Ticker

Ticker代写 Mitsubishi Electric company can rely on the ASTES4 SA as a wholly owned subsidiary to provide integrated solutions in the international market.

Date: 12.09.2018

| Ticker: 6503.T | Recommendation: BUY |

| Price: 25.515 USD [13.09.18] | Price Target: 51.12 USD |

|

Earnings/Share (In Yen) |

|||||||

| Mar. | Jun. | Sept. | Dec. | Year | P/E Ratio | ||

| 2015A | 36.07 | 19.18 | 21.62 | 9.73 | 86.6 | 10.37 | |

| 2016A | 21.91 | 15.93 | 28.76 | 28.21 | 94.81 | 8.93 | |

| 2017A | 23.64 | 18.38 | 31.09 | 31.39 | 104.5 | 7.51 | |

| 2018E | 19.87 | 14.76 | 11.59 | 28.14 | 74.36 | 11.97 | |

Figure 1: E/S figures from Yahoo and Bloomberg

Key Merits: The ASTES4 SA has been acquired by Mitsubishi Electric Corporation. Ticker代写

ASTES4 SA is a company that based in Switzerland that is engaged in development, production and sales of patented automated sorting solutions for sheet metal laser processing machines, on August 3. Mitsubishi Electric company can rely on the ASTES4 SA as a wholly owned subsidiary to provide integrated solutions in the international market.

In addition, Mitsubishi will embedded ASTES4 SA’s automated sorting systems into high value-added sheet metal laser processing machines. The main purpose of Mitsubishi Electric Corporation is to further expand their worldwide business through kinds of acquisition.

The metal laser processing machine business of Mitsubishi Electric Corporation has developed in the different countries, which include China, India, Europe,US and Southeast Asia and like. Automating sheet metal laser processing can replace the lack of human resources in the production facilities and the higher energy was demanded by the fiber lasers, which can promote the productivity. Lately, worldwide demand for different sorting solutions is on the increase, which include loading the material, laser cutting and unloading cut materials.

Key Risks:

Due to the adjustment of industrial structure and the increasingly fierce competition in the industry, Mitsubishi’s corporate profitability in the 17th year has dropped significantly. The return on capital has fallen by nearly half compared to last year. Through strict control of sales expenses, Mitsubishi Corporation has a slightly smaller decline in corporate profits in the case of a large decline in sales revenue. It is expected that due to the impact of the big environment, Mitsubishi Enterprises will remain in a low-profit state in the next few months, and sales revenue and profits are unlikely to change significantly.

Buy Recommendation:

I estimate the stock price of Mitsubishi Corporation at 51.2 USD per share, which will be 100.35% higher than the current price. Along with the reason that Mitsubishi has huge growth potential and a broad consumer market, I suggest that you should buy shares in Mitsubishi.

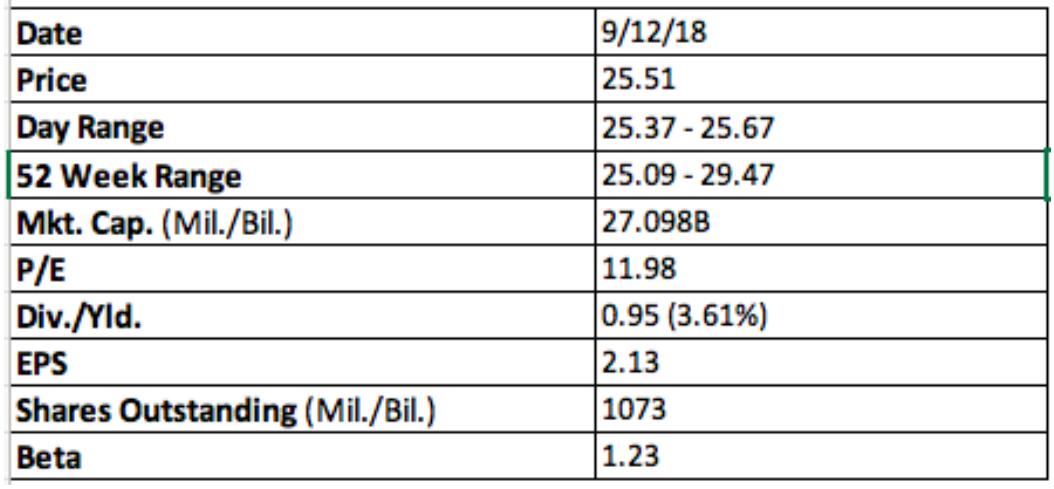

Figure 2: 2018 stock price data from Yahoo

Figure 3: market profile data from yahoo and annual report

Business Description Ticker代写

Company overview

Founded in 1921, Mitsubishi Electric is a world-renowned comprehensive enterprise group. Ranked 196th in the 2007 Fortune 500 rankings. As a technology-oriented company, Mitsubishi Electric has a number of leading technologies, and with strong technical strength and good corporate reputation, it is occupied by global power equipment, communication equipment, industrial automation, electronic components, home appliances and other markets.

Important position. The Mitsubishi Electric Group aims to cultivate and strengthen its business position in the global competition, and strives to expand its business based on global perspectives, strengthen cooperation between Japan and overseas, and strengthen marketing, research and development, and financial support. In the global cooperation of the basic requirements of the business, we strengthen the business promotion system.

As a socially responsible company, Mitsubishi Electric has been actively supporting intellectual property protection worldwide and promoting environmental protection through continuous research on new technologies and products. Mitsubishi Electric (China) Co., Ltd. was established in October 1997. It has established 26 wholly-owned and joint ventures in China. Its business covers various fields such as home appliances, automation, semiconductors, and electric power equipment. It has more than 10,000 employees and is open annually. More than 300 billion yen

Industry Overview and Competitive Positioning Ticker代写

1.Outlook by business

The corporate principle of the Mitsubishi Electric company is that depend on enhance its technologies to

Create a vibrant and affluent society. There are some main data about its basic information and different

systems of business.

| President and CEO: | Takeshi Sugiyama |

| Time: | January 15, 1921 |

| capital: | $25,836.81 million |

| Shares issued: | 2,147,201,551 shares |

| Consolidated net sales: | $651,165.97 |

| Consolidated total assets: | $472,916,21 |

| Employees: | 142,340 |

Figure 4: data from the 2017 annual report

2.Management philosophy and policy Ticker代写

The Mitsubishi Electric company relys on corporate mission and seven guiding principles positioned Company society responsibility as pillar of its company management. As a result, the Group has made an effort to become a company that has been appreciated for its initiative to solve social problems. In other words, the company through earns customers satisfaction to acquire trust by the stakeholders, society and employees. Since 2002, the company pay attention on management policy of maintaining the balance management. It through three sections , which include growth, profitability and efficiency to achieve the balance.

3.Management targets

The Mitsubishi Electric company has change the growth targets for the fiscal 2021 in order to achieve 5 Trillion Yen or more, and the operating income ratio of 9% or more. The group will also continuously and stably to maintain follow goals: ensure the ROE can achieve 13% or more, and 14% or less of total assets in the interest-bearing debt. In 2017, The Mitsubishi Electric company has achieved consolidated net sales of 4,243.8 billion yen, and the operating income of 240.51 billion yen. Moreover, the group has achieve the management goal of ROE of 12% or more and 15% or less of total assets in the interest-bearing debt, respectively 10.4% and 7.9%.

Growth target to be achieved by Fiscal 2021:

| Net sales: | 5.0 trillion yen or more |

| Operating income rate | 8.4% |

Figure 6: data from the company official website

Management goals to be continuously and stably achieved:

| ROE: | 13% or more |

| Ratio of interest-bearing debt to total assets | 15% or less |

Figure 7: data from the company official website

Valuation Ticker代写

Overview

In this section, we will use three different valuation methods to estimate the company’s stock price. The dividend discounted model will use the company’s dividend and the discounted rate (computed using the CAPM) to get the stock price. The discounted cash flow method is to use the free cash flow given by the cash flow and the relative valuation methods use the company’s price to equity ration as well as the company’s related company’s to get the final stock price.

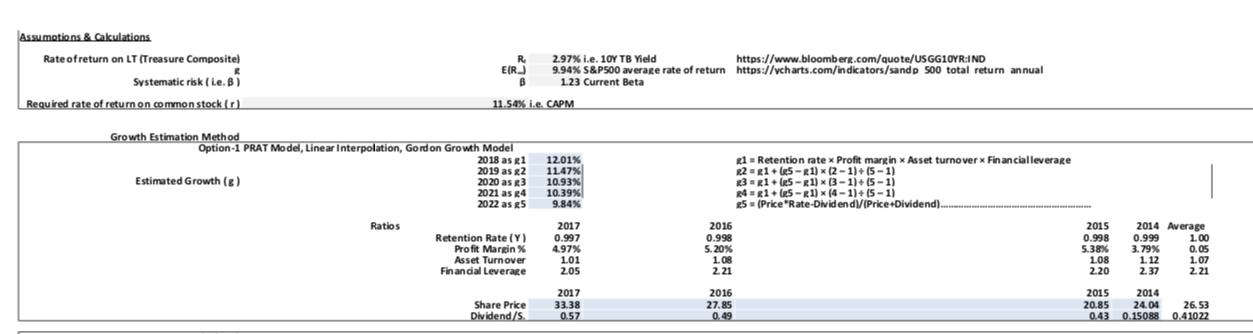

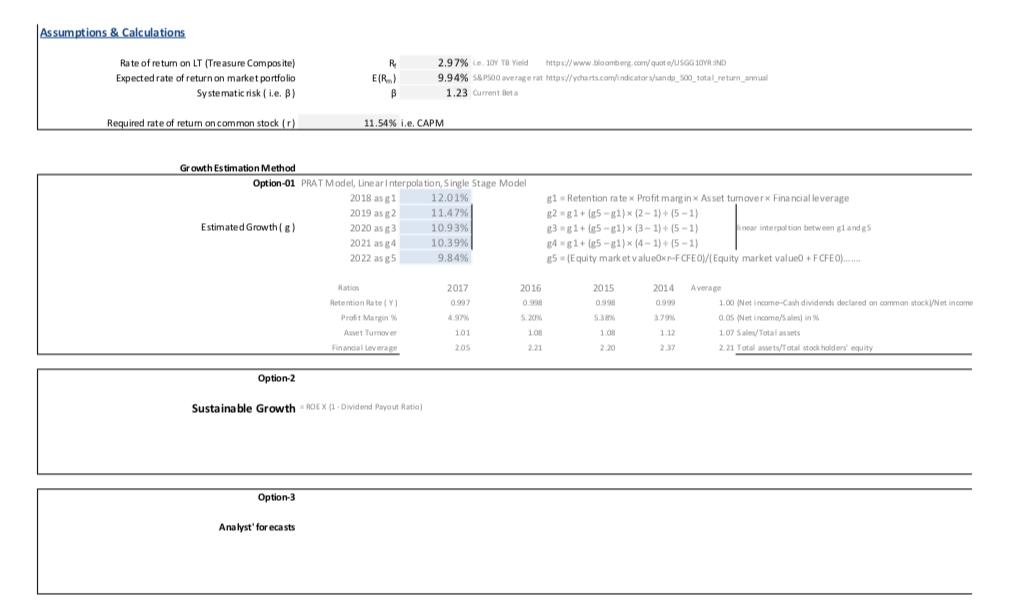

DDM

In this section, the dividend was given by Yahoo finance. Mitsubishi announces 2 dividends per year on march and septemper. So the yearly dividends equals to the sum of the March dividend and September dividends. CAPM is used as a discounted rate. In this case, the Rate of return on LT (Treasure Composite) is 2.97%, this was given by the 10 year TB yield. Expected rate of return on market portfolio is 9.94%, this was given for average return on S&P 500 this year and beta, which represents for the systemic risk for Mitsubishi is 1.23. The result for the required return is 11.54%, which is also the discounted rate in this case.

The second problem to solve is the growth rate. In this case, we use the PRAT model. By computing 2018 growth rate as growth period 1 and “g5 = (Price*Rate-Dividend)/(Price+Dividend)” as the last growth period. Price equals to the average stock price from 2014 to 2017, dividend also equals to the average dividend from 2014 to 2017. Rate equals to the the required rate of return. We can the final intrinstic value 38.68 USD.

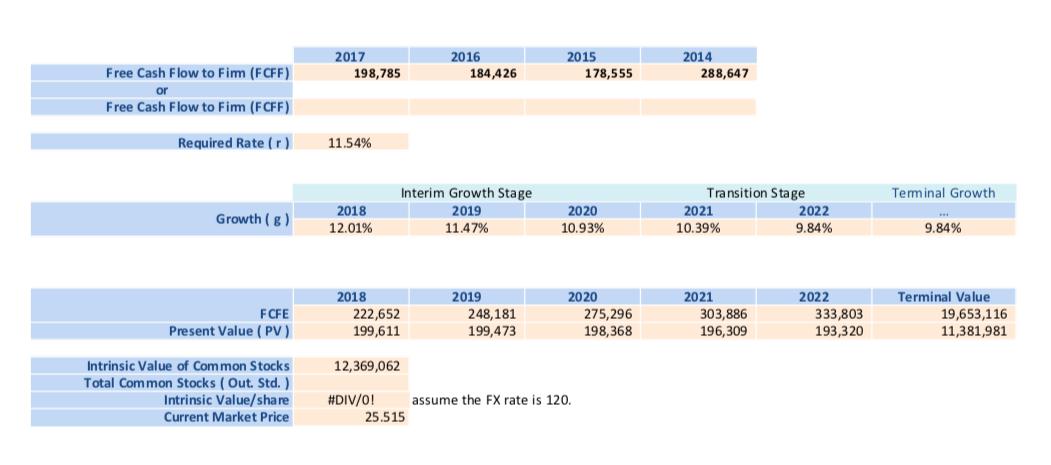

DCF

DCF uses the same discounted rate as DDM, which is 11.54% computed by the CAPM. The free cash flow was given by the cash flow filing on Yahoo Finance. We can get the intristic value of common stocks is 12,369,062 million in JPY. The total share outstanding is 1073 million. However, since the company’s filing only available in JPY, while the price on Yahoo finance is in USD, I converted the JPY into USD using the foreign exchange rate USD/JPY = 1/120. This number is given by the average FX rate in ten years. Since Japan’s FX to USD doesn’t fluctuate too much, the intristic value given by this way is 96.06 USD.

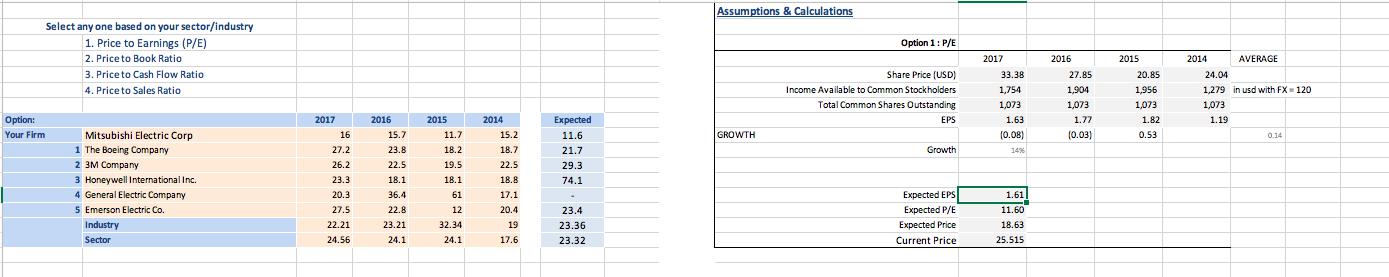

RELATIVE VALUATION – P/E Ticker代写

In this valuation section, I used the P/E as the relative valueation method for the stock price. In this section, we have to find out the expected EPS, expected P/E. For the expected EPS, I took the average from 2014 to 2017. Then for the expected P/E, I used the estimation of the Yahoo Finance. The stock price given by the relative valuation method is 18.63 USD

FINAL PRICE

The method above are not perfect by themselves. However, if we use them together to get the final price, it would be more accurate than use either of them. Therefore, in the final result sheet, I averaged the three estimation prices to get my final estimation for the Mitsubishi stock price: 51.12 USD. The market price on 13/09/2018 is 25.515 USD. The estimation is about 100% more than the market price now, therefore, I recommend to buy this stock.

RISKS TO FINAL RECOMMENDATION

The risk for DDM method includes: 1. It’s hard to project a right growth rate, if the growth rate is not right, the dividends in the future can not be predicted correct. 2. This method also ignores the potential share repurchase in the future. Since stock repurchase always seems as a way to increase the value of the stock, Ignoring this effect will let the stock be unddervalued . DCF encounter the same problem as DDM did, the projection for the growth rate may not be correct. For thr relative valuation, P/E estimation is computed by the average of the P/E from 2014 to 2017. However,

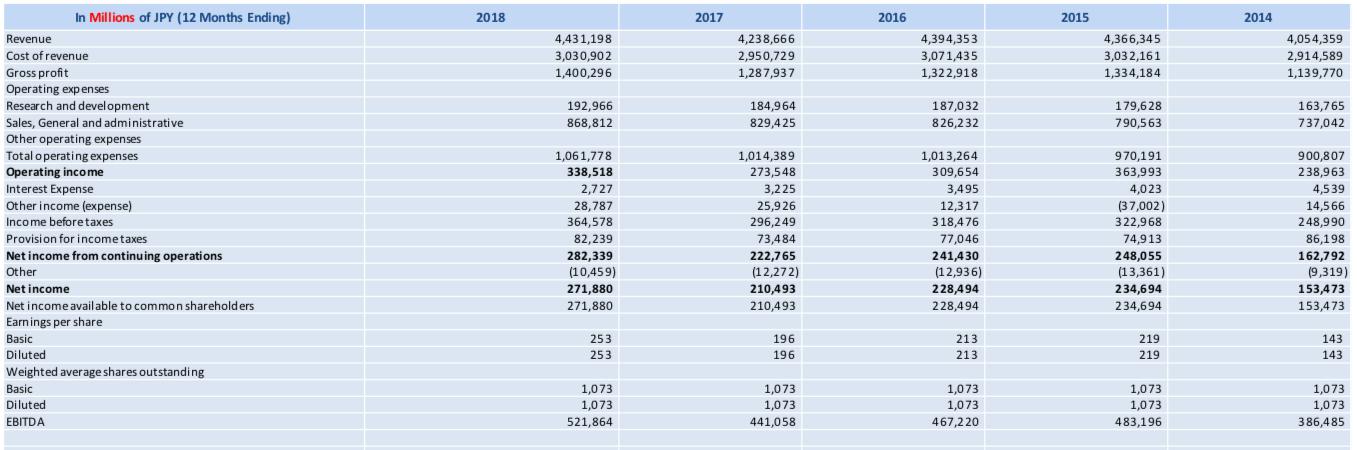

Financial Analysis Ticker代写

This section will focus on analysis of the company’s financial status. To be more specific, the statistics on the income statement, balance sheet as well as the cash flow. The growth rate and

Earnings

The earnings per share has increased from 2015 to 2017, however, the statistics shown that it will decrease in 2018. This may due to the US stock markets depreciation at the end of 2017 since the Beta for Mitsubishi is 1.23 which is higher than the overall market. However, Since Mitsubishi Electiric company is in industrial sector. The elastic of its price is not very high. I assume that the future prediction for Mitsubishi is still positive.

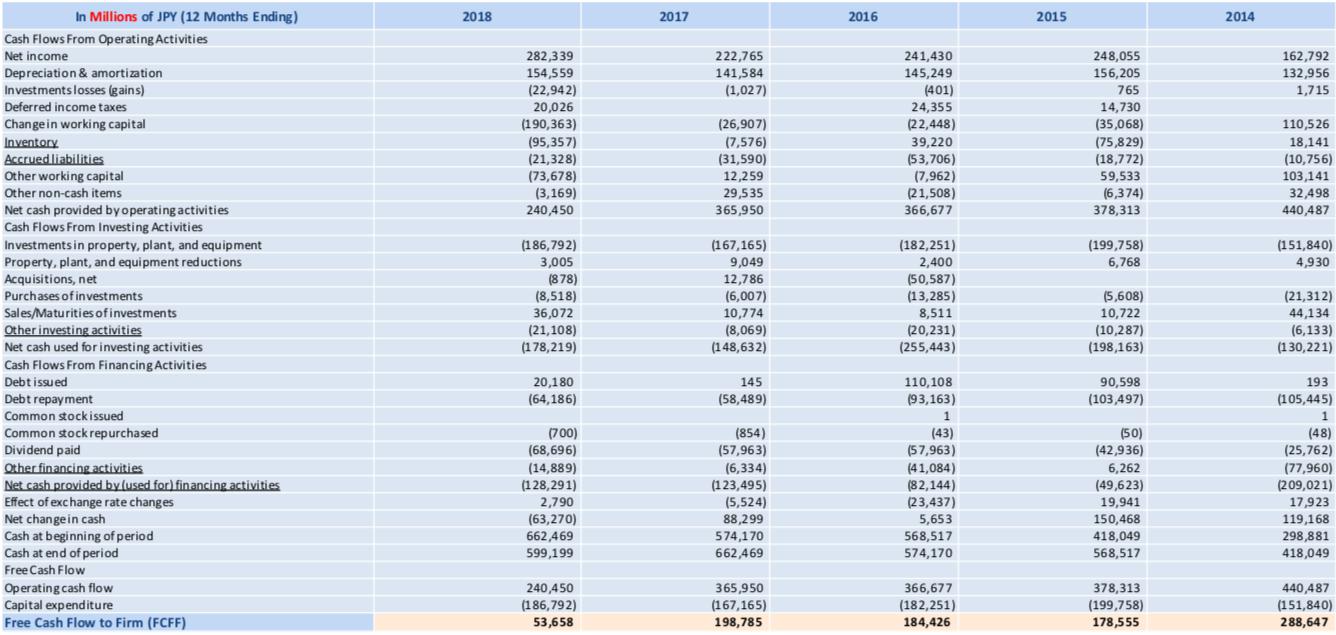

Cash Flow

The cash flow has been decreasing from year 2014 to year 2018. The variation from 2014 to 2018 is lying in the normal range. However, the free cash flow for 2018 is lower significantly. Net income for 2018 is higher so that net income isn’t the reason for the decreasing FCF. Looking through the cash flow, the reason is significant change in working capital that cause the decrease of net cash provided by operating activities.

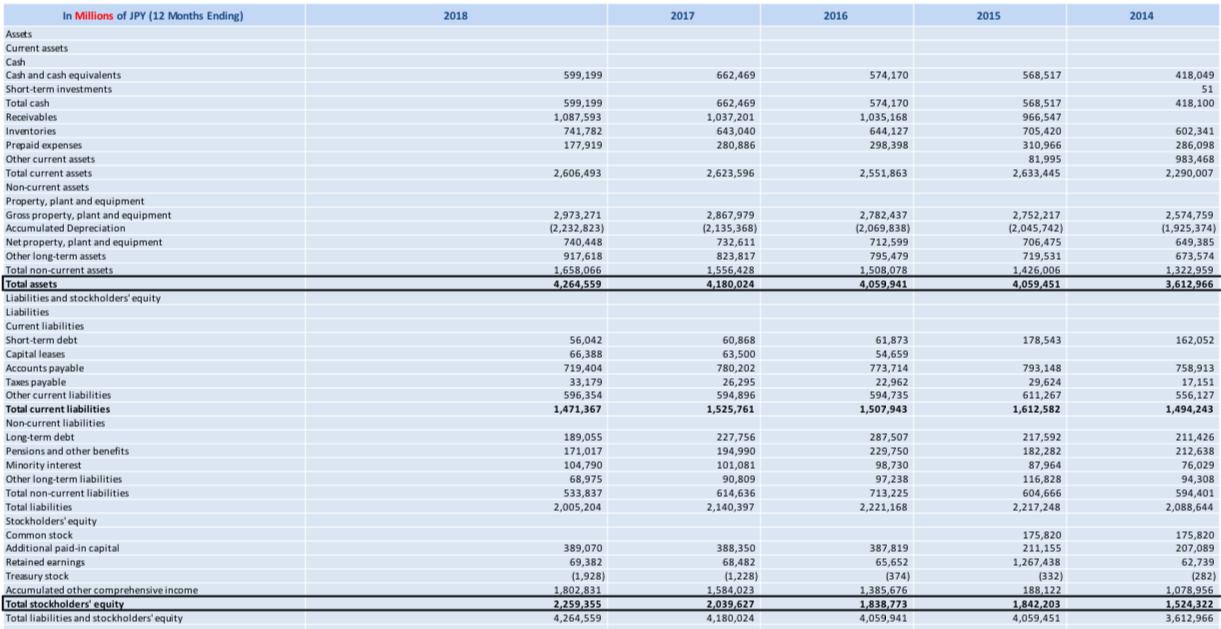

Balance Sheet & Financing

Balance sheet for Mitsubishi shows that the company has a stable and health financial condition. The total asset has been increasing from 3,612,966 millions JPY to 4,264,559 millions JPY from year 2014 to year 2018. At the same time period, the Total shareholder’s equity also increased from 1,524,322 millions JPY to 2,259,355 millions JPY. This statistics shows that Mitsubishi worth a long time investment.

Investment Risks Ticker代写

This section will covers the potential risk for the investors who want to invest in Mitsubish Electiric company. This section will be divided into three part.

Internal Growth

I used the PRAT model to estimate the geowth rate for this company. However, there exists some problem with the the retention estimation. For example, the retention rate equals to the net income minus the cash dividends declare on common stock. As I mentioned before, the dividends is changing overtime. If we only use the average to estimate the final result, It would definitely cause some error.

Economic Risks Ticker代写

Since Mitsubishi is a comprehensive industrial company, many of its products is on oversea market. The global economy development needs to be taken into consideration. The estimation of China’s development is still flat while United States is experiencing and expansion. The change has resulted a exchange rate movement. From May 2017 to November 2017, the JPY remains weak against the US dollars. Therefore, the company has to seek for a growth strategy for the sake of maintain its market position. Although it did a good job for the net sales on fiscal year 2018, their future development can not be predicted.

Environment Risks

Mitsubishi electric company’s operation focus on Energy and electric systems, Industrial automation systems, Information and communication systems, Electronic devices and Home appliances. It’s carbon dioxide emission as well as the non-greenhouse gas emission has always been a serious problem. The company’s exapnasion strategy for the next few year will cause this problem more sever. Although it developes some program in order to reduce the gas emission, the tradeoff of expansion strategy and environmental plan reveals an uncertainty for company’s future.

Income Statement

Balance Sheet

Cash Flow

Dividend Discounted Model Ticker代写

Cash Flow Model

Relative valuation

更多其他:Essay代写 数据分析代写 润色修改 prensentation代写 Case study代写 Academic代写 Review代写 Resume代写 Report代写 Proposal代写 Capstone Project

您必须登录才能发表评论。