Financial Analysis代写 According to the income statement composition analysis table,the company’s first business profit,other business profits are profitable.

Ticker: 6841.T |

Recommendation: BUY |

| Price: 2170.00 JPY[26.08.18] | Price Target: 51.65USD |

|

Earnings/Share |

|||||||

| Mar. | Jun. | Sept. | Dec. | Year | P/E Ratio | ||

| 2015A | 20.15Yen | 13.46Yen | 16.18Yen | 17.01Yen | 66.8Yen | 31.83 | |

| 2016A | 27.87Yen | 28.93Yen | 28.64Yen | 28.59Yen | 114.03Yen | 15.72 | |

| 2017A | 17.53Yen | 19.49Yen | 27.98Yen | 31.04Yen | 96.04Yen | 18.69 | |

| 2018E | 16.28Yen | 21.04Yen | 14.92Yen | 28.03Yen | 80.27Yen | 26.95 | |

Figure 1: E/S figures from Yahoo and annual report

Highlights (Heading2: Times New Roman 14 Bold)

Key Merits: Yokogawa India, a subsidiary of the Yokogawa Group (headquartered in Bangalore, general manager: Sajiv Ravindran Nath), won an order from RajCOMP Info Services Ltd for the central information management system of the water and sewage pipeline in Jaipur, the capital of Rajasthan. . RajCOMP Info Services Ltd is an IT company owned by the Rajasthan government. This multi-million dollar project is part of the smart city plan implemented by the Indian government. The installation and commissioning of the system will be completed in November 2018, after which Yokogawa India will provide a five-hour 24-hour equipment management service.Financial Analysis代写

Key Risks:·a set of technology and automatic control equipment is the main important parts of factory automation, because it can improve the productivity and quality of products.However, the company faces limited capital inflows, high investment in the implementation of factory automation systems and a lack of professionals will hinder the growth of the company’s factory automation market.Financial Analysis代写

Buy Recommendation: Financial valuation model shows that yokogawa motor is currently undervalued;We currently value yokogawa at 2,372 Yen, higher than the current market value of 9.3 per cent, and therefore recommend buying positions. The underestimation of T is mainly due to the limited capital inflow faced by the company, the over-investment in the implementation of the factory automation system and the lack of professionals will hinder the development of the company’s factory automation market.Financial Analysis代写

|

Market Profile |

|

| 52 week price Range | 1671.00-2429.00 |

| Average Daily Volume | 409,000 |

| Beta | N/A |

| Dividend Yield(Estimated) | N/A |

| Shares Outstanding | N/A |

| Market Capitalization | 591.64B |

| Institutional holdings | 47.9% |

| Insider holdings | 36.7% |

| Book value per share | 1530 |

| Debt to total capital | 1,480,262,000 |

| Return on equity | 29% |

Business Description

Company overview

Yokogawa electric group was founded on September 1, 1915, in Tokyo shibuya district electricity meter institute. The company business has expand measurement, control, and information technology fields. Due to the dramatic social and economic change, the company take the initiative to constantly transform and it has built an impressive track record of continuous expansion.Financial Analysis代写

It is important for the field because the strategy contributes to the growth and development of industry through solutions. Yokogawa pay a significant role in the terms of industrial automation and test and measurement solutions. Yokogawa combines superior technology with engineering services, project management and maintenance. At the same time, it also offer field proven operational safety, quality and efficiency.Financial Analysis代写

Nowadays, Yokogawa has become international leader in the control field of industrial automation. Yokogawa pay more attention on solve the social issues through kinds of business activities. The aim of the Yokogawa is that contributing to society and sustainable world environment. Here are main data about year of Yokogawa,’s establishment, consolidated net sales, and number of firms and number of employees in the group.Financial Analysis代写

| name: | Yokogawa electric corporation |

| Founded Time: | Sep 1, 1915 |

| HQ | Tokyo |

| President: | Takashi Nishijima |

| net sales: | 406.6 billion yean (fiscal year 2017) |

| Number of companies: | 113 (worldwide) |

| Number of staff: | 18,290(worldwide)* |

| business in: | 61 countries |

Figure 2: figure from 2017 annual report of Yokogawa

Industry Overview and Competitive Positioning

Outlook by business

Yokogawa has announces that they need to transformation in 2020 (“TF2020”). this is new mid term business strategy which can promote profitability and improve the level of company’s transformation. The business plan will be implemented in the fiscal year 2018. in fact, Yokogawa has drew up the transformation 2017, which is the mid term business strategy in order to achieve the target of building a foundation for mid to long term rise.Financial Analysis代写

During the three years of transformation 2017, business environment changes are faster and more complex than expected, especially in the Yokogawa’s primary market. Moreover, the industry changes bring the unprecedented wave of innovations in the digital technology, and it has create important impact for the Yokogawa’s business environment. Under the transformation 2017, there are three transformation for the company:1. pay more attention on the customers, 2. finding new value, 3. improve the efficiency of company.Financial Analysis代写

2. Key performance indicators

According to the basic policy of the maximization of company and shareholder value during the mid to long term, Yokogawa focus on the EPS,organic free cash flow generation and ROE as target indexes. The aim of Yokogawa is that EPS growth with 8 to 11% per year or higher and it can generate about 98 billion yen or more of organic free cash flow, which cumulative over the four years period of the strategy). In addition, the company expect that the ROE will reach 16% or higher by the fiscal year 2020. In other words, the profit growth, cash flow creation and capital efficiency will surpasses the market expectations.Financial Analysis代写

| Index | Target value |

| net sales | 4-6% / per year |

| EPS | 6-8%/per year |

| ROS | 11% or more |

| ROE | 15% or more |

| Organic free cash flow* | 95 billion yen or more |

3. Sustainability goals and long-term business framework

Yokogawa built the long term business framework in the 2015, and it defines company’s future goals for the next 20 years and offer some suggestions about what will be need to accomplish them. The framework not only includes the directions of Yokogawa will take, but also defines the core abilities for achieving the goal and specifies target business. After the establishment of the framework, there are some obvious changes in the public policy, which include the sustainable development goals by the united nations and the Paris agreement at the 21st conference of Parties to the united nations framework convention on the climate change. Due the these changes, Yokogawa has built the sustainable goal and indicate the clear direction that it will achieve these targets.Financial Analysis代写

Valuation

DDM

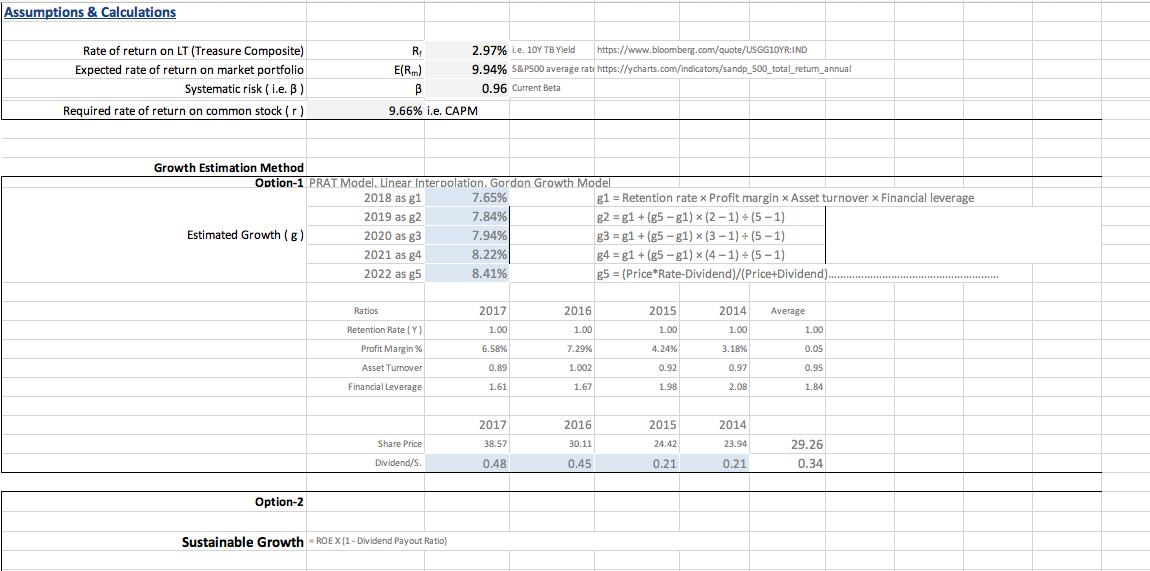

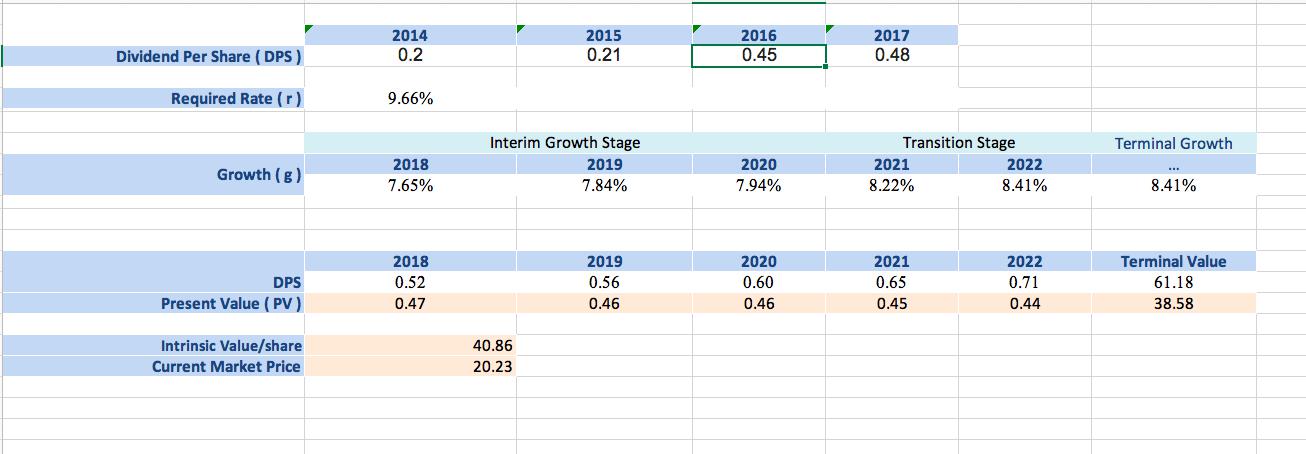

The dividend discount model is a model of stock valuation and is a model used in the analysis of the value of common stocks by the income capitalisation method. The dividends expected to be distributed in the future are converted to the present value at an appropriate discount rate to assess the value of the stock. DDM is similar to a bond valuation model that translates future interest and principal payments into present value.Financial Analysis代写

Yokogawa has a consistent dividend policy, increasing its dividend per share to $0.2 in 2014 from $0.48 in 2007. Based on PRAT Model, the sustainable growth rate was as high as 8.41%. The main drawback with DDM is that it assumes that the only value of a stock is the return on investment it provides through dividends, and DDM does not adequately reflect the underlying price of a stock.Financial Analysis代写

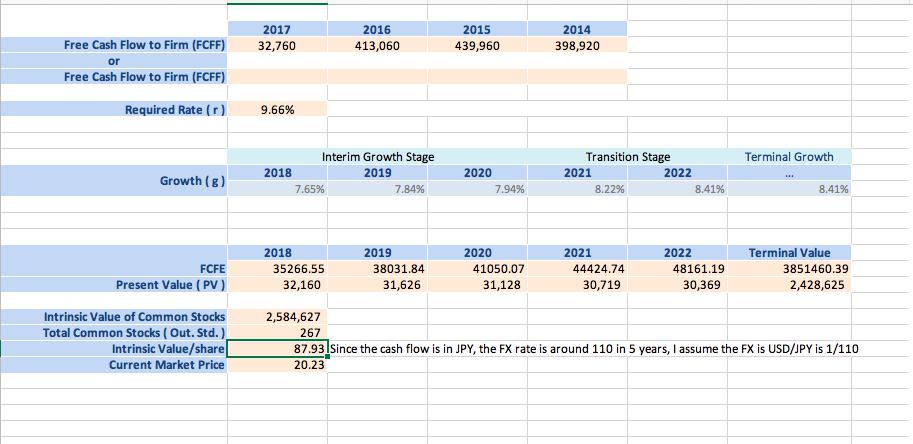

DCF

This model adopts the same hypothesis, FCFE growth rate is the same as DDM that of Yokogawa, which is 8.41%. The table in the appendix shows that the intrinsic value of ABC using the DCF model is $87.93.Whether cash flow is expense or asset, this approach provides the closest underlying valuation of a stock, and free cash flow tracks the money left by investors.Financial Analysis代写

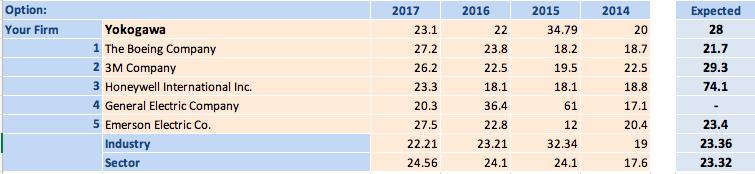

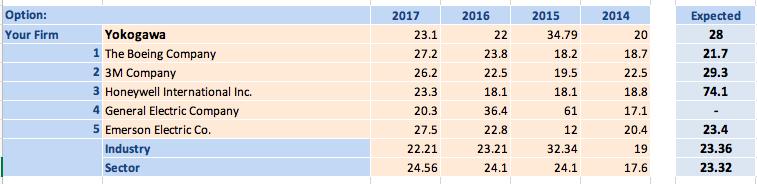

RELATIVE VALUATION – PE

All of Yokogawa’s competitors in the industry show that the historical p/e ratio for the past five years is the average of the forward p/e ratio in the table below. We assume that the company USES the same p/e ratio as the industry expects. By doing so, the intrinsic value for the stock price is $26.14.Financial Analysis代写

Other Analysis

In the first quarter, the company achieved a net profit of $1.053 million, a decrease of $55.16 million over the same period of the previous year, a reduction of 34 %. Reasons for the decline in net profit: First, the total profit decreased by US$505,000 compared with the same period of the previous year. Second, due to the increase in the income tax rate, the income tax paid increased by US$4.65 million year-on-year. The decrease in total profit was the main reason for the decline in net profit.Financial Analysis代写

COMPARABLE COMPANIES

National Instruments (NI) helps engineers and scientists in the test, control, and design industries solve the challenges of design, prototype, and release. With off-the-shelf software, such as LabVIEW, and cost-effective modular hardware, NI helps engineers in all areas innovate to reduce development time while reducing development time.Financial Analysis代写

Today, NI offers a wide range of application options for 30,000 different customers around the world. Headquartered in Austin, Texas, USA, NI has offices in 40 countries and employs more than 5,200 people. For the past 12 consecutive years, Fortune Magazine has selected NI as one of the 100 best companies to work in the United States.Financial Analysis代写

FINAL RECOMMENDATION

Financial valuation model shows that Yokogawa is currently undervalued; We now value Yokogawa at 51.65 USD, higher than the current market value of 155.28%, and therefore recommend buying positions. The underestimation of T is mainly due to the limited capital inflow faced by the company, the over-investment in the implementation of the factory automation system and the lack of professionals will hinder the development of the company’s factory automation market Financial Analysis代写

RISKS TO FINAL RECOMMENDATION

A set of technology and automatic control equipment is the leading essential parts of factory automation because it can improve the productivity and quality of products. However, the company faces limited capital inflows, high investment in the implementation of factory automation systems and a lack of professionals will hinder the growth of the company’s factory automation market.Financial Analysis代写

Financial Analysis

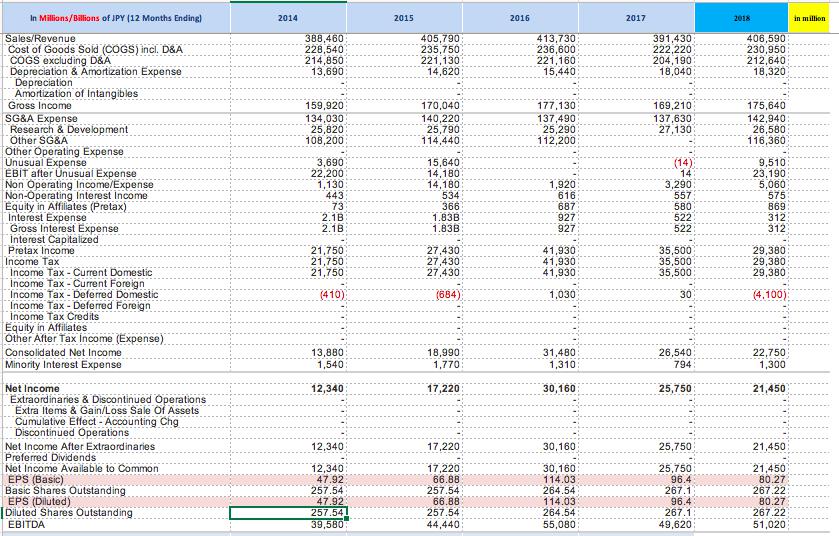

Earnings

According to the income statement composition analysis table, the company’s first business profit, other business profits are profitable, but the total profit and net profit are losses, which shows that our company is valuable, but because of the large cost, leading to company losses.Financial Analysis代写

| project | Accumulated this year | last year | Increase or decrease |

| Profit from principal operations | 262 | 466 | -204 |

| Other business profits | 756 | 3349 | -2593 |

| The total profit | -464 | -1921 | 1456 |

| Net profit | -464 | -1921 | 1457 |

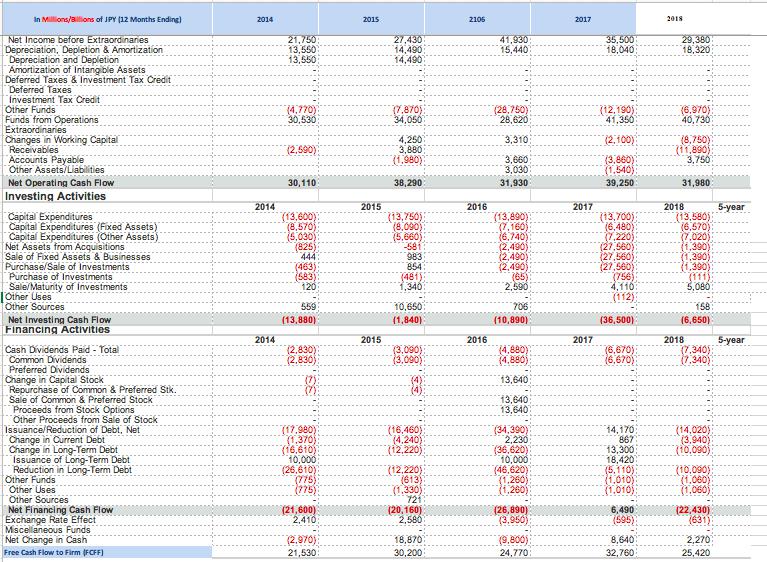

Cash Flow

Among the total cash inflows, cash from operating activities accounted for 28.32%, down 5.61% from the same period of last year, money from investment activities accounted for 5.19%, up 5.19% from the same period of last year, and cash from financing activities accounted for 66.49%, up 0.43% from the same period of last year. It can be seen from this that the primary sources of cash inflows are operating activities and financing activities, and the investment activities have little contribution to the cash inflows. (See Appendix)Financial Analysis代写

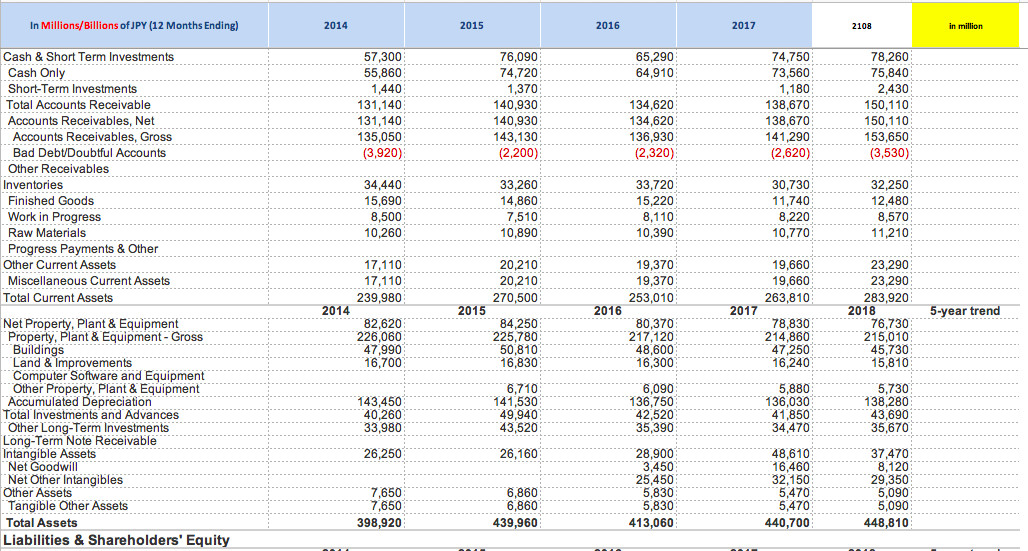

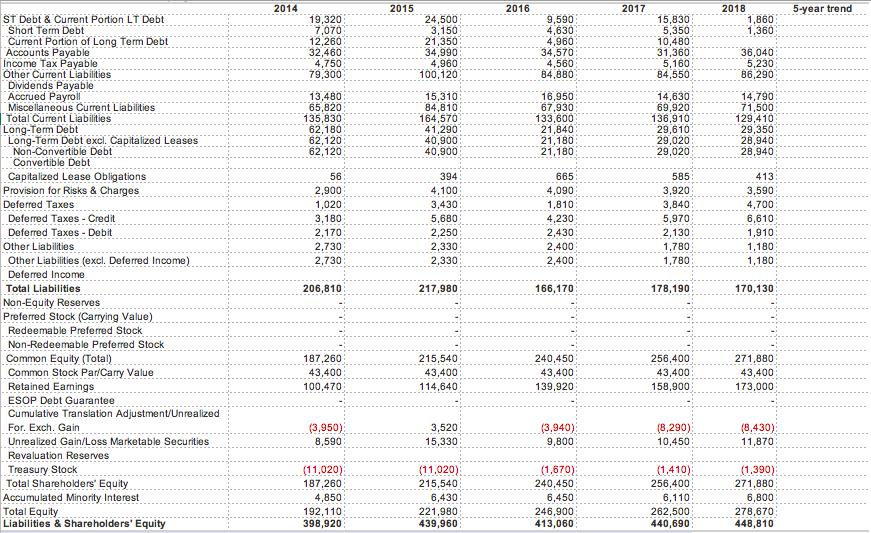

Balance Sheet & Financing

Current assets accounted for 63.26% of the total assets, non-current assets accounted for 36.74% of the total assets, indicating that the flexibility of the enterprise is substantial, but the foundation is weak, there is no risk in the enterprise’s short-term operation, but the long-term operational risk is higher. The proportion of current liabilities to total liabilities is 76.07%, indicating that enterprises rely on short funds very strongly. The pressure on enterprises to pay debts shortly is more significant. The responsibilities of non-current assets are 42.56%, which indicates that the enterprises are more dependent on long-term. The long-term debt repayment pressure of enterprises is more significant. (See Appendix)Financial Analysis代写

Investment Risks

Yokogawa electric company’s investment risk can be expressed in Environment, social and economic risk. Since the company’s product is capital intensive and requires a lot investment. The environmental risk is the serious one to face with.Financial Analysis代写

Environment Risks

One of Yokogawa electric company’s three goals is to achieve the net zero essision. Since the climate change has been an urgent problem, Yokogawa has facing the problem like wasting resources, chemical substance, water resource wasting and harmful to biodiversity. However, Yokogawa has employeed measurement to control this risks.Financial Analysis代写

Social Risks

One problem Yokogawa has faced in society perspects is that the health and safety for their employee. The potential risk of its employment is the process of production. Since it is a production company, safety problem should not be ignored.Financial Analysis代写

Economic Risks

One economic risk should be pay attention to is that the global foreign exchange rate. Since United States targeted at a expansion strategy for its economy. The exchange rate has decreased from 110 to 105. This means that the JPY has been appreciated comparing to the the USD. This change will certainly affect the growth rate estimation as well as the stock price. As we use 110 as a FX rate to estimate the final price.Financial Analysis代写

Income Statement

Balance Sheet

Cash

Flow

Assumptions

DDM

DCF

Relative Valuation

更多其他: 数据分析代写 Assignment代写 商科论文代写 Essay代写 Case study代写 Report代写 Academic代写 哲学论文代写

您必须登录才能发表评论。