EXAM CODES: BFF5250 PAPER 1 SAMPLE EXAM QUESTIONS 1

TITLE OF PAPER: CORPORATE TREASURY MANAGEMENT

企业财务管理代写 ABC Ltd. currently is running in a very stable business environment. It current annual sales amount to $200,000 with an EBIT margin of 50%.

Question 1 (30 marks) 企业财务管理代写

ABC Ltd. currently is running in a very stable business environment. It current annual sales amount to $200,000 with an EBIT margin of 50%. Specifically, ABC has no capital expenditures, other income, or changes in net working capital. Its annual depreciation costs are $6000 currently and will decrease at a constant rate of 40% per year. ABC’s annual interest expense is $12,000 for its perpetual debt.

ABC is considering issuing new debt and purchasing a machine for $120,000 to replace a currently rented machine. The machine can boost sales by $12,500 per year and save the company annual rental costs of $8,000. The machine is purchased today. The life of the machine is ten years. Assume that the machines will be depreciated via the straight-line method over the five-year life of the machine for tax purposes. The salvage value of the

machine is $9500. There is no other change on operating costs.

Suppose the appropriate discount rate for the project is 10% per year. Its cost of equity is 12%.

Its cost of debt is 6%. Risk-free rate is 2.5%. The marginal corporate tax rate is 30%. The investment does not change the firm’s net working capital.

You are required to complete the following questions, round to the nearest dollars for your final answers.

a. Suppose ABC does not invest in the project: 企业财务管理代写

i. Calculate the current free cash flow for the firm (FCFF) of ABC. (3 marks)

ii. Calculate the market value of equity for ABC, assuming its sales and EBIT margin stay at current levels forever and ABC does not issue any new debt. (5 marks)

b. Calculate the FCFFs of the project in year 0, year 1, and year 10 respectively. (6 marks)

c. Calculate the NPV of the project. (3 marks)

d. Suppose ABC is now offered with an option to abandon the project at the end of the third year: if ABC pays extra $5,000 when buying the machine, the maker of the machine is willing to buy back the machine in three years for $30,000. The volatility in the value of the project is 30%. Answer the following questions (i. to ii.) considering such an option to abandon:

i. Calculate �” and �# used in Black-Scholes Model to value the option to abandon.

(7 marks)

ii. Calculate the value of the option to abandon. Should ABC invest in the project? (6 marks)

Question 2 (20 marks) 企业财务管理代写

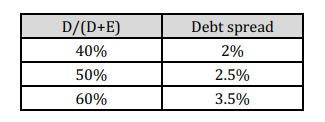

Firm XYZ has a debt ratio of 50% (D/(D+E)). XYZ’s current equity beta is estimated to be 2. The corporate treasurer of another firm UVW decided to use XYZ as the comparable firm to calculate its cost of capital. XYZ’s marginal corporate tax is 40%, UVW’s marginal corporate tax is 25%, and there is no other type of taxes. UVW’s current market D/E ratio is 1. The current risk-free rate is 3% per annum, and the market risk premium is 5% per annum. Suppose the treasurer of UVW can only adjust the debt ratio to either 40% or 60%. UVW’s debt spreads over the risk-free rate at different leverage ratios are

You are required to answer the following questions. Keep two decimal places (e.g. 99.99% or 9.99).

a. What is the asset beta of XYZ? (4 marks)

b. What is the WACC of UVW? (6 marks)

c. Calculate the WACCs of UVW if its debt ratio changes to 40% and 60%, respectively. How should the treasurer adjust UVW’s leverage? (10 marks)

Question 3 (20 marks)

You have invested in the bonds of Firm A, with the total face value of $1000, semi-annual coupon payment at 9%, maturity of four years, and a current yield to maturity of 7.5%. The historical standard deviation in the change of daily yield is 15 basis points.

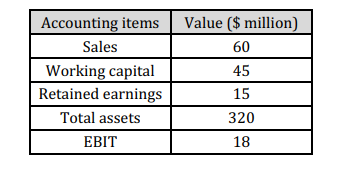

You have also invested $3,000 in Firm B’s stock. Firm B’s stock daily return follows a normal distribution with the standard deviation=0.3%. Firm B has a market-to-book ratio of 1.2 and a book debt-to-equity ratio of 3. The correlation between the returns in Firm A’s bond and Firm B’s stock is 0.2. The following information is from Firm B’s most recent accounting statements:

a. What is the modified duration of Firm A’s bond? (5 marks)

b. What is the 10-day 99% Value at Risk of your investment portfolio? (5 marks)

c. Suppose Firm A’s bond can be called in 2 years. Calculate its YTC. (5 marks)

d. Calculate the Altman’s Z-score of Firm B. Based on your calculation, assess the credit risk of Firm B. (5 marks)

Question 4 (18 marks) 企业财务管理代写

You extend credit terms of 2/15, net 45, to your customers. Currently, you have annual sales of $1 million and accounts receivables of $137,000.

a. Identify two reasons why your customers should take trade credits as a source of financing. (4 marks)

b. What is the effective annual cost for your customers who choose not to take advantage of trade discounts? Keep two decimal places and express in percentage points, e.g. 9.99%. (4 marks)

c. Do your customers on average pay on time? Why? (6 marks)

d. You are considering selling all of your accounts receivable to a factor for 3.5% discount. What is the effective annual cost of financing through the factor? Keep two decimal places and express in percentage points, e.g. 9.99%. (4 marks)

Question 5 (12 marks)

a. What are the major activities performed by corporate treasury? (6 marks)

b. Explain the key difference to arrange short-term financing by factoring and by discounting accounts receivables. Explain why discounting is more popular than factoring. (6 marks)