India Fiscal Regime for Petroleum Exploration and Development

Petroleum Exploration代写 India Fiscal Regime for Petroleum Exploration and Development:India is the fourth largest consumer of oil and gas.

India is the fourth largest consumer of oil and gas.

This places the country among the top countries that determine the economic performance of the oil and gas industry. India is yet to find oil reserves that will place it on the top of petroleum production. Production sharing contract is a common trend in oil exploration and development. The structure was introduced by the Indian government in 1991-92 to provide equal platforms for both local and foreign companies in the exploration and production of petroleum. In this article, the petroleum fiscal regime for India will be described under the production sharing contract as well as present the numerical cash flow analysis of the country.

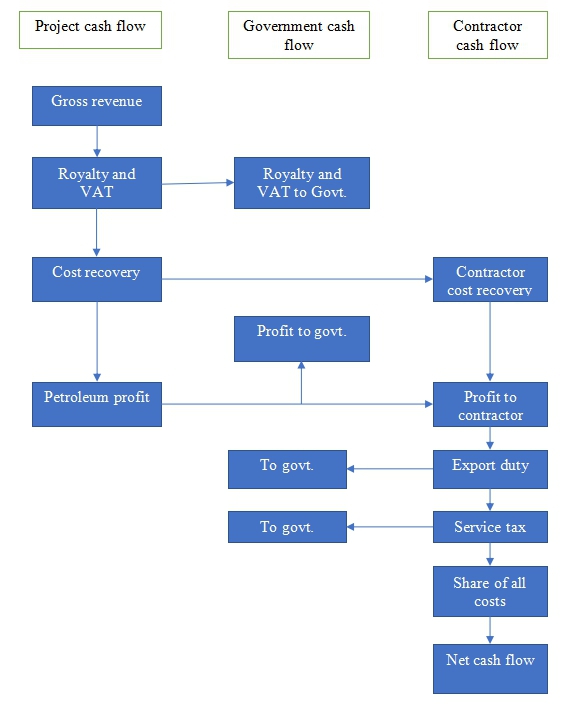

The Indian fiscal regime has three components including the project cash flow, government cash flow, and contractor cash flow. Petroleum Exploration代写

Figure 1 below shows the basic structure showing the PSCs terms as a flow chart. The flow chart shows how the contractors calculate net cash flow in PSC terms. The flow chart begins with gross profits for the whole project at the tops right hand. The outgoing costs to the contractor are charged against the allocated profit to get the net-cash flow including bonuses, operations costs, income tax, and excise duty.

The exploration and development costs, production and royalties are 100 percent tax-deductible and are eligible for cost recovery. The costs that are not recovered in the current years can be carried forward to the subsequent financial years. PSC terms also allow the deduction of operational expenses from profit petroleum. The capital allowances, incentives such as tax holidays, and lack of ring-fencing. These increase the favorability of PSC in India.

Additionally, India has a hybrid system of production sharing contract and contains elements of royalty and sharing of production with the government. Petroleum Exploration代写

Royalties are paid depending on the shores either onshore, shallow water offshores and deep-water offshore areas. Onshore areas pay higher royalties. For this illustration, 10 percent royalty for shallow-water offshore areas will be used. Under PSC terms, contractors do not pay bonus and hence bonus is assumed to be $0. In this case, we assume that all the oil was exported and excise duty of 12.5 percent is paid. The net cash flow is derived after the above deductions.

The total revenue that accrues to the contractor is equal to profit allocated and adding back cost recovery.

The deductions include excise duty, bonus, service tax, and operating costs. The net cash flow is indicated at the bottom right-hand side as the remaining revenue.

Figure 1: PSC term in India

Components of Indian PSC term Petroleum Exploration代写

a. Royalty: The rate varies from the onshore, offshore shallow sea and deep-sea areas. For this illustration, the shallow offshore sea rate of 10 percent will be used. The rate is fixed for the area identified and does not vary with production.

b. Value-added tax: It is based on the sales of goods and charged at a rate of 5 percent.

c. Cost recovery: The contractor is allowed to recover the cost of exploration, development, production and royalty costs. Cost recovery is charged after deducting Royalty. However, the cost recovery does not have a limit and is 100 percent deductible.

d. Profit-sharing: Petroleum profit is allocated between the contractor and the government after deducting royalty, VAT and cost recovery. Profit-sharing is negotiated in PSCs terms and the contractor is entitled to share that varies from 80 to 30 percent.

e. Export duty: Excise duty of 12.5 percent applies to contractors exporting petroleum products oversea. The duty is mostly levied as a percentage of the transaction value of goods.

f. Income tax: There are various income taxes applicable to contracts in India including revenue tax, minimum alternate tax, dividend distribution tax, and wealth tax. For simplicity, in this case, the revenue tax is considered. We assume that the contract is a foreign company. Thus, the income tax rate of 40 percent is applicable.

Numerical analysis of the PSC terms using chart flow Petroleum Exploration代写

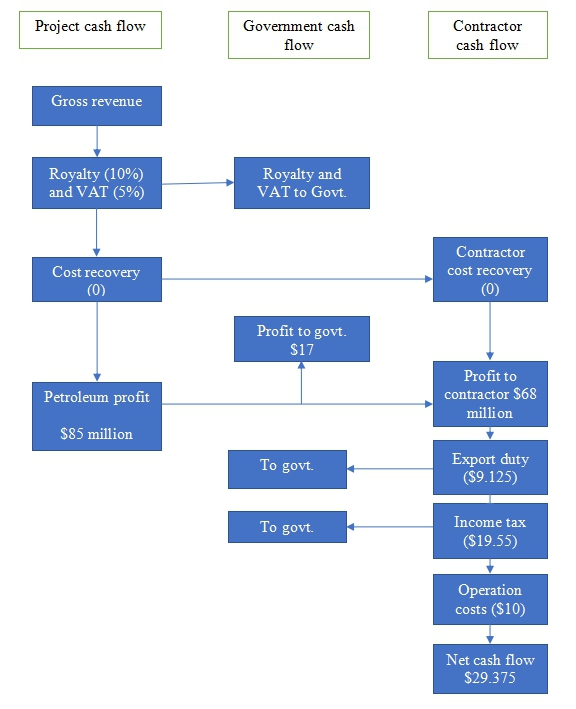

The numerical illustrations in figure 2 below show cash flow analysis using the Indian offshore contractor of a single year. The three main components of PSC terms include project cost, government cash flow, and contractor cash flow. The following are the assumptions applicable to the analysis.

a. Gross oil revenue is $100 million

b. Operating expenses

c. 100 percent cost recovery

d. 80 percent contractor profit share

e. 5% excise duty of export revenue

f. VAT of 5%

g. $0 bonus for the year of study

h. 40 percent income tax

Gross revenue Petroleum Exploration代写

The gross oil revenue is shown on the left-hand side of the flow chart. We assume that the oil profit is $100 million. A value-added tax and royalty of 5 percent and 10 percent respectively are deducted from the gross revenue. VAT and royalty = 10%. Thus, 15% * 100 = $15 million. The remaining profit is $100 – $15 = $85 million.

Cost recovery

Cost recovery is done after royalty deduction. There is no cost recovery ceiling. Royalty and VAT will not be recovered because they do not fall into the category of recoverable costs. For this illustration, we assume that the company has already recovered exploration and development costs and hence will not be recovered.

Profit-sharing Petroleum Exploration代写

The profit to be shared is calculated by deducting VAT, and royalty and adding cost recovery. That is, {100 – (5 + 10)} = $85 million. Depending on the negotiation between the contractor and the government, the sharing percentage varies from 30% to 80%. In this case, we assume the company negotiated for 80% profit share. That is, (80% * 85) = $68 million will go the contractor and (85 – 68) = $17 million go to the Indian government.

Excise duty, and bonus

Excise duty and bonus are charged on the allocated profit to the contractor. There is no bonus payment in India. We assume that the contractor exports all the oil oversea. Thus, the applicable excise duty is 12.5 percent of the allocated revenue. Hence, {12.5% * (68 + 5)} = $9.125 million.

Figure 1: Indian PSC term numerical analysis

Income tax Petroleum Exploration代写

Taxable income is allocated revenue to the contractor less operating cost and export excise duty. In this case, there is no cost recovery. As such, {(68) – (9.125 + 10) = $48.9 million is the taxable income. The taxable income is given by 40% * 48.9 = $19.55 million.

Net cash flow to the contractor

The net revenue for the contractor is indicated at the right-hand corner of the flow chart. The total outgoing costs for the contractor include export duty, bonus, income tax, and operation costs. The net cash flow is calculated by deducting the outgoing costs from the contractor’s allocated revenue. Thus, {68 – (9.125+ 0 + 19.55 + 10) = $29.375 million.

Summary Petroleum Exploration代写

Project gross revenue is $100 million

Government take is $60.675 million

Contractor take is $29.375 million

Reference Petroleum Exploration代写

(2019). Global oil and gas guide 2019. Retrieved from https://www.ey.com/Publication/vwLUAssets/ey-global-oil-and-gas-tax-guide-2019/$FILE/ey-global-oil-and-gas-tax-guide-2019.pdf

更多其他:商科论文代写 Essay代写 人文社科代写 Review代写 艾莎代写 Case study代写 艺术论文代写 文学论文代写 心理学论文代写 哲学论文代写 cs论文代写 学术代写 研究论文代写 Report代写 cs代写 代写论文