Buying a House or Condominium in Toronto

Name

Institution

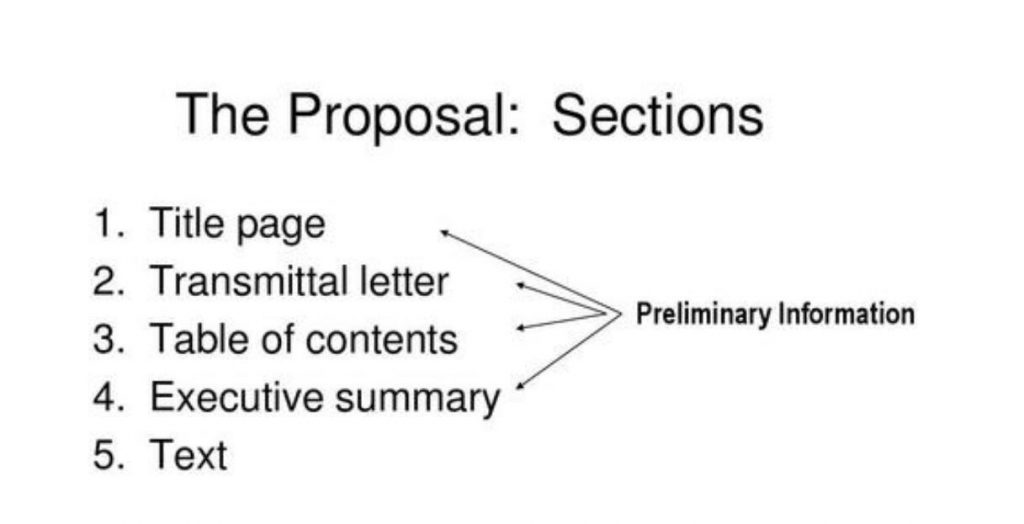

Letter of Transmittal

Letter of Transmittal代写 A proposal for the evaluation and analysis of houses and condos in Toronto city to facilitate buying decision.

Mr. Christopher Brown

CEO

HBSC Bank

Toronto.

Dear Mr. Brown,

Business Intelligence Solutions Consultant is pleased to submit to you this report detailing the cost and conditions of buying a house or a condominium in Toronto city. Also included is a proposal for the evaluation and analysis of houses and condos in Toronto city to facilitate buying decision.

HBSC Bank is an essential component in the real estate business. Your bank acts as an intermediary between investors and buyers as well as an enabler of investments through financing and mortgages. As such, this report will be useful to you and your clients, mainly to be used in decision making. Letter of Transmittal代写**格式

I want to extend my gratitude to your staff for the assistance they have accorded me, and without which this work would not have been credible. The staff allowed me access to relevant documents on mortgages, offered insight on house prices, financing, and repayment options. It was not without them sacrificing their time and loads of work.

Feel free to contact the company for further discussions and clarifications of this report. Business Intelligence Solutions Consultant fraternity is pleased to be part of this research.

Yours sincerely,

(Name)

Executive Summary

Introduction Letter of Transmittal代写

The demand for houses in Toronto has been rising for the last decades. Due to demand, house prices have been increasing. The cost of house is determined by an array of factors the main of them being location and market forces. As such, this paper will analyze the prices of owning a home in Toronto and evaluate various options available to buyers.

Background

Toronto is one of the largest cities in Canada and most populous. The population is ever growing, and the demand for houses is rising. Thus, people need to know how and where to choose a house of their preferences, and they can afford it.

Methodology Letter of Transmittal代写

The research used questionnaire and semi-structured interviews to get information from 10 participants who owned houses in Toronto. The participants were randomly selected from the entire population of Toronto.

Evaluation Criteria

The research used seven evaluation criteria, including:

a. Private mortgage insurance

b. Interest rates on mortgages

c. Home owner’s insurance

d. Resales values

e. Condo association fees

f. Maintenance

g. Shared amenities

Options Letter of Transmittal代写

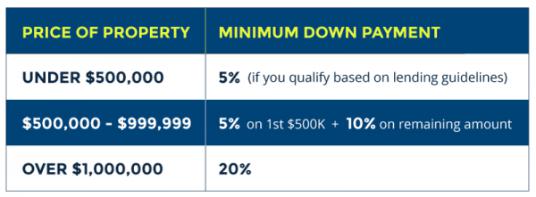

A house buyer had options to either buy a condo or an apartment. Also, buyers were required to pay down payments depending on their ability to pay, ranging from 5 to 20 percent.

Findings

More people prefer the condo because they are cheaper compared to owning an apartment. Most apartment owners were middle to high-income earners. The most favorable method to acquire a home was to get mortgage financing.

Analysis Letter of Transmittal代写

The best places to buy a house are in up-and-coming areas. Buyers have options of either to deposit 5 percent to 20 percent depending on their ability to pay. A buyer who pays more than 20 percent pays less since it does not attract insurance.

Conclusion

The cheapest method of payment is by paying more than 20 percent deposit because it does not require private mortgage insurance. However, low-income buyers can make down payment of 5 percent with private mortgage insurance.

Recommendation Letter of Transmittal代写

a. The best places to buy a house are up-and-coming areas with houses retailing at less than $500,000.

b. Though mortgage can be expensive, a buyer has the option to pay more than 20 percent down payment to eliminate the cost of private mortgage insurance.

c. However, low-income earners can pay as low as 5 percent to own a home and incur insurance costs with affordable monthly mortgage premium.

Buying a House or a Condominium in Toronto

Report

Introduction Letter of Transmittal代写

Toronto is the provincial capital of Ontario and one of the most populated cities in Canada. The city has more than 6 million people, and it is marked to be the fastest growing city in North America (Montgomery, 2019). Toronto is the hub for international investors and businesses, finance, arts, and culture. The city has grown to the level of being cosmopolitan in the world by being a multicultural city in the world. As such, to accommodate the growing population, the city is growing in upwards and horizontally covering wider areas. Real estate business has been a boom as many investors build houses to let and sell to the millions of people working harder to own a house. Letter of Transmittal代写**格式

The purpose of this paper is to evaluate the price of house and condos in Toronto. The analysis will answer the question on which option of home ownership is most suitable for a person who wishes to live around the city. Also, the report will offer a comparison between houses and condos before giving recommendations.

Houses and Condominium Options

According to the interviews and questionnaires, a buyer has two option of home ownership. A buyer can either opt to buy a condo or an apartment. The choice for any of the two depends on the buyer preferences and ability to incur the costs.

Evaluation Criteria Letter of Transmittal代写

The houses will be evaluated based on the following factors:

d. Availability and payment of mortgage financing: The question will be on whether there are available mortgage options available to finance the ownership of either condo or apartment.

e. Interest rates for a mortgage: The interest rates will determine the financing option that a buyer has.

f. Condo association fees: These are the fees required by a condo or homeowner association. The fees vary from one area to the other depending on the catchment, and some can be prohibitive.

g. Private mortgage insurance: The down payment determines the required private mortgage insurance. It can be difficult to secure private mortgage insurance for some condominium purchases, but if possible, it is expensive. Letter of Transmittal代写**格式

h. Homeowner’s Insurance: Townhouse is secure since each owner has a private space. However, condo owners are open for access by the public, and hence, they are viewed as less secure.Homeowner insurance will is high for condos compared to townhouses and increase based on the safety rating of the condo.

i. Resale value: A homeowner may want to resell the property after some time. The sales price will be dependent on the desirability of the building as a whole, market values at the current time or any other economic cycles which affect property prices.

j. Shared amenities: Condo has shared amenities which reduce costs compared to apartments which have private spaces, making them expensive. The choice depends on buyer preferences and financial ability.

k. Maintenance: Maintenance is a cost that most home buyers are likely to incur. It is essential to discuss the cost at the time of purchase, especially for a condo.

Discussion on Findings Letter of Transmittal代写

The research surveyed ten participants. Out the ten, seven participants owned a condo, and three owned an apartment. Each of them had reasons for their choice of house. All of them sourced for mortgage financing. They cited that most interest rates and private mortgage insurance are high, which makes the cost of owning a home in the city expensive. Those who owned condo felt that the costs are lower compared to owning an apartment. Five of condo owners agreed to have paid condo association fee, which they cited is a limiting factor to own a condo in certain areas.

Condo owners pay for the maintenance of their house and the same case for the apartment owners. All condo owner agreed that condo houses have little security because of shared amenities and space, and hence getting homeowner insurance was difficult and expensive. However, all have not considered reselling their home, but three of them felt that reselling a condo will fetch less in the market compared to new homes. Letter of Transmittal代写**格式

On the other hand, apartment owners were mostly middle to a high-income earner. All of them have a home in Toronto city. They agreed that owning an apartment in Toronto city is very expensive since the cost of lands are high, and the demand for new homes is rising. All the three paid for their house through mortgage financing because of high prices. The apartments were expensive due to high insurance premiums and interest rates.

Analysis Letter of Transmittal代写

Most house owners bought condos because they are cheap to acquire through mortgage financing. Since condos have shared amenities, they are presented a more affordable option to house buyers, particularly those with a small family or living single (Dautovich, 2019). Below is the analysis of the Toronto condo market.

Source: https://pierrecarapetian.com/cost-buy-condo-toronto/

The best area to buy a condo or an apartment in Toronto depends on the different variables. Annex and Rosedale are the best options to buy a condo unless one is ready to incur the high prices. The demand for houses under $500,000 is high, especially in Junction and along the Danforth where prices are lower. Condo prices in neighborhoods like Leslieville and Riverside are tremendously on the rise over the years. Therefore, the best places to own a house is in neighborhoods that are up-and-coming. Letter of Transmittal代写**格式

Additionally, when a buyer is looking for a house, one must have a deposit fund available. Buyers are expected to have a down payment of at least 5 percent of the total purchase price. For instance, to acquire a house worth $500,000, one needs to deposit $25,000, and the rest can be covered by the mortgage, as shown in table 2 (Carapetian, 2018; Government of Canada. 2017). The minimum down payment depends on the purchase of the condo. However, down payment that is lower than 20 percent requires private mortgage insurance, which may make the price higher, as shown in table 3. A down payment of over 20 percent is better because it requires little or no insurance.

Table 2: Source: https://pierrecarapetian.com/cost-buy-condo-toronto/

Table 3: Source: https://pierrecarapetian.com/cost-buy-condo-toronto/

Therefore, monthly mortgage cost varies with different down payments. Mortgage payments are based on a five year fixed rate of 3.39 percent over a 25-year amortization. When a buyer pays $100,000 down payment saves $464,000 per month. Table 4 below shows the differences in monthly mortgage payments.

| 5% down payment | $25,000 |

| CMHC insurance | $19,000 |

| Monthly mortgage | $2,438 |

| 10% down payment | $50,000 |

| CMHC insurance | $13,000 |

| Monthly mortgage | $2,290 |

| 15% down payment | $75,000 |

| CMHC insurance | $11,000 |

| Monthly mortgage | $2,156 |

| 20% down payment | $100,000 |

| CMHC insurance | $0 |

| Monthly mortgage | $1,974 |

Table 4

Conclusion Letter of Transmittal代写

An array of factors determined the cost of owning a house in Toronto city. According to the findings, the major cost factor was the location of the house and the level of development in that area. The areas with expensive homes were Annex and Rosedale while those with cheaper homes are Danforth and Junction. A buyer had financing options regarding mortgage monthly payment and down payment. It is clear, therefore, that paying a down payment of over 20 percent is better because it does not require private mortgage insurance. Low-income earners, however, have the option of paying a 5 percent down payment and lower monthly payment but have to bear the cost of private mortgage insurance.

Recommendation Letter of Transmittal代写

A buyer interested in owning a house in Toronto city has difficult choices to consider. However, with these recommendations, it is easier to own a house in any part of the city.

l. The best places to buy a house are up-and-coming areas with houses retailing at less than $500,000.

m. Though mortgage can be expensive, a buyer has the option to pay more than 20 percent down payment to eliminate the cost of private mortgage insurance.

n. However, low-income earners can pay as low as 5 percent to own a home and incur insurance costs with affordable monthly mortgage premium.

References Letter of Transmittal代写

Carapetian, P. (2018). How much does it cost to buy a condo in Toronto? Retrieved from https://pierrecarapetian.com/tips-buying-condo-toronto-2019/

Dautovich, N. (2019). Tips for buying a Toronto Condo in 2018. Retrieved from https://www.huffingtonpost.ca/nathan-dautovich/buying-toronto-condo-tips-2018_a_23349364/

Government of Canada. (2017). How much you need for down payment. Retrieved from https://www.canada.ca/en/financial-consumer-agency/services/mortgages/down-payment.html

Montgomery, M. (2019). Toronto: Fastest growing city in North America. Radio Canada International.

更多其他:Report代写 Proposal代写 商科论文代写 Case study代写 论文代写 Essay代写 数据分析代写 Review代写 研究论文代写 Capstone Projects 文学论文代写 Academic代写

您必须登录才能发表评论。