Computing Means

Computing Means代写 denote as daily return, as mean of portfolio daily return, as standard deviation of portfolio daily return.

(a) solution: Computing Means代写

denote as daily return, as mean of portfolio daily return, as standard deviation of portfolio daily return.

clear all; clc

%% import data

data = xlsread(‘Portfolios_Formed_on_Size_Daily.xlsx’,’A4:O22279′);

dt = data(:,4:15);

meanrtn_daily = 100*mean(dt,1); % means of returns

stdrtn_daily = 100*std(dt,0,1); % std of returns

| section | CAP1RET | CAP2RET | CAP3RET | CAP4RET | CAP5RET | CAP6RET |

| 0.0676 | 0.0537 | 0.0466 | 0.0472 | 0.0454 | 0.0458 | |

| 1.3083 | 1.1999 | 1.1343 | 1.1080 | 1.1455 | 1.1323 | |

| section | CAP7RET | CAP8RET | CAP9RET | CAP10RET | vwretd | ewretd |

| 0.0459 | 0.0419 | 0.0449 | 0.0388 | 0.0401 | 0.0866 | |

| 1.1377 | 1.1131 | 1.0937 | 1.0681 | 1.0624 | 1.0604 |

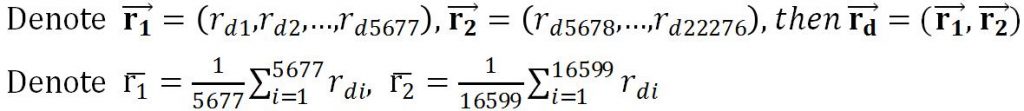

(b) solution: Computing Means代写

denote as mean of portfolio monthly return, as standard deviation of portfolio monthly return. as mean of portfolio annualized return, as standard deviation of portfolio annualized return. assuming that there are 21 trading days in one month, and 252 trading days in one year, then we have

![]()

meanrtn_monthly = 21*meanrtn_daily;

meanrtn_annually= 252*meanrtn_daily;

stdrtn_monthly = sqrt(21)*stdrtn_daily;

stdrtn_annually= sqrt(252)*stdrtn_daily;

| section | CAP1RET | CAP2RET | CAP3RET | CAP4RET | CAP5RET | CAP6RET |

| 1.4203 | 1.1285 | 0.9792 | 0.9920 | 0.9530 | 0.9608 | |

| 5.9952 | 5.4985 | 5.1979 | 5.0774 | 5.2495 | 5.1888 | |

| section | CAP7RET | CAP8RET | CAP9RET | CAP10RET | vwretd | ewretd |

| 0.9649 | 0.8796 | 0.9434 | 0.8149 | 0.8414 | 1.8182 | |

| 5.2137 | 5.1010 | 5.0121 | 4.8945 | 4.8683 | 4.8592 |

| section | CAP1RET | CAP2RET | CAP3RET | CAP4RET | CAP5RET | CAP6RET |

| 17.0438 | 13.5425 | 11.75 | 11.9042 | 11.4358 | 11.5291 | |

| 20.7681 | 19.0475 | 18.006 | 17.5886 | 18.1849 | 17.9746 | |

| section | CAP7RET | CAP8RET | CAP9RET | CAP10RET | vwretd | ewretd |

| 11.5792 | 10.5546 | 11.3204 | 9.7784 | 10.0965 | 21.818 | |

| 18.0607 | 17.6704 | 17.3624 | 16.9549 | 16.8643 | 16.8329 |

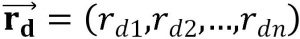

(c) solution: Computing Means代写

yes, we can compute the means using a simple regression.

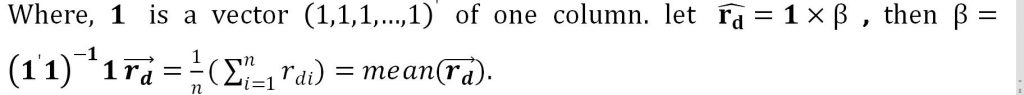

With MATLAB command .

We can get the results below, which are equal with the result in part(a).

beta = [];

for i = 1:size(dt,2)

[b,bint,r,rint,stat] = regress(dt(:,i),ones(size(dt,1),1));

beta = [beta,b*100];

end

% check whether beta equals meanrtn_daily

check = round(beta) – round(meanrtn_daily);

| CAP1RET | CAP2RET | CAP3RET | CAP4RET | CAP5RET | CAP6RET | |

| beta | 0.0676 | 0.0537 | 0.0466 | 0.0472 | 0.0454 | 0.0458 |

| CAP1RET | CAP2RET | CAP3RET | CAP4RET | CAP5RET | CAP6RET | |

| beta | 0.0459 | 0.0419 | 0.0449 | 0.0388 | 0.0401 | 0.0866 |

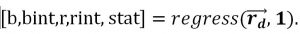

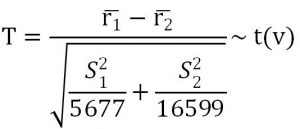

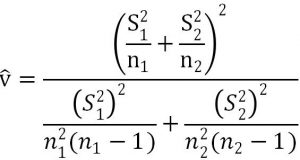

(d) solution:

Hypothesis testing: Computing Means代写

the mean of each portfolios for the pre-1945 and post-1945 subsamples are same.![]()

the mean of each portfolios for the pre-1945 and post-1945 subsamples are different.![]()

Testing statistic:

![]()

Level of Significance: a = 0.1

Decision rule: , reject

Computation: by MATLAB command we can get T =-1.1411, then .

Conclusion: we accept that the mean of each portfolios for the pre-1945 and post-1945 subsamples are same.

presub = dt(1:5677,:); postsub = dt(5678:end,:);

r_pre = 100*mean(presub,1); r_post= 100*mean(postsub,1);

n1=size(r_pre,2); n2=size(r_post,2);

S1 = std(r_pre,0,2); S2 =std(r_post,0,2);

Sw2 = S1^2/n1+S2^2/n2;

Tstat = (mean(r_pre,2)-mean(r_post,2))/sqrt(Sw2);

v = Sw2^2/(S1^4/n1^2/(n1-1)+S2^4/n2^2/(n2-1));

alpha = 0.05; % set significance level of 0.05

criticalvalue = tinv(1-alpha/2,v);

if abs(Tstat)>= criticalvalue

disp(‘reject Null Hypothesis’);

else

disp(‘accept Null Hypothesis’);

end

>> accept Null Hypothesis

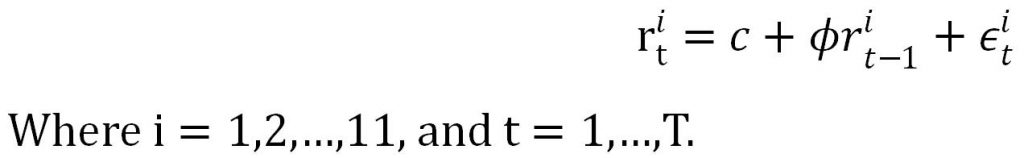

2. Efficient Markets Computing Means代写

(a) using each of the 11 portfolio returns ( value-weighted and 10 decile portfolio returns), estimate:

Solution:

y = dt(1:end-1,1:11);

x = dt(2:end,1:11);

x0 = ones(size(x,1),1);

clist = [];

philist = [];

for i = 1:size(y,2)

X = [x0,x(:,i)];

Y = y(:,i);

[b,bint,r,rint,stat] = regress(Y,X);

clist = [clist,b(1)];

philist = [philist,b(2)];

end

(b) test the hypothesis that markets are efficient, i.e. that returns are not serially correlated.

This is known as weak form efficiency (Fama(1970,1990)). Please conduct the test for each portfolio separately.

Solution:

testing = [];

for i = 1:size(y,2)

X = [x0,x(:,i)];

Y = y(:,i);

[b,bint,r,rint,stat] = regress(Y,X);

est_ep=sqrt(stat(4));

C = inv(X’*X);

Tstat = b(2)/(est_ep*sqrt(C(2,2)));

criticalvalue = tinv(1-alpha/2,size(Y,1)-2-1);

if (abs(Tstat)>= criticalvalue)

disp([num2str(i),‘-th Portfolio: serially correlated, reject Null Hypothesis’]);

temp = 1;

else

disp([num2str(i),‘-th Portfolio: not serially correlated, accept Null Hypothesis’]);

temp = 0;

end

testing = [testing;b(2), Tstat, criticalvalue, temp];

end

(c) explain your results.

Solution:

The result runs in part b is

>>1-th Portfolio: serially correlated, reject Null Hypothesis

>>2-th Portfolio: serially correlated, reject Null Hypothesis

>>3-th Portfolio: serially correlated, reject Null Hypothesis

>>4-th Portfolio: serially correlated, reject Null Hypothesis

>>5-th Portfolio: serially correlated, reject Null Hypothesis

>>6-th Portfolio: serially correlated, reject Null Hypothesis

>>7-th Portfolio: serially correlated, reject Null Hypothesis

>>8-th Portfolio: serially correlated, reject Null Hypothesis

>>9-th Portfolio: serially correlated, reject Null Hypothesis

>>10-th Portfolio: serially correlated, reject Null Hypothesis

>>value weighted Portfolio: serially correlated, reject Null Hypothesis

As the testing result shows, all portfolios ‘s return is serially correlated. we can conclude that the market is not efficient enough.

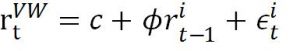

3. Data-Mining

(a) you have no clear model in mind,

but intuition tells you that the returns of small companies might forecast market (value-weighted) returns. therefore, you decide to run the regression:

Where is the return of the value-weighted (market?) portfolio, and is the lagged return of Decile 1 companies. Run similar regressions for Decile 2 and Decile 3.

Solution: Computing Means代写

yvw = dt(2:end,11); % value-weighted returns r_t

x = dt(1:end-1,1:3); % decile 1/2/3 r_(t-1)

x0 = ones(size(x,1),1);

datamining = [];

for i = 1:size(x,2)

X = [x0,x(:,i)];

[b,bint,r,rint,stat] = regress(yvw,X);

est_ep=sqrt(stat(4));

C = inv(X’*X);

Tstat = b(2)/(est_ep*sqrt(C(2,2)));

criticalvalue = tinv(1-alpha/2,size(Y,1)-2-1);

if (abs(Tstat)>= criticalvalue)

disp([num2str(i),‘-th decile Portfolio: significant, can forecast market returns’]);

temp = 1;

else

disp([num2str(i),‘-th decile Portfolio: not significant, can not forecast market returns’]);

temp = 0;

end

datamining = [datamining;b(2), Tstat, criticalvalue, temp];

end

(b) can the return of small companies forecast the market return?

Solution:

The running result in part(a) is:

>>1-th decile Portfolio: significant, can forecast market returns

>>2-th decile Portfolio: significant, can forecast market returns

>>3-th decile Portfolio: significant, can forecast market returns

So, we can conclude that small companies can forecast the market return.

4. Simulation: Computing Means代写

Solution:

%(a) to start the recursion, we need an initial value Y0,let Y0=0

Y0 = 0;

%(b) generate a sequence of Gaussian white noise {epsilon_t} for T=100

T = 100;

Y1= [Y0;NaN(T,1)];

noise = [0;normrnd(0,1,T,1)];

% (c) for phi =0.1, serial 1

phi = 0.1;

for i = 2:T+1

Y1(i) = phi* Y1(i-1)+noise(i);

end

% (d) noise Guassian white noise epsilon

Y2 = [0;NaN(T,1)];

noise2 = [0;normrnd(0,1,T,1)];

% (e) serial 2

for i = 2:T+1

Y2(i) = phi* Y2(i-1)^2+noise2(i);

end

YY = [];

YY = [YY,Y1,Y2];

% (f) repeat b~c

for loop= 3:1000

Y_temp = [Y0;NaN(T,1)];

noise_temp = [0;normrnd(0,1,T,1)];

for i=2:(T+1)

Y_temp(i) = phi*Y_temp(i-1) + noise_temp(i);

end

YY = [YY,Y_temp];

end

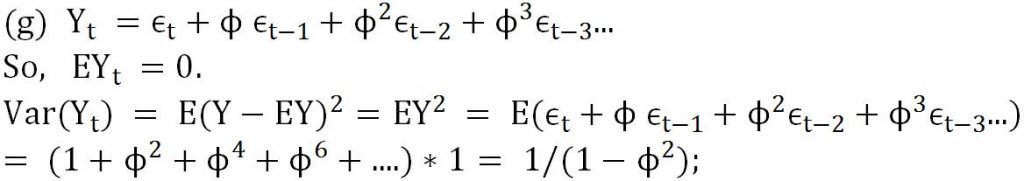

% (g) compute E(Y_t) and Var(Y_t)

% Y_t = e_t + phi* (e_(t_1))+phi^2 * e_(t-2)+…

% EY_t =0

% Var(Y_t) = E(Y^2) = E(e_t+phi*e_(t-1)+phi^2*e_(t-2)+…)

% = (1+phi^2+phi^4+….)*1

% = 1/(1-phi^2);

% (h) compute the mean of Y_t across time

muhatN = mean(YY(2:end,:),1);

% (i) compute the mean of Y_t at each t across sectional returns.

muhatT = mean(YY(2:end,:),2);

% (j) plot the histogram of the conputed in part h

subplot(2,2,1)

hist(muhatN)

title(‘muhatN’)

% (k) plot the histgram of the computed in part i. Do they vary over time?

subplot(2,2,2)

hist(muhatT)

title(‘muhatT’)

% (l) How do the estimate in h an i compare with the theoretical mean

% E(Y_t) ?

% the simulation values is approximate to 0.

% (m) OPTIONAL: do parts h-k for the second moments.

sighatN = mean(YY(2:end,:).^2,1);

sighatT = mean(YY(2:end,:).^2,2);

subplot(2,2,3)

hist(sighatN)

title(‘sighatN’)

subplot(2,2,4)

hist(sighatT)

title(‘sighatT’)

更多其他: 数据分析代写 润色修改 代写案例 Essay代写 prensentation代写 Case study代写 Academic代写 Review代写

您必须登录才能发表评论。