BUS224 International Corporate Reporting

企业报告代写 YOU ARE NOT PERMITTED TO READ THE CONTENTS OF THIS QUESTION PAPER UNTIL INSTRUCTED TO DO SO BY AN INVIGILATOR

YOU ARE NOT PERMITTED TO READ THE CONTENTS OF THIS QUESTION PAPER UNTIL INSTRUCTED TO DO SO BY AN INVIGILATOR

This exam contains two sections: Section A and Section B.

Answer FOUR questions in total (25 marks each). Please choose at least ONE question from EACH section.

If you answer more questions than specified, only the first answers (up to the specified number) will be marked. Cross out any answers that you do not wish to be marked

Calculators are permitted in this examination. Please state on your answer book the name and type of machine used.

Complete all rough workings in the answer book and cross through any work that is not to be assessed.

Possession of unauthorised material at any time when under examination conditions is an assessment offence and can lead to expulsion from QMUL. Check now to ensure you do not have any notes, mobile phones, smartwatches or unauthorised electronic devices on your person. If you do, raise your hand and give them to an invigilator immediately.

It is also an offence to have any writing of any kind on your person, including on your body. If you are found to have hidden unauthorised material elsewhere, including toilets and cloakrooms it will be treated as being found in your possession. Unauthorised material found on your mobile phone or other electronic device will be considered the same as being in possession of paper notes. A mobile phone that causes a disruption in the exam is also an assessment offence.

EXAM PAPERS MUST NOT BE REMOVED FROM THE EXAM ROOM

SECTION A 企业报告代写

Question 1

A company which prepares financial statements to 31 December classifies a non-current asset as held for sale on 1 October 20X3. The asset’s carrying amount at that date is £30,000 and its fair value is £23,400, with estimated costs to sell of £900. The asset is sold in July 20X4 for £24,000 (net of costs). In accordance with the requirements of IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations, calculate any impairment losses or gains that should be recognised in the company’s statement of profit or loss for the year ended 31 December 20X3 and the profit or loss that should be recognised on the disposal of the asset in 20X4 if the asset’s fair value less costs to sell at 31 December 20X3 is determined as below (3 different scenarios). Following your calculations, you are required to comment on your results for each scenario (a, b, and c).

a) £21,000 (9 marks)

b) £25,500 (8 marks)

c) £33,000 (8 marks)

(25 Marks)

Question 2

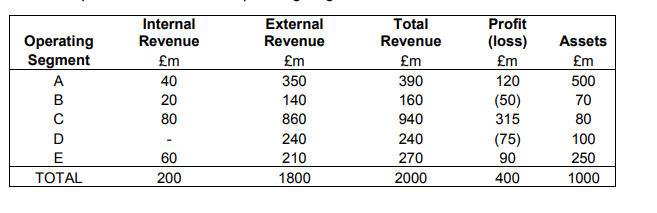

Florence Plc is a company with five operating segments and no other activities except those of the five operating segments. The company reports in accordance with the minimum requirements of IFRS 8 Operating Segments.

a) Outline the principles in IFRS 8 Operating Segments for the determination of a company’s reportable segments (10 marks).

b) Explain whether each of Florence Plc’s operating segments is a reportable segment

(please show your workings clearly – 15 marks).

(25 Marks)

Question 3 企业报告代写

On 1 January 20X4 Girona Plc enters into a contract with a customer to provide a product which it will deliver on 31 December 20X5. The customer makes a down payment of £75,000 on 1 January 20X4, and will be required to pay a further £150,000 on delivery. The customer would be required to pay £240,000 on 31 December 20X5 if it did not make the down payment.

In accordance with IFRS 15 Revenue from Contracts with Customers, how would this transaction be accounted for in the financial statements of Girona Plc for the years ended 31 December 20X4 and 20X5?

(25 Marks)

Question 4

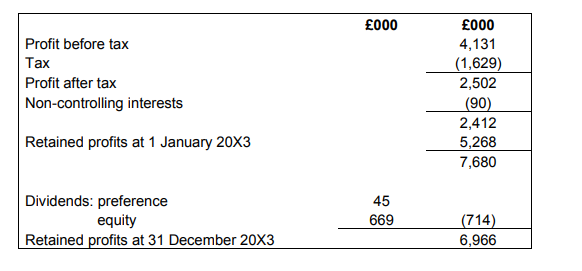

You are given the following information relating to Siena Plc for the year ending 31 December 20X3:

i. From 1 January 20X2 until 31 March 20X3 the issued share capital of Siena Plc was as follows:

Equity 25p shares £3,000,000

5% irredeemable preference shares of £1 each £900,000

ii. On 1 April 20X3, Siena made a 1 for 4 rights issue of equity shares at £1. The market price of an equity share of Siena in the last day of quotation cum rights was £1.50.

iii. The earnings per share for the year ended 31 December 20X2 had been calculated at 15.0 pence.

Question 4 – continued 企业报告代写

In accordance with the requirements of IAS 33 Earnings per Share, you are required to:

a) Calculate the basic EPS of Siena Plc for the year ended 31 December 20X3 (15 marks).

b) Calculate the adjusted basic EPS of Siena Plc for the year ended 31 December 20X2 (5 marks).

c) Show how the results of your calculations, together with any necessary notes, would be disclosed in the financial statements of Siena Plc (5 marks).

(25 Marks)

SECTION B

Question 5 企业报告代写

Critically discuss:

a) why neutrality is a key ingredient of high quality financial reporting (9 marks).

b) how might non-neutral financial information be harmful to investors? (8 marks)

c) whether financial information can be both neutral and prudent? (8 marks)

(25 Marks)

Question 6

Critically discuss why publicly listed companies are required to report on corporate governance matters in their annual reports.

(25 Marks)

Question 7

Briefly outline the issues relating to revenue recognition that led to the introduction of a new standard IFRS 15 Revenue from Contracts with Customers.

(25 Marks)

Question 8 企业报告代写

Discuss whether the following relationships of Aria Plc constitute a related party relationship as defined by IAS 24 Related Party Disclosures:

a) The spouse of a director of Aria Plc.

b) Mr. Brown owns 25% of the share capital of Aria Plc.

c) A director of Aria is also a director of Brella Plc (which is independent of Aria), but is a shareholder in either entity.

d) Chantelle Plc is one of Aria Plc’s suppliers.

e) Dune Ltd is an entity owned by the nephew of Aria’s finance director.

Each point is worth 5 marks.

(25 Marks)