QR模型代写

Lecture 5: Qualitative Response Models

QR模型代写 Qualitative response models (QR) are regression models in which dependent variables take discrete values. These models…

Qualitative response models (QR) are regression models in which dependent variables take discrete values. These models have numerous applications in financial economics because many behaviour responses are qualitative in nature: merge & acquisitions; fund survival etc. QR models are also called limited dependent variable (LDV). In this class we only consider the simplest case in which the dependent variable is a binary variable taking on only two values, zero and one.

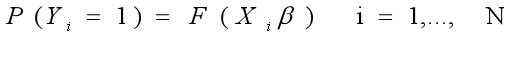

A univariate binary QR model is defined by

where y is a sequence of independent binary random variable taking the value of 0 or 1, X is a vector of explanatory variables , ![]() is the unknown parameters, and F is a certain known function.

is the unknown parameters, and F is a certain known function.

The function forms of F most frequently used in application are the following:

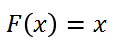

- Linear probability model:

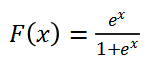

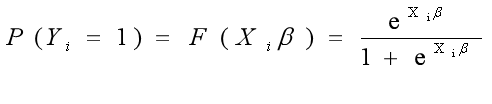

- Logit model:

The linear probability model is simple to estimate and use, but it has some drawbacks. The most important drawback is that the fitted probabilities can be less than zero or greater than one. This limitation of the linear probability model can be overcome by using more sophisticated binary response model. i.e., logistic model. ![]() is called the logistic function.

is called the logistic function.

That is

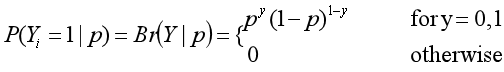

A random variable y that has a Bernoulli probability distribution can take either 1 or 0 possible values with probability p and 1-p respectively. The quantity is called a parameter of distribution of y. That is:

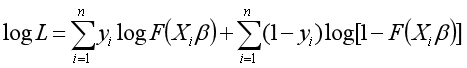

The logarithm of the likelihood function is given by

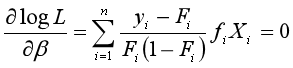

Therefore, the MLE ![]() is a solution of

is a solution of