BEEM157

BEHAVIOURAL FINANCE

行为金融学代写 Consider a person with the following utility function over wealth: u(w) = e w, where e is the exponential function (approximately equal to 2.7183) and w is wealth.

Duration: 1 hours 30 minutes + 30 minutes upload time

No word count specified

Please answer all questions

This is an Open Book exam

Additional materials needed:

Approved calculators are permitted

To achieve full points for a problem it is not sufficient to provide the correct final answer. I must be able to retrace every step that took you to your answer.

-

Problem – Expected utility (15 points) 行为金融学代写

Consider a person with the following utility function over wealth: u(w) = e w, where e is the exponential function (approximately equal to 2.7183) and w is wealth. Suppose that this person has a 30% chance of wealth of ✩2 and a 70% chance of wealth of ✩10.

a) What is the expected value of wealth?

b) Is this person risk averse, risk neutral, or risk seeking? Explain your answer.

c) What is this person’s certainty equivalent for the prospect?

2.Problem – Prospect theory (15 points)

According to prospect theory, which is preferred? Explain your answers.

a) P1(0.8,✩50,✩0) or P2(0.4,✩100,✩0)?

b) P3(0.00002, ✩500,000, ✩0) or P4(0.00001, ✩1,000,000, ✩0)?

c) Describe how the interplay of the characteristics of the value function and the probability weighting function make the above choices jointly consistent with prospect theory.

-

Problem – Anomalies (15 points) 行为金融学代写

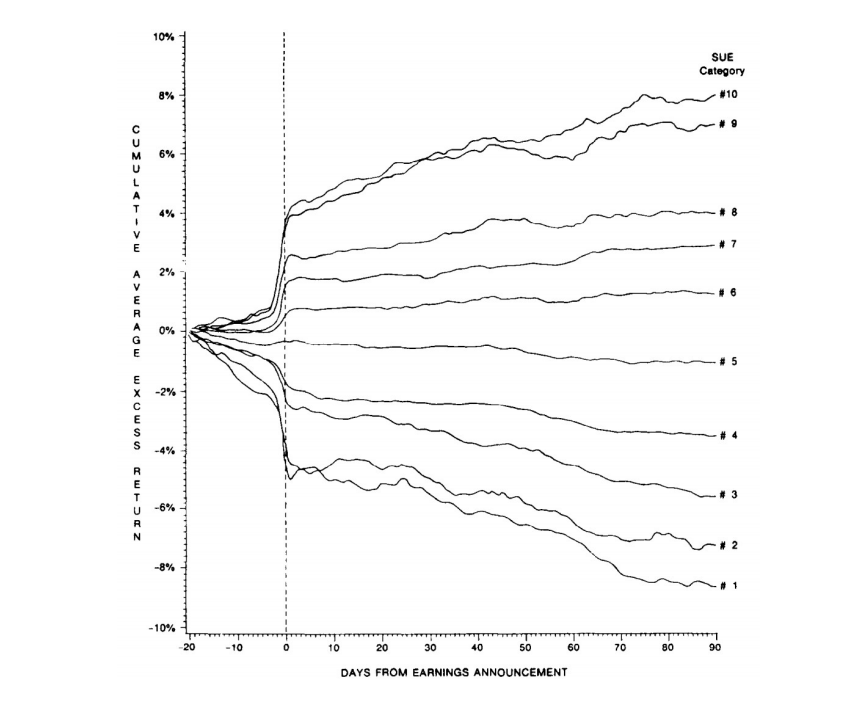

The following graph shows cumulative average excess return (CAR) paths around earnings announcements (t=0) as reported in the study of Rendleman, Jones, and Latan´e discussed in the lecture1 . Earnings announcements in the graph are grouped into ten deciles according to an estimate of standardized unexpected earnings (SUE) ranging from extremely negative surprises (SUE catergory 1) to extremely positive surprises (SUE category 10).

a) Explain why the reported CAR paths may be interpreted as casting doubt on the efficient markets hypothesis?

b) Taking into consideration only the graph of CAR paths shown here, can you conclude with certainty that the efficient markets hypothesis does not hold? Explain why or why not.

-

Problem – Limits to arbitrage (12 points)

Arbitrage is limited because the wealth of arbitrageurs is limited. Discuss this statement in the context of those who are managing their own money and those who are managing other people’s money.

-

Problem – Heuristics and biases (12 points)

Lily gets an A in a course 80% of the time. Still, she likes her leisure, only studying for the final exam in half of the courses she takes. Nevertheless, when she does study, she is almost sure (95% likely) to get an A.

a) Assuming Lily got an A in a course, how likely is it she studied?

b) If someone estimates the above to be 75%, what error are they committing? Explain.

-

Problem – Overconfidence (15 points) 行为金融学代写

Consider two investors (A and B) with the following demand curves for a stock where p denotes the price of the stock in ✩ and q denotes the quantity of the stock:

A: p = 100 − q

B: p = 150 − 2q

a) At a price of ✩50, how much will A and B purchase?

b) If the price falls to ✩30, who will increase their holdings more?

c) On this basis, which investor seems to be more overconfident? Explain your answer.

7.Problem – Implications of heuristics and biases for financial decision-making (16 points)

In a regression of long-term investment value (LTIV) as perceived by senior executives on a survey measure for management quality (MQ), the following significant coefficient was estimated by Shefrin and Statman in a study that we discussed in the lecture2 :

LT IV = −0.79 + 1.03MQ

a) Based on the results of this regression, would you conclude that the senior executives are knowledgeable of or believe in the efficient markets hypothesis? Explain your answer.

b) Which heuristic or bias could be driving the results? Explain how. 行为金融学代写

Adding firm size (S) and book-to-market ratio (B/M) to the regression equation, the following coefficients (all significant) were estimated by the authors:

LT IV = −0.86 + 0.15log(S) − 0.11log(B/M) + 0.85MQ

c) How do the results of the second regression relate to what you know about the historical evidence concerning the relationships between firm size, book-to-market ratio, and excess returns?