AMB303 International Logistics: Case Study

Logistics代写 This paper explores the concepts of internationalization logistics and strategies. It begins by providing background…

Executive Summary Logistics代写

This paper explores the concepts of internationalization logistics and strategies. It begins by providing background information about the SALSORA diversification strategy and overall consideration and assessments. The second part gives the literature reviews on foreign market entry strategies, including direct exportation and direct investment or wholly-owned subsidiary in the host country. The paper continues with an assessment of the two market alternatives, namely alternative A, which is exportation to Egypt and alternative B, which is a direct investment in a subsidiary plant in Egypt. The assessment is completed through the completion of spreadsheets, recommendation, and justification of the recommendations. Lastly, the paper provides the results of the recommendation by providing a risk assessment matrix, procurement tactical assessment plan, and complete value chain of the subsidiary.

1.0 Introduction and background Logistics代写

Expansions into developing countries where poor necessary infrastructure, volatile politics, limited technology, and the unstable economy is the norm, requires in-depth consideration of entry strategies and associated logistics. In such a unique market, companies can face difficult decisions on whether to adopt integrated globalization or localization strategies. As in all cases of operating international businesses, there is no one right solution. Given the pressure on SALSORA to diversify its operations and meet financial targets, expansion into Egypt and other emerging markets in the MENA region is essential.

The successful expansion of SALSORA in the U.S offers insights on the benefits of international business. Although SALSORA has been licensed to produce 150 metric tons of El Sin Rival’s premium ice-cream (maruenge-type fluffy sorbet) per annum, the company is still operating below capacity due to market and societal challenges. Therefore, expansion to Egypt will enable the company to maximize its production capacity and exploit emerging opportunities in the MENA region.

2.0 Foreign market entry strategies Literature Review Logistics代写

Market entry is an essential aspect of strategizing and involves in-depth market research of the target customers, competitors, and potential entry barriers. Market entry strategy consists of the development of a delivery and distribution method for goods or services in a target market (Claver, Rienda & Quer, 2007). Companies must approach international marketing with caution. They need to analyze opportunities and risks in the new market, as well as their capabilities to determine the best entry method (2007). It is advisable to start with a low-risk strategy before progressing to other methods that involve higher risks or high investments (2007).

The international ice-cream industry is dominated by large multi-national organizations that enjoy a significant market share in regions they operate. While the end-user of the ice-cream is the customer (B2C), most of the SALSORA’s transactions mostly occur in B2B format, where it sells to retailers. Success in the industry depends heavily on customer service, building effective relationships with suppliers, and cost-effective logistics. The top management team (TMT) at SALSORA considers direct exportation or wholly-owned subsidiary (WoS) as entry strategies for the Egyptian market.

2.1 Direct Exportation Logistics代写

Direct exportation is the production of goods in one country and then selling them to the new market. Exportation is a low-risk strategy that is attractive to many businesses for several reasons (Chung & Enderwick, 2001). Firstly, it is an opportunity to find new markets for mature products in different countries (2001). Secondly, it is sometimes cheaper and less risky to export their existing products that develop new ones for the new markets. Thirdly, it is an effective strategy for balancing seasonal variations in the demands of a product. Finally, this strategy helps firms to exploit untapped demand overseas. Small organizations prefer this strategy because it gives them significant control over their resource commitment, cost, and risk.

Therefore, SALSORA can consider direct exportation of finished goods inventory (FGI) to Egypt as a good strategy for lowering its risk in the new market. The strategy will involve the expansion of its Salvadorian operations by 300% to meet the increased demand for the FGI. The finished goods are stored in the warehouses or merchandising stores as they await exportation. These goods form part of the company’s assets and should reflect in the balance sheet. To produce the finished goods inventory, the company must first obtain raw material inventory (RMI). These are raw materials that have not been processed or incorporated into any product.

The RMI is then converted into a work-in-progress inventory (WI). A product is considered a work-in-progress inventory when it is not finished, and specific components are missing. When all the components are all put together, the product becomes an FGI until it is sold. The FGI is a short-term asset for the company. The finished goods inventory (FGI) is calculated using the formula below;

FGI = initial FGI + cost of manufactured goods – costs of sold goods

2.2 Direct Investment or Wholly-owned Subsidiaries Logistics代写

International organizations may invest in full-scale manufacturing and marketing in their new markets by establishing wholly-owned subsidiaries. As opposed to exportation, this approach enables the company to own the manufacturing and marketing investments in the overseas markets (Basu, 2018). This entry strategy allows the foreign company to learn more about the market and compete aggressively (2018). However, this method requires significant capital outlay because the foreign firm is responsible for all activities, from production to sales and marketing (Chung & Enderwick, 2001). This approach is a risky strategy because it requires a company to understand the cultures, business environment, and the customs in the new market (Basu, 2018).

Direct investment creates employment opportunities in the host country, and the foreign government may give tax incentives to appeal to investors. The foreign company may benefit from readily available resources and labor in foreign markets. SALSORA considers setting up a wholly-owned subsidiary (WoS) in Egypt as part of its market entry strategy. This approach will involve the construction of a sorbet production plant in Cairo with five times the capacity of the Salvadorian plant. Such a plant will be strategic for expanding operations in other countries within the MENA region.

3.0 ASSESSMENT OF ENTRY OPTIONS Logistics代写

This section analyzes the two entry alternatives that SALSORA can adopt to enter the MENA market. That is, it will examine the expansion of Salvadorian operations and export to the MENA market or establish a wholly-owned subsidiary in Egypt to serve the MENA market. The assessment will help to compare the two options and choose the best expansion entry strategy based on the costs, revenues, and prospects of the project.

3.1 Alt. A: Expand the Salvadorian operations by 300% and Export FGI directly to Egypt (see Excel file)

3.2 Alt. B: Set up a Wholly-owned Subsidiary (WoS) with a Sorbet Production Plant

3.3 Recommendations Logistics代写

The assessment of the two alternatives regarding profits and return on capital, as well as consider other factors, reveals that establishing a subsidiary is the best option. In regard to other factors besides profits and cost, alternative B is found to be the most favorable market entry strategy for various reasons. First, it will cut the cost and associated difficulties of transporting finished products from the home market to the host market. The shipment of raw material by sea is the most affordable and cheaper method of transportation and yield higher profits of $14.1 million. While air transport yields profits of $10.6 million.

The profit margin for sea transport is also higher at $47 million compared to air transport of $42.1 million. The return on investment for alternative B with sea transport is 8 percent. It, therefore, means alternative B will have used the assets efficiently since ROA of more than 5 percent is favorable (Nakhaei, & Hamid, 2013). Overall, although alternative A yields higher profits and returns on assets than alternative B, considering other business environment factors such as political, economic, social, and legal, among others in host country, alternative B is the most promising internationalization strategy.

Therefore, based on the above evaluation of alternatives, several recommendations can be made.

First, SALSORA management needs to establish a subsidiary in Egypt capital or industrial center. The subsidiary should have a full and higher production capacity similar to that in Salvador. It will serve the six MENA region countries whose capacity in metric tons per year is 20, 55, 30, 80, 60, and 70, respectively. A capital of $13.8 million will be needed to make the plan operational. Secondly, the newly established SALSORA should have separate management based in Egypt for more accessible and smooth control of operations.

In addition to having 33 local staff, the manager will need experienced managers from the parent company to help strengthen the foundation of the subsidiary. Thirdly, the start-up will require imports of raw materials from the home country and other suppliers. According to the assessment, it is recommendable to use sea transport because of its convenience and costs. There are no direct flights from El Salvador to Egypt, but ships are connecting the two countries, which makes sea transport most convenient and cheaper. Lastly, other logistics such as warehousing should be provided at distribution centers for more accessible inventory and demand management.

3.4 Justification Logistics代写

Egypt is far from the company’s home country, and hence importing ice cream can be challenging. The country as a host country of the subsidiary offers convenience and safety of finished products. Ice cream is in category od perishable goods and hence requires specialized handling, storage, and transportation equipment. Since ice cream is temperature sensitive, it can be at risk of melting during transit (Sok, 2014). Thus, maintaining ice cream flavor and freshness can be a challenge because of possible unwanted temperature variations. Also, it becomes a big problem to transport different flavor combinations over a long distance (UPS, 2019). The reason being, the blending flavor can change the way the ice cream reacts to changes in temperature.

For instance, it is even more challenging to transport strawberry-chocolate ice cream mix and strawberry ice cream in the same shipment conditions because they have different melting conditions. Notably, the new component added in ice creams such as marshmallows, chocolate chips, and candy complicates ice cream transportation because of how each reacts to cold (UPS, 2019). Also, transporting ice cream requires either dry ice or gel packs, needs a maximum of 30 hours to transport, and close monitoring of the packages (UPS, 2019). Therefore, it becomes inconveniencing for the company to ship or airlift ice cream, and hence manufacturing in a host country is manageable, controllable, and cost-effective.

Additionally, Egypt is friendly and favorable to the exporters Logistics代写

And locally producing companies than importing entities. The country aims at promoting local and FDI industries by imposing import quotas and regulations. In 2016, the government enacted a law on imports that require companies that import to be 51 percent owned by Egyptians. It acts to discourage foreign companies from manufacturing from outside Egypt and importing into the country. As such, it will become costly and inconvenient for SALSORA to manufacture in the home country then import to Egypt.

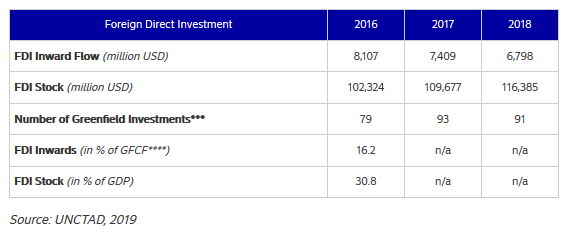

Besides, there are business environmental and logistical factors that are considered that favored alternative B. These are the macroenvironmental influences on international logistics, including culture, demographic, economy, nature, political, and technological factors. Egypt is one of the most attractive investment hubs in Middle Eastern and African markets for foreign direct investments. According to UNCTAD’s 2019 World Investment Report, inward investment flows in the country was $6.8 billion in 2018 (UNCTAD, 2019). Most of the FDI is concentrated in the oil and gas industry, followed by constructions, manufacturing, real estate, and the financial sector. Egypt’s dynamic economy, strategically positioned in the MENA market, availability of labor that is skilled, a high tourist attraction that is unique, high energy reserve, large market, and political are attributed to the high growth in FDI.

The favorability of Egypt to establish a foreign direct investment is the key to this internationalization strategy. The Egyptian government enacted Investment Law that stipulates performance requirements regarding labor-intensive projects and geographical location (World Bank, 2020). The government has set aside a special economic zone that has business-friendly regulations such as liberalization, administration, low tax, convenient registration, and customs, as well as improved infrastructures. The Investment Law has facilitated the establishment and growth of foreign companies in the country (see figure 1). Logistics代写

Figure 1: Country comparison for the protection of investors

Source: (United Nations Conference on Trade and Development, 2019)

Additionally, the government, through the General Authority for Investment and Free Zones (GAFI), created incentive programs aimed at attracting foreign investors. The program has also reduced custom duties by 35 percent and simplified tariff payment (United Nations Conference on Trade and Development, 2019). FMI has supported Egypt since 2016 to establish economic reforms such as low VAT rate, subsidization of fuel, and electricity, among others (2019). These actions are an indication of government political and legal will to make business macro-environment favorable, especially to foreign companies.

Moreover, Egypt is a party to bilateral investment agreements with many African countries, middle east countries as well as American countries and hence makes it strategic access to the MENA market (World Banks, 2020). It has also signed trade agreements along Mediterranean Basin with Algeria, Spain, France, Greece, Italy, Libya, Morocco, among other countries that come in handy for the company’s international market expansion. Besides, the country also signed an agreement with the Mercosur bloc of the Latin American nations. The trade and investment agreements between various countries mean that SALSORA will be protected and can use Egypt as a hub for exports and springboard to explore other markets in Africa, Europe, and Asia.

Equally important is the strategic location of Egypt to the target market Logistics代写

That makes it easier to manage demand and inventories. A production plant in Egypt will have proximity to the market than in the home country. It will make it convenient for the management and distributors to control inventory flow, do marketing, and serve a wider market. Alternative A can be prone to disruptions in the supply chain, such as warfare and pandemic. For instance, many companies that rely on exporting products to the host countries have been adversely affected by the novel COVID-19 (Fernandes, 2020). The pandemic has reduced global travel due to the few spread. Reduction in seas and air travel means that the inventory management and hence demand are adversely affected in such companies.

Lastly, the culture and demographic characteristics are favourable to FDI. The young population is growing at a higher rate, with one-third of the total under age 15 (United Nations, 2019). Thus, the large number of the population provides both skilled and semi-skilled labor. Also, growth in population is an indication of a larger market. Egypt’s poverty has been declining as the economy is slowly recovering from a previous burgeoning population. The cultural environment, on the other hand, is favorable. Islam, family and fatalism influence the business culture. Egyptians also value loyalty, education, modesty, and pride, which to an FDI. Overall, the foreign businesses are required to adapt to these business and local cultures that are not hostile to their growth.

4.0 Outcomes of Recommendations Logistics代写

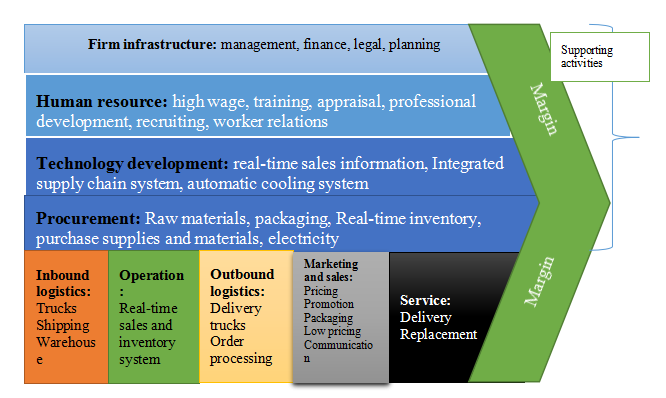

The new subsidiary will be established in Greater Cairo Zone at Giza. The location is strategic and offers the company a catchment to the market, coast, and benefit from government incentives. The project will cost EGP 315 million to complete various support tasks in the value chain, including human resources, technology development, procurement, and construction of firm infrastructure. Most importantly, the fund will be used to cover primary activities, including operations, inbound and outbound logistics, marketing, and services. Furthermore, the facility will require 33 FTE local staff. Each of these FTE will be paid £9,800 per month. The various skills needed for the start-up subsidiary include supervisors, accountants, managers, engineers, and other semi-skilled workers for construction and machine operations and repairs.

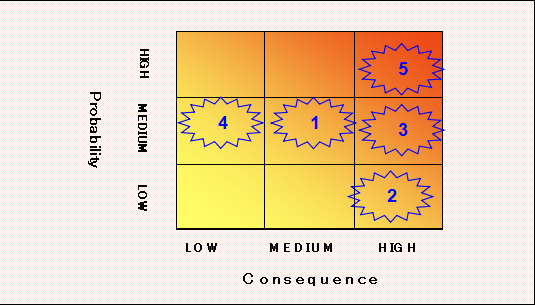

However, there are inherent risks associated with the establishment, as analysed below in figure 2.

4.1 Risk Assessment

Figure 2: Risk Assessment

Short term (ST) = <6 months Medium term (MT) = 12-24 months Long term (LT) = >24 months

| R. # | Time

frame |

Risk description: | Suggested Mitigation: |

|

1 |

Long term (LT) = >24 months | Political remain uncertain and arouse tense for foreign investors | Remain politically neutral and contribute to the community empowerment |

|

2 |

Long term (LT) = >24 months | Unstable regional security situations that thwart bilateral agreements | Have a good relationship with various trade partners and participate in peace agreements |

|

3 |

Medium-term (MT) = 12-24 months | Poor market performance and low profitability | Engage in rigorous marketing by establishing a robust distribution in the supply chain. |

|

4 |

Long term (LT) = >24 months | Bureaucratic customs procedures and non-tariff trade barriers | Join government negotiations through associations for better trading terms |

|

5 |

Short term (ST) = <6 months | Stiff competition from rivals and new entrants | Product quality, uniqueness, and extensive marketing |

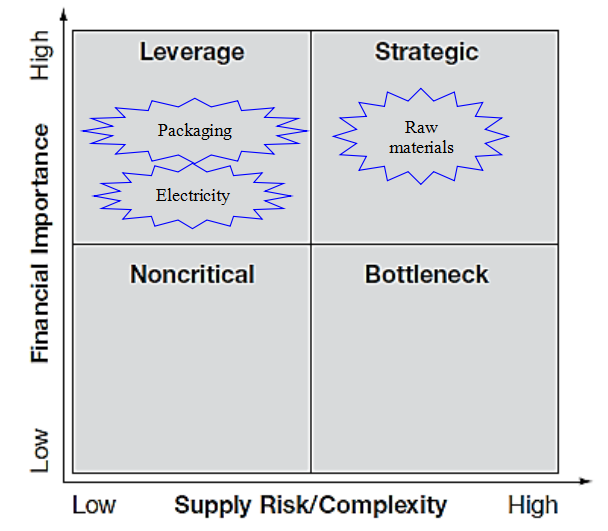

4.2 Procurement Tactical Assessment Plan Logistics代写

Figure 3: Kraljic’s Procurement Model

4.3 Value chain model Logistics代写

Figure 4: Value chain analysis

References

Basu, C. (2018, October 20). The advantages & disadvantages of a wholly-owned subsidiary. Retrieved from https://bizfluent.com/info-8627934-advantages-disadvantages-wholly-owned-subsidiary.html

Chung, H. F., & Enderwick, P. (2001). An investigation of market entry strategy selection: Exporting vs. foreign direct investment modes—a home-host country scenario. Asia Pacific Journal of Management, 18(4), 443-460.

Claver, E., Rienda, L., & Quer, D. (2007). The internationalization process in family firms: Choice of market entry strategies. Journal of General Management, 33(1), 1-14.

Fernandes, N. (2020). Economic effects of coronavirus outbreak (COVID-19) on the world economy. Available at SSRN 3557504.

Nakhaei, H., & Hamid, N. I. N. B. (2013). The relationship between economic value added, return on assets, and return on equity with market value added in Tehran Stock Exchange (TSE). In Proceedings of global business and finance research conference (Vol. 16, No. 11, pp. 1-9).

Sok, H. (2014). International ice cream headache. Global trade. Retrieved from https://www.globaltrademag.com/ice-cream-headache/

UPS. (2019). A guide to shipping ice cream. UPS. Retrieved from https://www.ups.com/us/en/services/knowledge-center/article.page?kid=art168a4d1b8bf

United Nations Conference on Trade and Development. (2019). World investment report. Special economic zones [online]. UNCTAD. Available from https://unctad.org/en/PublicationsLibrary/wir2019_en.pdf

United Nations. (2019). World population prospects 2019 [online]. Department of economic and social affairs population dynamics. Retrieved from https://population.un.org/wpp/

World Banks. (2020). Comparing business regulations in 190 economies: Economy profile, Egypt, Arab Republic [online]. Doing business 2020 indicators. Available from https://www.doingbusiness.org/content/dam/doingBusiness/country/e/egypt/EGY.pdf