EXAM CODES: BFF5250 PAPER 2 SAMPLE EXAM QUESTIONS 2

TITLE OF PAPER: CORPORATE TREASURY MANAGEMENT

资金管理final代考 Company A is a publicly listed renewable energy company with a credit rating of B. It has 10 million shares outstanding and is…

Question 1 (20 marks)

Company A is a publicly listed renewable energy company with a credit rating of B. It has 10 million shares outstanding and is currently paying a dividend per share of $0.5. The dividend is expected to grow at a constant rate of 4% per year. Company A’s current share price is $10.

Company A’s only debt involves a coupon bond with semi-annual coupon payments and $50 million face value. The coupon rate is 8%. The bond will mature in 5 years and is currently traded at the total market value of $45 million. Company A’s marginal tax rate is 30%.

A textile Company B is planning to invest in a diversifying project in the renewable energy industry. The treasurer of Company B picks Company A as a comparable firm to calculate the project cost of capital. Company B is planning to finance the diversifying investment by 50% debt and 50% equity and can borrow at a rate of the risk-free rate plus 300 basis points. Company B’s marginal tax rate is 40%.

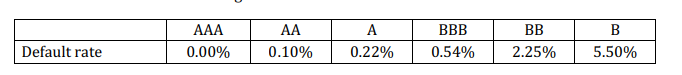

The current risk-free rate is 1.5%. The expected market return is 8%. The average recovery rate at default is 40%. The average annual default rates are listed below:

Based on the above information, complete the following questions. Keep two decimal places (e.g., 99.99% or $9.99).

a. Calculate the cost of debt for Company A.

(5 marks)

b. Calculate the cost of equity for Company A.

(3 marks)

c. Calculate the asset beta for Company A.

(5 marks)

d. Calculate the project cost of capital for Company B’s renewable energy investment.

(7 marks)

Question 2 (30 marks) 资金管理final代考

XYZ Pharmaceutical Co. is currently considering buying a patent on a new drug named APTX4869. The patent seller asks for $10 million in a “take it or leave it” fashion. If XYZ does not buy the patent immediately the seller will walk away. If XYZ purchases the patent and starts the production now, the drug can generate sizable revenues for 10 years. After ten years from now, the patent will expire and competition will drive any cash inflows to zero.

The management team of XYZ can choose to invest in the new drug project anytime once the patent is purchased.

Producing the drug requires an upfront investment outlay of $140 million to purchase equipment and set up the plant. The project can start generating profits in the next year. The fixed assets will be depreciated via the straight-line method over ten years. Also, producing the new drug will further require an upfront investment of $5 million in net working capital, which is to be fully recovered at the end of the project (year 10). The marketing department of XYZ predicts that the new drug can generate expected annual sales of $50 million starting from year 1 based on the total market demand for the new drug.

The gross profit margin is estimated to be 55%. Annual selling, general and administrative expenses are estimated to be 6% of the annual sales. The management team plans to sell all equipment and the plant at the end of year 10 for an expected salvage value of $15 million.

The appropriate discount rate is 10%. XYZ’s marginal tax rate is 30%. There are no other costs or benefits associated with the project.

You are required to complete the following questions. Express answers in the units of million dollars and keep two decimal places.

a. Suppose the project will generate $50 million annual sales until the end of year 10, calculate the following items if XYZ purchases the patent immediately and invests in the new drug project now (year 0): 资金管理final代考

i. EBITDA in year 1.

ii. FCFF in year 10.

iii. The NPV of the new drug project (including the purchase cost of the patent).

(4+6+5 marks)

b. Suppose the annual sales may grow at a constant rate of 8% per year due to increased market demand with a 60% chance from year 2. With a 40% chance, the expected annual sales will stay at $50 million. The management team will learn about the actual growth rate at the end of year 1.

i. Calculate the NPV of the new drug project (including the purchase cost of the patent).

(13 marks)

ii. Should the management team purchase the patent? If so, when should XYZ invest in the new drug production?

(2 marks)

Question 3 (19 marks) 资金管理final代考

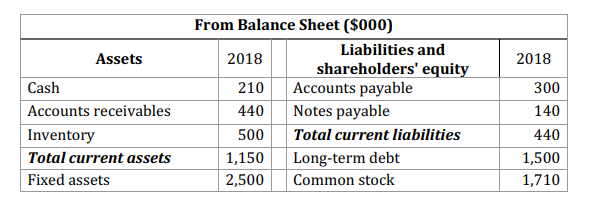

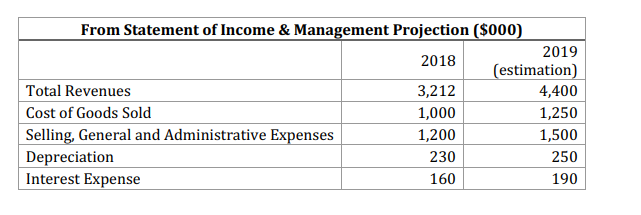

Lindor Ltd. generated annual sales of $3,212,000 in 2018 and has projected the revenues, costs and related expenses in 2019. The following tables contain information from Lindor’s accounting statements in 2018 and the projection in 2019.

Lindor does not expect to incur any cash flows in investment activities in 2019. The marginal tax rate is 35%. Answer the following questions:

a. Calculate the 2018 cash conversion cycle of Lindor. Round to the nearest integer.

(5 marks)

b. Lindor is planning to sell half of its accounts receivables to a discounter for 15% discount with recourse arrangement. What is the cost of financing (EAR) from the discounter? Keep two decimal places (e.g., 99.99%).

(5 marks)

c. Assuming Lindor’s working capital days do not change in 2019 (maintaining the levels in 2018), calculate Lindor’s Net Income and FCFF in 2019. Round to the nearest dollar.

(9 marks)

Question 4 (19 marks) 资金管理final代考

Consider a company whose assets only consist of long-term assets of $900 market value and cash of $300, and whose only liability is 10-year zero-coupon bonds issued three years ago of $1,000 face value. The current bond yield is 8%. The duration of the company’s long-term assets is 13 years. Keep two decimal places for your final answers (e.g., 9.99 or $9.99).

Assume that the current yield curve is flat at 5%. You are analysing the interest rate risk of the company.

a. What is the current equity duration of the company?

(6 marks)

b. Consider the effect of a surprise increase in interest rates—the yields rise by 50 basis points. What would happen to the value of the equity?

(4 marks)

c. In order to minimize the interest rate exposure, you are going to liquidate a portion of the company’s long-term assets and reinvesting the proceeds in short-term Treasury bills and notes with an average duration of 2 years. How many dollars do you need to liquidate and reinvest?

(3 marks)

d. Rather than immunizing the company using the strategy in part c, you consider using a swap contract. If the duration of a 10-year, fixed-coupon bond is 8 years, what is the notational amount of the swap you should enter into? Should you receive or pay the fixed rate portion of the swap?

(3+3 marks)

Question 5 (12 marks) 资金管理final代考

Choose any TWO of the following three sub-questions (a-c) to answer.

a. Identify the agency problems between debtholders and shareholders that contribute to the agency costs of debt.

(6 marks)

b. Identify three option features that are commonly embedded in corporate bonds and explain whether the option adds to the flexibility of the issuer or the investors.

(6 marks)

c. What are the major activities performed by corporate treasury?

(6 marks)