expensive than those non-colonial style houses in a signifificant way?

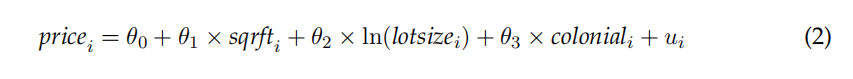

(f) (15 points) Estimate the following multiple linear regression model

Report the estimated model and interpret the estimated coeffificient on coloniali . Comment on the signifificance of the individual coeffificient estimates. Do you prefer the regression model (2) to the regression model (1)? Explain.

(g) (10 points) Test the null hypothesis H0: θ2 = 31 (vs. H1: θ2≠ 31) at the 1%, 5%, and 10% signifificance levels and construct the corresponding confifidence intervals (CI). Re-do these tests with homoskedasticity-only SEs. Comment on your fifindings.

(h) (15 points) Test the null hypothesis H0: θ2 = 31 and θ1 = θ3/10 at the 10% signifificance level. What is the alternative hypothesis H1 of this test? Test the null hypothesis H0: 10θ1 + θ3 = θ2 at the 5% signifificance level. What is the 95% CI for 10θ1 + θ3 − θ2?

(i) (10 points) Use Model (2) to predict the price of a non-colonial style house with sqrft = 1, 500 and lotsize = 500. Find a 95% CI for your prediction. Do you think the 95% CI makes sense? Why? Econometrics代写

(j) (5 points) The lecturer suggested to include the interaction term between sqrt × colonial. If we can, how to interpret its coeffificients? If we cannot, why?