Question 2.1

risk premia strategie代写 The market is proxied by a made-on-purpose ‘Imperial Stock Index’, which is available on a separate sheet of the workbook.

risk premia strategie代写

They aim to extract:risk premia strategie代写

1. a Momentum effect

2. a Mean-Reversion effect

The time series of daily log-return of stocks on close are available in the first sheet of the “daily stock return-cw2018.xlsx” file. The market is proxied by a made-on-purpose ‘Imperial Stock Index’, which is available on a separate sheet of the workbook.

For each risk premia strategy, rank the stocks according to their NAV using the metrics defined below and build two portfolios: one which is long the best decile;

another one which is long the worst decile.

1. Momentum: sum(log-returnt-1day to log-returnt-260days)>0 constitutes a buy signal for the coming day otherwise no investment on the coming day. Stocks with a high momentum are preferred to those with a low or negative momentum.risk premia strategie代写

2. Mean-Reversion: when the sum of the last 10-day log returns is >1.50%, then short the stock over the coming day, otherwise stay long.

Within each decile, the relative weights in portfolios are rebalanced on the last trading day of each month. All positions are initially equally weighted.

The composition of each portfolio at the start of any given month is derived from the decile ranking obtained from inception up to the last completed month.

A month is assumed to correspond to 21 daily observations.risk premia strategie代写

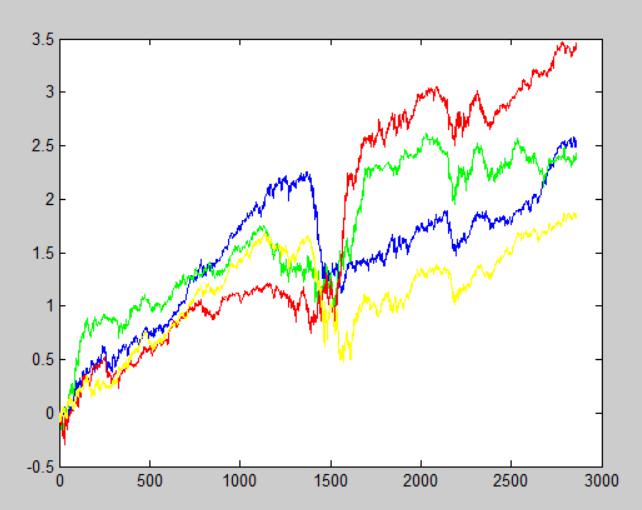

1.Show the back-tested cumulative returns starting at ‘t463’ for each of the four portfolios and compute their annualized returns and volatilities from this date onwards.

Solution:

The blue curve is the cumulative returns of the best decile of momentum metrics;

The green curve is the cumulative returns of the worst decile of momentum metrics;

The red curve is the cumulative returns of the worst decile of mean-reverse metrics;

The yellow curve is the cumulative returns of the best decile of mean-reverse metrics.

| best decile of Momentum metrics | worst decile of Momentum metrics | worst decile of Mean-reverse metrics | best decile of Mean-reverse metrics | |

| annualized return | 0.3128 | 0.3032 | 0.3931 | 0.2530 |

| annualized volatility | 0.2891 | 0.3394 | 0.3303 | 0.3012 |

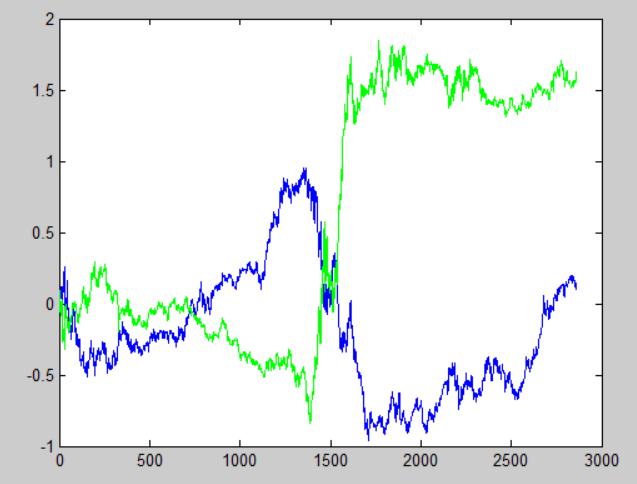

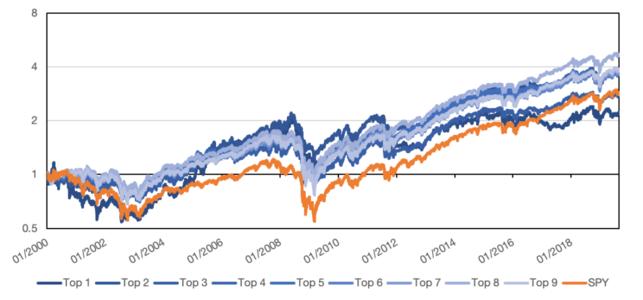

2. Assume that a structuring team is able to provide you with the return stream of the best decile portfolio minus the worst decile portfolio for both strategies.

There is no rebalancing and, for simplicity reasons, even though it is not realistic, take the difference between both performance series. These “long/short” portfolios are named MomentumRP and MeanReversionRP. Please plot the results.risk premia strategie代写

Solution:

Blue curve is the cumulative returns of MomentunRP;

Green curve is the cumulative returns of MeanReversionRP;

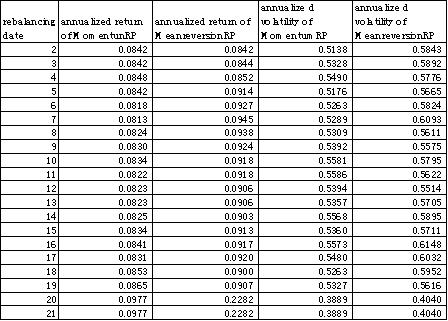

3.Assess the robustness of the two strategies. Provide the return and volatility of MomentumRP and MeanReversionRP when you:risk premia strategie代写

a.Change the monthly rebalancing date between the 1st to the 21st day of the month (daily increment). Keep the rest constant.

Solution:

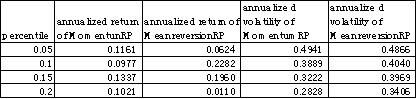

b.Change the selection rule by considering 5th, 10th, 15th, 20th percentile for long positions and respectively 95th, 90th, 85th and 80th percentile for short positions. Keep the rest constant.risk premia strategie代写

Solution:

c.Change parameters:

- For momentum:

| Pricet-200days | Pricet-230days | Pricet-260days | Pricet-290days | Pricet-320days | |

| Pricet-1day | (0.08,0.37) | (0.12,0.37) | (0.1,0.39) | (-0.01,0.38) | (0.06,0.36) |

| Pricet-5days | (0.18,0.35) | (0.19,0.39) | (0.19,0.39) | (0.14,0.37) | (0.09,0.35) |

| Pricet-10days | (0.09,0.38) | (0.16,0.37) | (0.17,0.39) | (0.06,0.37) | (0.01,0.37) |

| Pricet-20days | (0.12,0.38) | (0.15,0.37) | (0.19,0.36) | (0.06,0.35) | (0.05,0.35) |

- For Mean-Reversion: the signal is based on 5 days, 10 days, 15 days and 20 days.risk premia strategie代写

Solution:

d.Would you invest in these premia?

Solution:

As annualized return of empirical index is 23.56% and corresponding volatility is 17.15%, the MomentumRP and MeanreversionRP ‘s performances both don’t excess the index, so I will not invest in these premia.

更多其他:prensentation代写 代写案例 Assignment代写 助学金申请 成品购买 文学论文代写 商科论文代写 艺术论文代写 人文代写

您必须登录才能发表评论。